DYI

Formula Based Asset Allocation*** STOCKS *** BONDS *** GOLD *** CASH................................ GeoPolitics/Economics...Removing Theory from Conspiracies

Russia knows the game that the Western financial elites are playing. They know about the fiat Ponzi scheme that the US government is involved in and in control of through their entitlement as the reserve currency of the world. They know this, which is exactly why they continue to invest in precious metals, predominately gold.

Russia and China are two countries that know about Western financial manipulation and are not playing "nice" with the rest of the world. While they are not alone, they are the key players in the opposition to the control structure that currently dominates the global financial market. Although its power is waning, the West is still a formidable force that will be a major financial contender right until its self-destruction.

Therefore, it is no surprise to learn that Russia has once again announced that it has increased its total reserves of gold. Unlike Canada, who foolishly just dumped the last of their precious metals, Russia is thinking ahead and planning for the days when the US dollar will be supplanted by a more stable and honest form of money.

The future that Russia sees is undoubtedly one that involves gold in some way. One possibility, as many have alluded to before, is a basket of currencies and commodities, which will include precious metals.

In this scenario, countries that own large holdings of gold will be in key positions to take advantage and gain profit. This is one reason why the Central Bank of the Russian Federation recently announced that they have added 300,000 additional ounces of gold to their holdings in the month of February 2016.

This addition of gold brings the total "official" Russian holdings to a whopping 46.5 million ounces, making them a true power player in the gold markets.

This gold positive trend of Russia’s is a long-term one and shows their true conviction in taking ownership of honest money. Russia, who has even outpaced China in gold accumulation, added a stunning 6,700,000 ounces (208 tonnes) to their holdings last year alone. This is in addition to adding 822 tonnes since 2009!

Sadly, the exact opposite is happening in the West, as can be seen from Canada's complete and utter disregard for the ownership of gold, which is something that their politicians will come to rue one day.

The power structure of the world is changing rapidly and political unrest can be found all over the world. Markets are on the edge and stability is difficult to find. One of the few sources of stability that still exists, as it always has throughout the eons of time, is the protection that gold offers in times of economic uncertainty. The question is: are you protected?DYI Comments: This is one of the few positive trends for Russia as their problems are multi-faceted as exampled by rampant alcoholism, AIDS, TB outbreaks, low birth rate, and massive corruption. If Russia can stay on track of increasing her gold reserves along with issuing coins as legal tender would move the country closer to a gold standard. My suspicion Russia's plan is the eventual pricing for her natural resources in gold. This would put a dent into the U.S. Dollar as the reserve currency for the world would see very clearly as it depreciates against gold.

A jump in the core U.S. inflation rate has persuaded many people that deflation is no longer a threat. But even those who never subscribed to the idea that consumer prices might decline for a sustained period should be wary of misreading the data and dismissing the risk of deflation.

When prices rise, people think the devil or other forces outside their control are at work. But when they pay less, it’s because they’re smart shoppers.

Consumers (and even economists) also aren’t aware that there's deflation in goods prices. In December 2015, the goods component of the inflation index fell 2.2 percent. Furthermore, U.S. consumers aren’t spending the windfall from lower gasoline prices and thereby spurring the economy and prices.

There’s also a link between the prices of goods and the costs of services, so the annual inflation rate for services has declined to 1.9 percent in December from as high as 2.5 percent in May 2014. (Laid-off oil field workers don’t take as many vacations; they frequent bars and restaurants less often.)

In addition, inflation worriers tend not to look beneath the headlines to acknowledge that the CPI measure considerably overstates inflation. Many quality improvements aren’t reflected in prices, despite what are called hedonic quality adjustments designed to capture improved performance. A new laptop, for example, may cost the same as its predecessor but have 10 times the computing power. Also, the CPI has fixed weights and doesn’t reflect the fact that when oranges are cheaper than apples, people buy more oranges.

