Worst Still Ahead for Mining Industry After Losing $1.4 Trillion

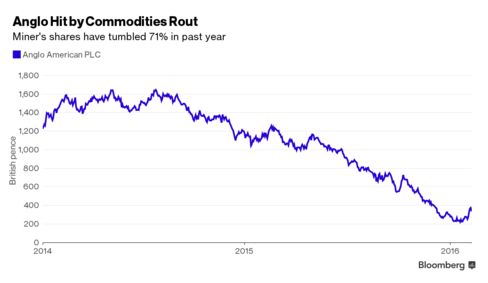

When you find yourself in a hole, the saying goes, stop digging. A simple lesson that arguably has bypassed a mining industry that’s wiped out more than $1.4 trillion of shareholder value by digging too many holes around the globe. The industry's 73 percent plunge from a 2011 peak is far beyond the oil industry's 49 percent loss during the same time.

DYI Comments: The best time to pick up corporate assets is when share prices have been decimated. The precious metals mining industry fits that perfectly as prices shown directly above VGPMX or Vanguard's Precious Metals and Mining Fund, to use my favorite word, decimated. The mining industry will go through hard times as marginal mines are closed, very weak players go bankrupt with the stronger players merging or buyouts. This consolidations in time will bring the remaining players back to profitability. This is turn will result in higher share prices down the road. Only suitable for long term value players, as this work out may take 3 to 5 years setting up for the next commodity bull market in the 2020's.

Updated Monthly

No comments:

Post a Comment