Billionaire George Soros makes grim forecast for China, global economy

The investor said a crisis similar to the financial catastrophe of 2008 could take place in 2016.

DAVOS, Switzerland, Jan. 22 (UPI) -- Billionaire hedge fund manager George Sorossaid the Chinese economy is in for a "hard landing," after stock markets tumbled early January in the world's second-largest economy.

Soros made his grim prediction at the World Economic Forum in Davos on Thursday, when he told Bloomberg that the downturn is "practically unavoidable."

John P. Hussman, Ph.D.

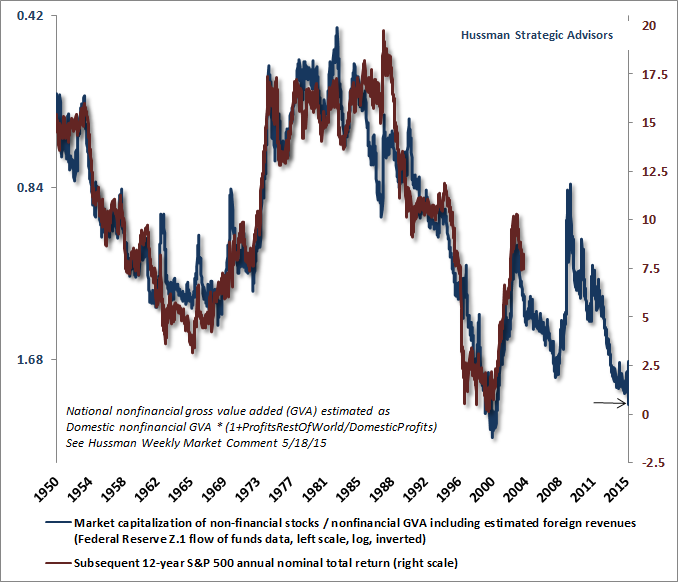

The chart below presents MarketCap/GVA on an inverted log scale (blue), along with the actual subsequent S&P 500 nominal annual total return over the following 12-year period (red). The good news is that the recent market retreat brought the 12-year prospective S&P 500 total return toward 2.5% annually in nominal terms. If this seems low, recall that the 12-year nominal S&P 500 total return following the more extreme 2000 market peak was actually negative. Consider the recent retreat as progress, but don’t imagine for a moment that it has gone a significant distance in resolving the distortion of years of yield-seeking speculation that the Fed provoked through its deranged policy of quantitative easing.

On the economic front, I continue to believe that a U.S. recession is not only a risk, but is now the most probable outcome. As I noted last week, among confirming indicators that generally emerge fairly early once a recession has taken hold, we would be particularly attentive to the following: a sudden drop in consumer confidence about 20 points below its 12-month average (which would currently equate to a drop to the 75 level on the Conference Board measure), a decline in aggregate hours worked below its level 3-months prior, a year-over-year increase of about 20% in new claims for unemployment (which would currently equate to a level of about 340,000 weekly new claims), and slowing growth in real personal income.

Gold Is Back in Fashion After a $15 Trillion Global Selloff

Hedge funds and other large speculators more than doubled their net-long position in bullion last week, just three weeks after they were the most-bearish ever. Investor holdings of gold through exchange-traded products are expanding at the fastest pace in a year, and the value of the ETPs has jumped by $3 billion in 2016.

“People have become complacent about risks, whether it’s macroeconomic and geopolitical,” said George Milling-Stanley, the Boston-based head of gold investments at State Street Global Advisors, which oversees $2.4 trillion. “What’s out of fashion may be coming back. That atmosphere of people feeling completely calm and untroubled, I think, is starting to go away. Gold is a very good risk-off trade, and I think people are starting to look very, very carefully at the risky positions that they have on a number of other markets.”

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 1/1/16

DYI

No comments:

Post a Comment