So, in my judgment, deflation remains not just possible but probable..... And this matters because the value of the consumer price index reverberates through the economy, ranging from cost-of-living assessments to the returns on U.S. government inflation-linked debt to how the Federal Reserve shapes monetary policy.DYI Comments: DYI agrees with Shilling that deflation being a very probable out come. I put deflation in the range of negative -1% to -3% starting at any time. However, when we move into the 2020's Federal commitments(liabilities) for Social Security and Medicare will be expanding at a feverish pace. Around 2022 one half of the Boomers will be receiving Social Security and Medicare with the remaining Boomers piling in all the way through the 2020's. Governments being as they are will only tax the populous just below the boiling point and then pay for the remaining dollars needed through the hidden tax of inflation. Between now and 2022 expect on again and off again(very low inflation) deflation. Even the possibility of negative interest rates is on the table as well.

Gold vs US Dollar and other currencies

I don't understand why the world is so enthusiastic about the US Dollar. I think in the long run will be a weak currency. I think the most desirable currency will be gold, silver, platinum and palladium. I still think the mining sector has embarked on a new bull market.

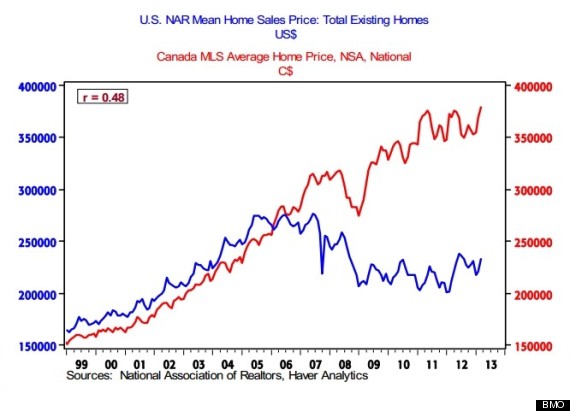

U.S. versus Canada housing

The U.S. had a major correction in housing. We all know this and lived through it. But home values in many U.S. metro areas are now back in bubble territory. But Canada never had a correction and in fact, prices continued to move up:

In 2005, the typical U.S. and Canadian home were about the same cost in U.S. dollars. Today, the typical Canadian home is about twice as much and growing. And in places like Vancouver, prices are going bananas. A large part of this is because of foreign money flowing in and not only into Canada:

This is an obvious tear down most likely in the Vancouver area(this is very typical!). So $2.4 million (Canadian dollars) just for the land and then the cost of rebuilding? Completed costs pushing the $3 million threshold? Your average Canadian has been priced out of the market. Only well healed buyers from foreign lands will be able to afford these prices.

This is an obvious tear down most likely in the Vancouver area(this is very typical!). So $2.4 million (Canadian dollars) just for the land and then the cost of rebuilding? Completed costs pushing the $3 million threshold? Your average Canadian has been priced out of the market. Only well healed buyers from foreign lands will be able to afford these prices. With the S&P 500 Index at the same level it set in early-November 2014, and the broad NYSE Composite Index unchanged since October 2013, the stock market continues to trace out a massive arc that is likely to be recognized, in hindsight, as the top formation of the third financial bubble in 16 years. The chart below shows monthly bars for the S&P 500 since 1995.

It's difficult to imagine that the current situation will end well, but it's quite easy to lose a full-cycle perspective when so much focus is placed on day-to-day fluctuations. The repeated speculative episodes since 2000 have taken historically-reliable valuation measures to extremes seen previously only at the 1929 peak and to a lesser extent, the 1937 peak (which was also followed by a market loss of 50%). Throughout history, at each valuation extreme - certainly in 2000, 2007 and today - investors have openly embraced rich valuations in the belief that they represent some new, modern and acceptable “norm”, failing to recognize the virtually one-to-one correspondence between elevated valuations and depressed subsequent investment outcomes.

Though corporate earnings are necessary to generate deliverable cash to shareholders, comparing prices to earnings is actually quite a poor way to estimate prospective future investment returns. The reason is simple - most of the variation in earnings, particularly at the index level, is uninformative. Stocks are not a claim to next year’s earnings, but to a very long-term stream of cash flows that will be delivered into the hands of investors over time. Corporate earnings are more variable, historically, than stock prices themselves. Though “operating” earnings are less volatile, all earnings measures are pro-cyclical; expanding during economic expansions, and retreating during recessions. As a result, to quote the legendary value investor Benjamin Graham, “The purchasers view the good current earnings as equivalent to ‘earning power’ and assume that prosperity is equivalent to safety.” Not surprisingly, the valuation measures having the strongest correlation with actual subsequent investment returns across history are smoother, and serve as better “sufficient statistics” for the relevant long-term cash flows.

