Casino Alert: 80 Percent Of Stocks Have A Lifetime Return Of Zero

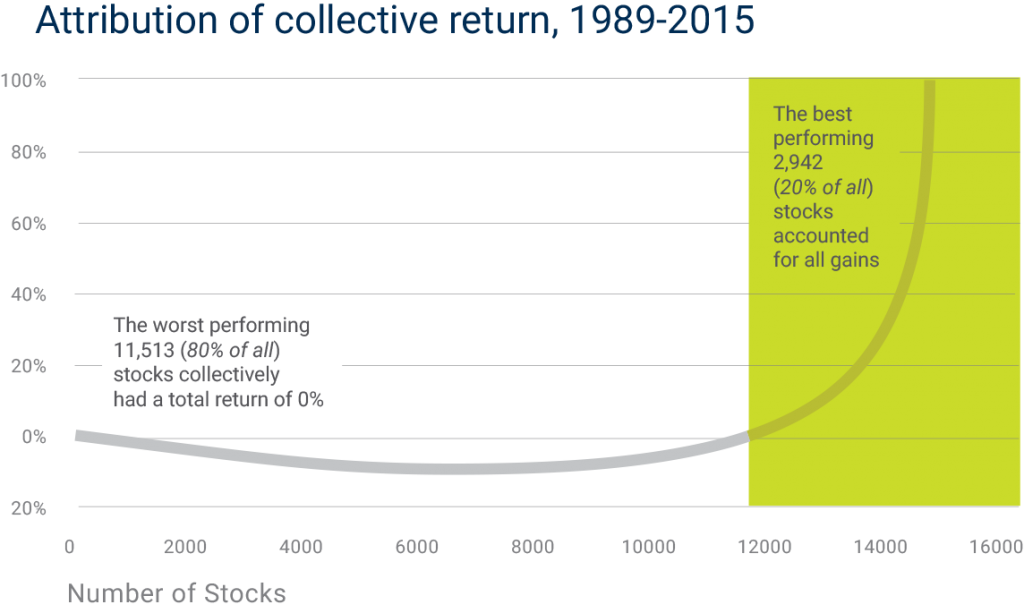

Longboard’s original research proves that over the long term, a small minority of stocks drive returns for the overall market.

The principle of the competition gap remains true in practice: The minority accumulates a disproportionate amount of the total rewards, creating a “fat tail” distribution of extreme out-performers and under-performers with a large gap between the two.

So, let’s say an investor’s portfolio missed the 20% most profitable stocks between 1989 and 2015. Instead, he invested in only the other 80%. His total gain would have been 0%.DYI Comments: Unless you're the next Warren Buffett a master stock picker, this adds more fuel to fire for the use of index funds. DYI model portfolio emphasis is index funds whenever possible. Vanguard's Precious Metals & Mining Fund is a fully non-indexed manage fund the remainder as you can see below are indexed.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 5/1/16

The only way to beat an index fund is with a different index fund that is far more undervalued than the former. Currently stocks and long term bonds are in bubble land only cash Vanguard's Short Term Bond Index Fund over the coming years will out perform both stocks and long term bonds. Even though the precious metals fund is not an index fund it is far more likely to out perform stocks and long term bonds as well. Markets have been upside down for many years as the Fed's have blown their third bubble in less than twenty years. Below are my sentiment indicators which is based upon a secular basis.

Market Sentiment

An upside down world indeed!

The Great Wait Continues...

DYI

No comments:

Post a Comment