Bubble

News!

Dow/Gold Ratio as of 8/14/18 is 21 to 1

But, we don’t need to round up the global real estate, securitized debt, and equity values as they have jumped over $100 trillion in just two years and are now in EXTREME BUBBLE territory. How can global equity (stock) values surge by $28 trillion in two years ($55 trillion to $83 trillion), a massive 50% increase, if global oil consumption has only risen by 3 million barrels per day, or a lousy 3%???

According to the IEA – International Energy Agency, total global oil demand increased from approximately 95 million barrels per day (mbd) in 2015 to 98 mbd in 2017. Please understand, the world isn’t producing 98 mbd of high-quality conventional oil. That figure 98 mbd figure includes shale oil, oil sands, NGL’s – natural gas plant liquids and biofuels.

If investors paid attention to the ENERGY, they would realize these global asset values (not including precious metals) are severely overvalued. I believe that within a decade, current global real estate, securitized debt, and equity values of $469 trillion will have lost at least 50% of their value.

If just $1-$2 trillion of this amount made its way into precious metals, it would push the value of gold and silver to levels never thought possible. I am not talking HYPE here, but logic. My analysis suggests that global oil production will begin to decline as U.S. shale oil production disintegrates, starting within the next 1-2 years. I forecast U.S. domestic oil production to be down 50-75% by 2025.

A 'Great Reset' approaches

by Adam Taggart

And Stockman thinks the top for the current asset price bubble era is in -- specifically, he thinks it hit its apex in January 2018. As this "Everything Bubble" prepares to burst, Stockman estimates the risk of economic crisis is as great, if not greater than, the 2008 Great Financial Crisis because of the radical and unsustainable monetary policy expansion the central banks have pursued over the past decade.

This has caused the prices of stocks, bonds, real estate and most other assets to appreciate at rates that have no basis in the ongoing income/cash flow of the global economy. In short, they are wildly overvalued.

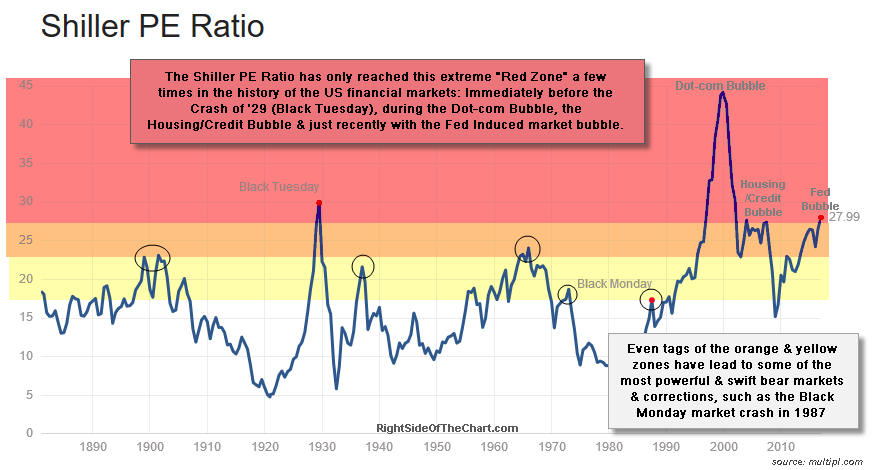

Shiller PE Ratio as of 8/13/18

32.66

The FAANG-nary In The Coal Mine

Facebook, Amazon, Apple, Netflix, Google

The long-awaited breakdown in sentiment is finally here

by Adam Taggart

ETF With FAANG Equities Within Top 15 Holdings

2018: 605

2017: 501

2016: 430

2015: 332

2014: 277

2013; 230

2012: 175

2011: 101

2010: 62

2009: 14

2008: 9

As portfolios have become more and more FAANG-dominated, more and more investors have come to see those five stocks as "unstoppable". They have unnaturally performed as both "risk-on" and "risk-off" havens for years -- delivering consistent share price growth when markets move higher, while holding steady when they don't.

As a result of this piling-in by investors, the five FAANG stocks collectively now have a whopping market capitalization of $4 trillion.

They comprise nearly half of the NASDAQ index's market cap.

DYI: Stocks are now bid to the moon and back with

valuations at nose bleed levels. As

money managers desperate to hold onto the money they manage are piling in to

the FAANG stocks hoping to post addition gains despite their insane valuations. This is very symptomatic of a market top in

process of being formed that take months to play out before the bear returns

bringing valuation back down to earth.

Surprisingly gold has not

drop more in price than it has with stock valuations in the stratosphere. You would think with stocks so jack up in

price the Dow/Gold Ratio would be in the neighborhood of 40-50 to 1 as opposed

to the current 21 to 1. Why?? Simple!

Despite gold’s and precious metals mining companies brutal bear market

it could have been far worse. The reason

gold hit the floor around fair value is due to all of the money printing

central banks around the world has done.

Once the stock market goes into a tail spin central banks will once

again go back to money printing driving down interest rates in a vain attempt

to stop the slide in equity prices. Don’t

be surprised to see negative rates going out as far as the 5 year Treasury

note. The Great Wait is becoming a bit

shorter.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 8/1/18

Active Allocation Bands (excluding cash) 0% to 50%

58% - Cash -Short Term Bond Index - VBIRX

35% -Gold- Precious Metals & Mining - VGPMX

7% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

No comments:

Post a Comment