With the S&P 500 still within a few percent of its record 2015 high, investors have a critical opportunity here to understand the difference between a run-of-the-mill outcome and a worst-case scenario. The present ratio of MarketCap/GDP is about 1.2, which we fully expect to be followed by nominal total returns in the S&P 500 of about 2% annually over the coming 12 years. Given the current dividend yield on the S&P 500 actually exceeds 2%, the historically run-of-the-mill expectation from current valuations is that the S&P 500 Index itself will be below current levels 12 years from today, in 2028.

To summarize present market conditions, the most historically-reliable valuation measures remain obscenely elevated; we fully expect nominal total returns for the S&P 500 to average 0-2% over the coming 10-12 years, with negative real returns over both horizons; and we expect a 40-55% market decline to complete the current market cycle. All of these would be only run-of-the-mill outcomes from present valuations. Market internals remain broadly unfavorable, but we’ve recently observed just enough improvement in trend-sensitive measures to hold us to a neutral rather than hard-negative outlook over the very near-term. A break below roughly 1975 would restore a hard-negative outlook. While we have to be comfortable with some amount of near-term uncertainty, I expect the completion of the present market cycle to produce strong opportunities to adopt a constructive or aggressive market stance. As I’ve said before, only informed optimists reject that the market is forever doomed to rich valuations and dismal future returns. That optimistic outlook has a century of evidence on its side.

The connection between this version of history and the events of today is obvious enough: once again, it is claimed, wildcat capitalism has created a terrific mess, and once again, only a combination of fiscal and monetary stimulus can save us.

In order to make sure that this version of events sticks, little, if any, public mention is ever made of the depression of 1920–21. And no wonder: that historical experience deflates the ambitions of those who promise us political solutions to the real imbalances at the heart of economic busts. The conventional wisdom holds that in the absence of government counter cyclical policy, whether fiscal or monetary (or both), we cannot expect economic recovery—at least, not without an intolerably long delay. Yet the very opposite policies were followed during the depression of 1920–21, and recovery was in fact not long in coming.

["We will attempt intelligent and courageous deflation, and strike at government borrowing which enlarges the evil, and we will attack high cost of government with every energy and facility which attend Republican capacity. We promise that relief which will attend the halting of waste and extravagance, and the renewal of the practice of public economy, not alone because it will relieve tax burdens but because it will be an example to stimulate thrift and economy in private life.

Let us call to all the people for thrift and economy, for denial and sacrifice if need be, for a nationwide drive against extravagance and luxury, to a recommittal to simplicity of living, to that prudent and normal plan of life which is the health of the republic. There hasn’t been a recovery from the waste and abnormalities of war since the story of mankind was first written, except through work and saving, through industry and denial, while needless spending and heedless extravagance have marked every decay in the history of nations."]

Instead of “fiscal stimulus,” Harding cut the government’s budget nearly in half between 1920 and 1922. The rest of Harding’s approach was equally laissez-faire. Tax rates were slashed for all income groups. The national debt was reduced by one-third. The Federal Reserve’s activity, moreover, was hardly noticeable. As one economic historian puts it, “Despite the severity of the contraction, the Fed did not move to use its powers to turn the money supply around and fight the contraction.” By the late summer of 1921, signs of recovery were already visible. The following year, unemployment was back down to 6.7 percent and was only 2.4 percent by 1923.

It is hardly necessary to point out that Harding’s counsel—delivered in the context of a speech to a political convention, no less—is the opposite of what the alleged experts urge upon us today. Inflation, increased government spending, and assaults on private savings combined with calls for consumer profligacy: such is the program for “recovery” in the twenty-first century.

["We must face the grim necessity, with full knowledge that the task is to be solved, and we must proceed with a full realization that no statute enacted by man can repeal the inexorable laws of nature. Our most dangerous tendency is to expect too much of government, and at the same time do for it too little. We contemplate the immediate task of putting our public household in order. We need a rigid and yet sane economy, combined with fiscal justice, and it must be attended by individual prudence and thrift, which are so essential to this trying hour and reassuring for the future. . . .

