Sign of a market top as more investors buy stocks on margin?

NEW YORK - The amount of money U.S. investors borrowed from their brokers to buy stocks rose for a seventh month in January to a record $451 billion, a potential warning sign that in the past has coincided with irrational exuberance and stock market tops.

In dollar terms, the current amount of “margin debt” dwarfs the amount borrowed near the past two stock market peaks in 2007 and 2000, according to New York Stock Exchange data. In March 2000, a then-record $278 billion in borrowed money was riding on stocks just as the Internet-stock bubble began bursting. The next record for margin debt didn’t occur until July 2007, when broker-supplied loans to investors swelled to $381 billion just three months ahead of the market peak and coming financial crisis in 2008.

Corporate insider bearishness at pre-2008 crash levels

Opinion: Don’t ignore the behavior of executives in the know

Warning: 10 Signs Of Stock Market Exuberance

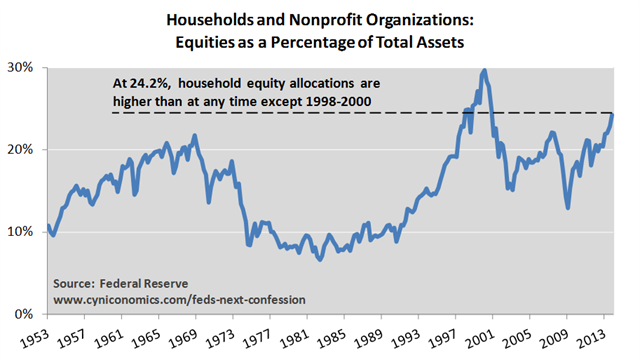

Today the market shows many of the elements that are present near markettops. In particular, sentiment is extremely bullish, investors are very long andleveraged, and valuations are extended on a wide variety of measures.

The Other Side of the Mountain

John P. Hussman, Ph.D.

John P. Hussman, Ph.D.

The financial markets are at a transition that reflects tension between two realities. The first is that the Federal Reserve’s policy of quantitative easing has driven the stock market to valuations associated with the most extreme speculative peaks on record, coupled with a fresh boom in initial public offerings – with companies having zero or negative earnings accounting for three-quarters of new issuance – and record issuance of “covenant lite” leveraged loans (loans to already highly indebted borrowers, lacking normal protections that mitigate losses in the event of default). The other reality is that unconventional monetary policy has done little to push real economic activity or employment past the border that has historically distinguished expansions from recessions (about 1.8% year-over-year growth in both real final sales and non-farm payroll employment).

Presently, on the basis of market capitalization to GDP, investors can expect negative total returns (nominal and including dividends) on the S&P 500, not only for the next 5 years, but for the coming decade. Using a broader range of historically reliable valuation measures, we actually estimate a somewhat higher annual total return for the S&P 500 of about 2.3% annually, though still with negative returns on horizons shorter than about 7 years. In any event, history suggests that it is a rather large speculative leap to believe that present extremes will not be amply corrected over the completion of this market cycle.

DYI Comments: NONE

No comments:

Post a Comment