Why one prominent hedge-fund boss is calling this ‘the biggest bond bubble’ ever

The “biggest bond bubble” ever. That is how Paul Singer, one of Wall Street’s most prominent hedge-fund managers, referred to the fervor to scoop up fixed-income investments, like government bonds.

Who can blame Singer? MarketWatch has mentioned this before, but central banks around the globe have rolled out unprecedented measures, including purchasing corporate and government bonds, in an effort to shock their wobbly economies to life and end a period of low inflation.

As a result, yields on trillions worth of bonds around the globe have been pushed into negative territory as central banks purchase debt and other securities in an attempt to drive down borrowing costs, push investors into riskier assets and spur economic growth.

Central Banks Could Be This Market’s Pets.com

The stock market is partying like it’s 1999, and for exactly the opposite reason. Last week the S&P 500, Dow Jones Industrial Average and Nasdaq Composite hit a synchronized high for the first time since the eve of the millennium. America’s most valuable company is a tech stock (Apple today, Microsoft back then). The tech sector is back above a fifth of S&P 500 market capitalization, and just as then bears worry that the market is overvalued, although not by anywhere near as much.

In 1999, wild optimism was elevating the market as investors piled into anything with “.com” after its name—leading to a rash of stock-price-boosting name changes. Investors punished dividend payers for not having enough ways to spend money on transformative tech. The number of clicks beat cash flow as an investment tool.

The contrary is true this year. Wild pessimism about the global economy has led investors to chase dividend payments, demand buybacks and punish companies that invest. Cash is king.

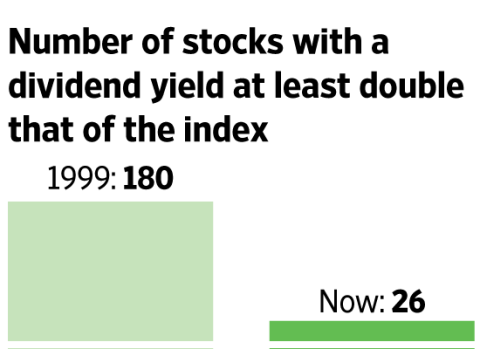

One big difference between the excess of 1999 and today is for those who think that he’s wrong, and low yields are unsustainable. In 1999 it was easy to find alternatives to wildly overvalued tech, media and telecom stocks. With dividend-paying stocks out of fashion, their yields were well above the wider market; more than 180 members of the S&P 500 paid a dividend yield at least twice that of the index. Now, that figure is just 26, as dividends are in demand.

It amounts to further evidence that it is harder to find anywhere to hide today, as the great central-bank monetary experiment makes everything expensive.

DYI Comments: DYI's model portfolio remains with its conservative stance. Yes, stocks and bonds are in a bubble.

Updated Monthly

No comments:

Post a Comment