The economic mechanism is intricate and its parts interdependent, and has suffered the shocks and jars incident to abnormal demands, credit inflations, and price upheavals. The normal balances have been impaired, the channels of distribution have been clogged, the relations of labor and management have been strained. We must seek the readjustment with care and courage. . . . All the penalties will not be light, nor evenly distributed. There is no way of making them so. There is no instant step from disorder to order. We must face a condition of grim reality, charge off our losses and start afresh. It is the oldest lesson of civilization. I would like government to do all it can to mitigate; then, in understanding, in mutuality of interest, in concern for the common good, our tasks will be solved. No altered system will work a miracle. Any wild experiment will only add to the confusion. Our best assurance lies in efficient administration of our proven system."]

Harding’s inchoate understanding of what was happening to the economy and why grandiose interventionist plans would only delay recovery is an extreme rarity among twentieth-century American presidents. That he has been the subject of ceaseless ridicule at the hands of historians, to the point that anyone speaking a word in his favor would be dismissed out of hand, speaks volumes about our historians’ capabilities outside of their own discipline.

The experience of 1920–21 reinforces the contention of genuine free-market economists that government intervention is a hindrance to economic recovery. It is not in spite of the absence of fiscal and monetary stimulus that the economy recovered from the 1920–21 depression. It is because those things were avoided that recovery came. The next time we are solemnly warned to recall the lessons of history lest our economy deteriorate still further, we ought to refer to this episode—and observe how hastily our interrogators try to change the subject.DYI

Stock Dividends

Although most equity investors today concentrate on capital appreciation, dividends are an important part of stocks’ total return. They were much more so in earlier years, so the long-run average for dividends’ contribution overstates their current importance. Dividend yields today of 2% on the S&P 500 are distinctly below the 3% that was the floor in earlier years. Dividend payout ratios are rising in an era of uncertain stock appreciation when investors want more return here and now, but at 51% are still not high by historical standards.

Furthermore, investor reactions to dividends today are mixed. Relatively high dividend yields is not tempting investors to buy energy and mining companies where earnings are plummeting and whose dividends earlier were considered rock solid. Since the beginning of 2015, the S&P index of metals/mining shares is down 49% while the energy index dropped 27%.

Swiss-based miner and trader Glencore has embarked on a debt-reduction plan of more than $10 billion, including a suspension of its dividend and a $2.5 billion share offering. Anglo American, which lost $5.6 billion in 2015 after a net loss of $2.5 billion in 2014, has cut its dividend while taking massive write downs on many projects. The company plans to exit the coal-mining business and sharply curtail its iron ore operation while cutting its mining businesses to 16 from 45, a further reduction from the 25 target announced last December. In mid-February, Moody’s slashed Anglo American’s credit rating to junk.

Copper mining giant Freeport-McMoRan dropped its dividend, cut capital spending and is selling 13% of its huge copper mine located on the Arizona-New Mexico border for $1 billion in order to pay down debt. Another major miner, Rio Tinto, cut its dividend in early February as the ongoing commodity price collapse pushed it to an annual loss in 2015. The company said it could no longer maintain, much less steadily increase, its dividend each year and plans to halve its 2016 dividend from 2015’s level. Similarly, last month BHP Billiton, the world’s top miner by market capitalization, abandoned its progressive dividend policy as it slashed its dividend by 75% amidst a $5.67 billion loss in the second half of 2015.

Ceasing to increase dividends every year, much less cutting them, has been devastating for the miners and other commodity producers. At the same time, investors are flocking to predictable dividend payers, especially recently as it became less likely that the Fed will raise rates this year, and, I believe, is more likely to cut them instead. Note that after the Great Recession, the ECB and the central banks of Sweden, Israel, Canada, South Korea, Australia and Chile all raised rates but subsequently cut them. So the Fed would not be alone.

This year, the stocks in the S&P High-Yield Dividend Aristocrats Index—companies that have increased their dividends every year for at least 20 years—are up 3% including dividends while the S&P 500 index suffered a total return drop of 2.8%. The total return on the S&P Utility index is up 6.7% year-to-date and I’ve favored utilities for years because of their attractive dividends as well as predictable earnings based on services consumers buy in good times and bad.

