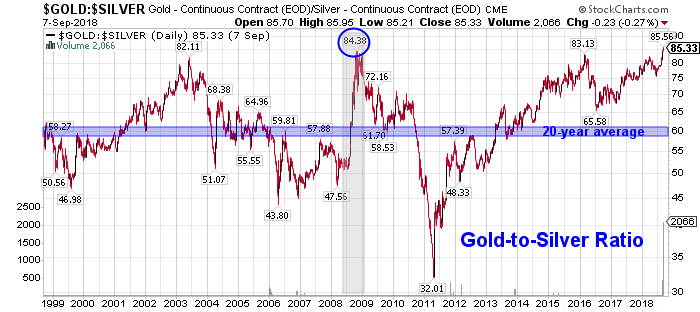

Gold to Silver Ratio

Breathtaking 84 to 1!

SILVER EAGLE SALES DOUBLED IN FEBRUARY: U.S. Mint Temporarily Suspends Authorized Purchases

Sales of Silver Eagles continue to be strong as demand for the official coins surged in February. Moreover, as the Authorized purchases of Silver Eagles jumped by 775,000 oz this past Thursday, the U.S. Mint issued a temporary suspension of sales until inventories can be restocked. This is a very positive sign as total Silver Eagle sales last year fell to low of 15.7 million, down more than 50%, compared to the 37.7 million set in 2016.

DYI: For those

of you who are hedging your portfolio with physical precious metals the Gold to

Silver Ratio is a lopsided 84 to 1. Gold

is selling 84 times greater than silver placing the odds in one’s favor for

silver to close this gap.

This indicator is a two way street. Silver could very well rise from here setting

up a nice capital gain or if precious metals go into a bear market then

silver’s loss will be significantly less than gold. This indicator is only between the two but

not the general direction. For long term

holders of gold and silver this ratio is a required tool for accumulation and

trading between both precious metals to enhance their total return.

DYI

No comments:

Post a Comment