Bear

Frustrations!

5

Stocks Extend S&P 500 Gains.

DYI: Microsoft, Alphabet, Amazon, Apple, and

Netflix’s over the past year have account for over 50% of the S&P 500 gains

making for a very crowded trade. This is

classic market top formation with less and less companies share prices

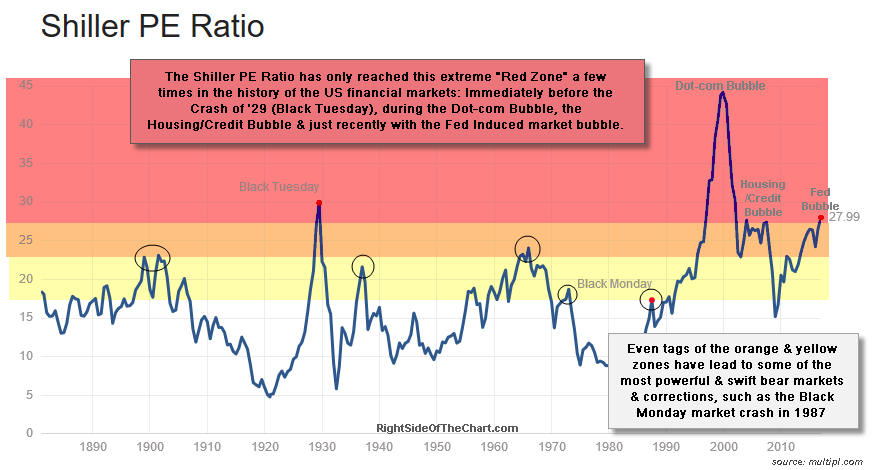

propelling the market higher. Simple math is bumping into our absurd valuation high flying stock market. Bonds

despite their sub atomic low yields will out perform stocks over the 7 to 12

years and possibly as long as 15 years.

As of 8/20/18 Shiller PE is

32.74

Investors

who stay fully invested will want to avoid the three industry crowded trade. Tech, Discretionary Spending, and Health Care

should be avoided and purchase Utilities and Real Estate that is the least

owned. During a multi month market melt

down a fully invested market player decline will be significantly less.

Bearish

Phenomenon.

What

is different today as compared to other stretched valuation market tops is the

lack of speculative fever among the general public. It is difficult to find any over the top

bulls that were so easy to find during the 1960’s or during the latter portion

of the 1990’s. Before the 2009 melt down

though diminished market bulls were still easy to find. Whether through snail mail newsletters, the

internet or on CNBC TV bulls were at the ready.

I’m at a loss to see any flat out fire breathing bulls so prevalent at

sky high valuation and yet you can find all of the bears [including me] you

would ever need or want.

My

speculation is this market forming top may go on for much longer they anyone

would ever guess including this blogger who has been involved in security markets

for over 40 years. One thing that is

perfectly clear valuations are not just elevated they are to the point of

insanity pushing down future estimated average annual returns over the next 10

years to the zero return area. Remember

that is before taxes, fees, and the biggest tax of them all INFLATION. Two plus two still equals four along with

massive overvaluation making this a lousy time to purchase stocks on a whole

sale basis such as an S&P 500 index fund. The late super investor Benjamin Graham [Warren Buffett's teacher] would state this is a lousy time time to purchase stocks on a broad basis. DYI's EYC Ratio is screaming get out of stocks!

Ben Graham's Corner

Margin of Safety!

Central Concept of Investment for the purchase of Common Stocks.

"The danger to investors lies in concentrating their purchases in the upper levels of the market..."

Stocks compared to bonds:

Earnings Yield Coverage Ratio - [EYC Ratio]

EYC Ratio = 1/PE10 x 100 x 1.1 / Bond Rate

1.75 plus: Safe for large lump sums & DCA

1.30 plus: Safe for DCA

1.29 or less: Mid-Point - Hold stocks and purchase bonds.

1.00 or less: Sell stocks - Purchase Bonds

Current EYC Ratio: 0.83 (rounded)

As of 8-01-18

Updated Monthly

Updated Monthly

PE10 as report by Multpl.com

Bond Rate is the rate as reported by

Vanguard Long-Term Investment-Grade Fund Investor Shares (VWESX)

DCA is Dollar Cost Averaging.

Lump Sum any amount greater than yearly salary.

PE10 ..........32.75

Bond Rate...4.05%

Lump Sum any amount greater than yearly salary.

PE10 ..........32.75

Bond Rate...4.05%

Over a ten-year period the typical excess of stock earnings power over bond interest may aggregate 4/3 of the price paid. This figure is sufficient to provide a very real margin of safety--which, under favorable conditions, will prevent or minimize a loss......If the purchases are made at the average level of the market over a span of years, the prices paid should carry with them assurance of an adequate margin of safety. The danger to investors lies in concentrating their purchases in the upper levels of the market.....

Benjamin Graham

DYI

No comments:

Post a Comment