Banks are not immune from dividend cuts, and big British bank Barclays just slashed its dividend by more than 50% as it reported a loss of $552.6 million in 2015 vs. $244 million the year before.

Share Buybacks

Many companies prefer share buybacks to dividend payouts because they don’t imply long-term commitments. Still, many announced buybacks are never completed, and the tendency is to buy high, sell low. Buybacks are often made at stock price peaks when CEO's are feeling confident and corporate cash is ample. In contrast, few are announced at equity price bottoms when fears of liquidity shortages if not bankruptcy are widespread.

In any event—as with dividends—investors of late have not been impressed by buyback announcements even though they increase earnings per share by reducing shares outstanding. Furthermore, buybacks often simply offset stock awards to company employees. Since the financial crisis, firms have repurchased $1.3 trillion in shares. Over the last three years, reductions in equities outstanding have increased S&P earnings per share by 2%, as of the last quarter.

That same dividend profile bleeds over into funds that focus on big baskets of these lauded dividend growers, resulting in modest yields for the most part. So it’d be natural to look at funds with names like the ProShares S&P 500 Aristocrats ETF (NOBL) or Vanguard Dividend Appreciation (VIG), see their sub-2% yields and think, “What’s the point?”

The answer? “Not the dividends themselves.”

You see, when a company is able to steadily increase its dividends for an extended period of time, that speaks to a certain measure of financial stability. And that’s where you get to the value provided by these funds. The focus on prolonged dividend growth isn’t about trying to put together a portfolio of eye-popping dividend yield — it’s about building a fund with high-quality holdings.

This low-cost index fund seeks to track a benchmark that provides exposure to U.S. companies that have a history of increasing dividends. The fund focuses on high-quality companies that have both the ability and the commitment to grow their dividends over time. One of the fund’s risks is the possibility that returns from dividend-paying stocks will trail returns from the overall stock market during any given period. Another risk is the volatility that comes with the fund’s full exposure to the stock market. An investor with a well-balanced, long-term portfolio who seeks some income and exposure to dividend-focused companies may wish to consider this fund.DYI Comments: When the market avails itself to increased valuations here is a fund that has potential for the possibilities of greater returns than the general market. At least with its focus on dividends the volatility could be reduced as well. Recommend that the fund be placed into a retirement type of account (IRA, Roth IRA, 401k if available) to shelter the income. Something to keep in mind, DYI will.

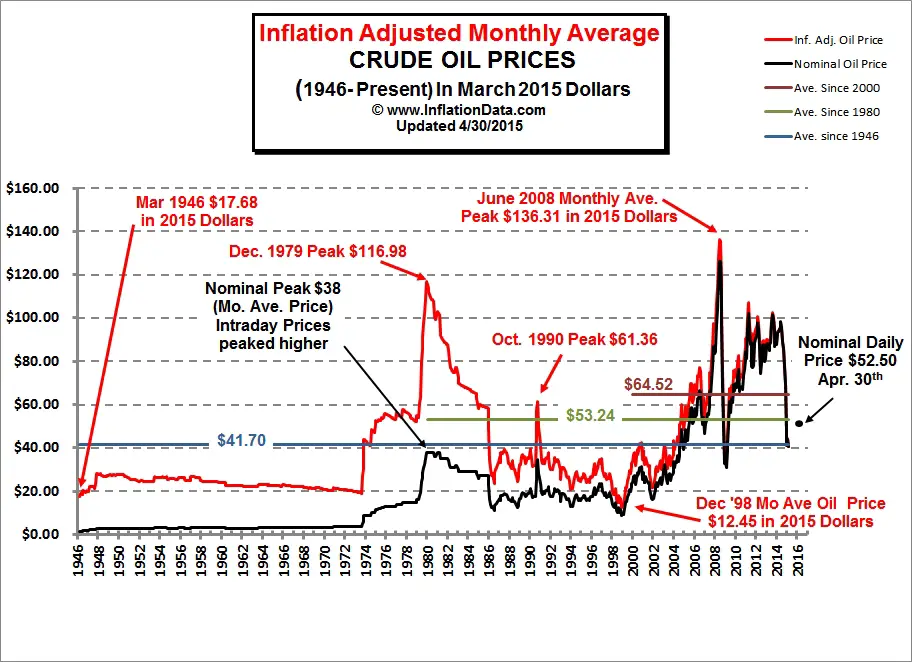

The depletion of old oil wells is expected to surpass new sources of supply in 2016, as the ongoing oil price slump puts a long list of oil projects on the shelf.

Bloomberg flagged new data from the Norwegian consultancy firm Rystad Energy, which predicts that legacy production will tip the supply balance into the negative in 2016 for the first time in years.

Rystad Energy estimates that the crash in oil prices has cut into upstream investment so severely that natural depletion rates will overwhelm the paltry new sources of supply in 2016. Existing fields will lose about 3.3 million barrels per day (mb/d) in production this year, while new fields brought online will only add 3 mb/d. This does not take into account rising oil demand, which will soak up most of the excess supply by the end of the year.DYI Comments: When oil prices will pop back up in price is any one's guess. Could prices go as low as $10 to $20 dollar range as Gary Shilling has stated. If the world wide economy goes bust then that is a very distinct possibility. If that were to occur then lump summing into the closed end fund Adams Natural Resource Fund symbol PEO would set you up for profits a few years from now. Oil prices at that level would be on the give - away - table.

Harry Dent, best-selling author and economist, has warned that the stock bubble in the U.S. today is the biggest in history and that the “greatest crash of your life is just ahead…”

I’ve been telling our Boom & Bust subscribers for months now that the dominant pattern in the stock is the “rounded top” pattern I show in the chart below:

With stock market valuations in the U.S. in particular looking stretched and U.S. stocks looking very overvalued, we agree with Dent that there is indeed a real risk of a material correction in stock markets as there was in 2000 and in 2007. In presentations to clients we have looked at and explained why we view these markets as over valued and having all the hallmarks of bubbles about to burst.

Portfolios with very overweight allocations to equities and bonds are now at risk and there is a strong case for increasing allocations to cash and gold. Careful consideration should be given to who you deposit your money with and store your gold with. Counter party risk and the return of capital rather than the return on capital will assume importance once again in the coming years.DYI

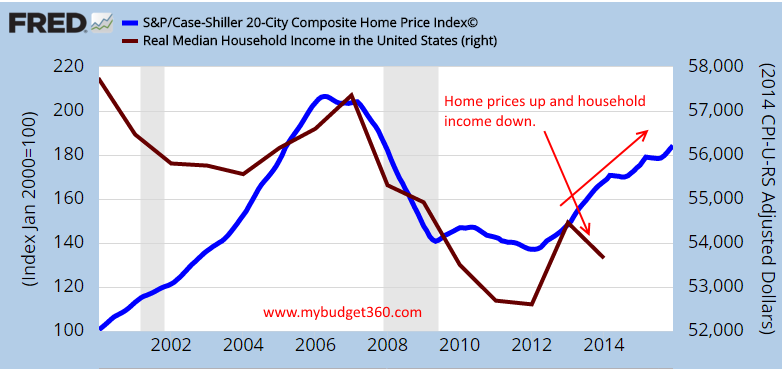

The scariest chart in housing

Home prices are up a stunning 34 percent from 2012. That is an incredible increase but this is not being driven by families buying homes. It would also be different if household incomes were going up. They are not. Take a look at this chart:

Will the housing bubble pop this year? Bubbles can last longer than most people think. But there are already cracks in the system. You saw the market briefly correcting this year. Suddenly stocks are up on low volume and current prices are still overvalued. The same can be said for housing. Low supply, low demand, yet prices are going up. The Fed is completely afraid to raise rates knowing that it has no other option but to keep rates low. This policy move has made the middle class a minority.

The Federal Reserve is held accountable for this fiasco. If it goes forward with a rate increase in the near future, it will be us who pay the price of another bubble.There’s only one action to take if you ask me — lower your exposure to the industry.

In stocks, that’s homebuilders and mortgage originators. Avoid them at all costs. In your personal investments, that’s being prepared for another real estate shock.These prices are unsustainable and due for a correction.

Once that happens, opportunity awaits you to pick up houses and housing-related stocks on the cheap.”DYI

What’s been lifting the S&P 500 to record levels over the past eight years? According to economic analysis, the Federal Reserve was responsible for more than 93% of the stock market’s movement. On top of that, the Fed was behind 100% of the entire market’s growth in the first half of 2013.

Former Federal Reserve chairman Ben Bernanke became Wall Street’s sugar daddy when he initiated a trillion-dollar bond-buying scheme in an effort to kickstart the flagging U.S. economy. Between November 2008 and October 2014, the Federal Reserve printed off roughly $3.5 trillion and artificially lowered interest rates to zero through three rounds of quantitative easing.

Not so coincidently, over the same time period, the S&P 500 doubled in value. Quantitative easing took income out of fixed-income investments like Treasuries and bonds and forced those looking to strengthen their depleted retirement portfolio to put all of their money into the stock market.

The Estonian government has approved the building of a 2.5-meter fence on its border with Russia as the latest measure aimed at fortifying Estonia’s part of EU outer borders, local media report.

“We will build a 2.5-meter fence along 90 to 135 kilometers of the land border,” Pevkur said, adding that the border would be enhanced with warning signs, light fixtures, boundary stones and even special barriers aimed at preventing animals from crossing.

Latvia has proved more consistent in its intention to fence itself off from Russia.

In early August 2015, Latvian Interior Minister Rihards Kozlovskis announced plans to build a 90-kilometer wall on the country’s border with Russia. It will be equipped with CCTV cameras and sensor systems. The project should take four years and cost €17 million, according to the minister.DYI

The firm pointed to a number of reasons, including Trump's hostility toward free trade, his accusing China of being a "currency manipulator, his advocating the killing of terrorists' families, and his proposal to move troops into Syria to fight ISIS and take its oil.

Also Wednesday, the Washington Post editorial board called for the Republican Party to aim for as brokered convention to prevent a Trump nomination, arguing that Trump "presents a threat to American democracy."

"Mr. Trump resembles other strongmen throughout history who have achieved power by manipulating democratic processes," the editorial board wrote. "Their playbook includes a casual embrace of violence; a willingness to wield government powers against personal enemies; contempt for a free press; demonization of anyone who is not white and Christian; intimations of dark conspiracies; and the propagation of sweeping, ugly lies."DYI Comments: Expect far more hit pieces especially if Trump secures the Republican nomination. So far he has been the only candidate to take on health care costs that have been artificially pumped up due to the lack of competition. Currently today we are spending more more on a GDP basis than the socialized systems of Europe.

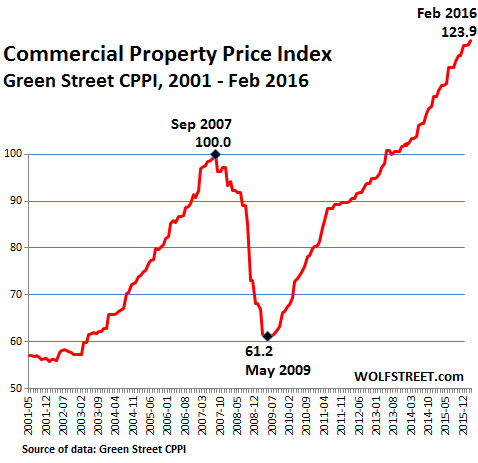

Commercial real estate values are up a stunning 102 percent since the low hit in 2009. There is a lot of silly money rushing into the game at this point. Valuations are ridiculous and you are also seeing money from abroad, in particular from China rushing into U.S. markets.

The machinery that created the last bubble never went away or got reformed. So the reason this story sounds very familiar is because we just lived it. The Fed and other central banks are only accelerating this wasteful spending and creating a world of debt bondage. The problem is, valuations are out of whack and trillions of dollars in debt are not going to be paid back. And I think we know what happens after that grim realization hits.DYI Comments: I haven't made remarks regarding REIT's in a long time so let me make up for lost time. REIT's currently are over blown in price since 2012. The dividend yield for Vanguard's REIT Index Fund symbol VGSLX is 2.77% not much solace for an industry that pays out the majority of their earnings in dividends. Until share prices come off their heavenly valuations there are better values in the oil/gas and mining industry.