DYI Comments: Notice the chart above since the end of QE3 the S&P 500 has formed a large arch. Stock prices as a whole have not moved up since January 2015! Prices as measured by price to dividends are now 109% above their average. Anything beyond 100% DYI's formula "kicks us out" of the market and rightfully so! Stocks are clearly in bubble land. For folks who are holding stocks or purchasing at these levels, who go to sleep like Rip Van Winkle, wake up 12 to 15 years from now will experience a nominal return of 0% to 2%! This return is nominal before inflation a rate that the reporting authorities always fudge to a lesser degree. If inflation is reported at 2% you can bet in reality is 3% to 3.5%. Then you have to take into account any fee's, commissions, trading impact costs, taxes that will reduce one's return. All told, on a purchasing power basis purchases or holding stocks at this level (and this includes dividend reinvestment) will be at a marginal loss. The bottom line, the price you pay for sales, earnings, or dividends is a determinate for future return.

Below is our proxy the 10 year Treasury yield for our formula. Today based on a price to interest 10 year Treasury prices are now 130% above their average. Clearly in bubble land. If the Fed's push rates negative then I will stop naming this bubble land and rename to "fantasy land." Anyone buying bonds, especially long dated will be setting themselves up for losses. As one would suspect our formula has "kick us out" of the long term term bond market as well.

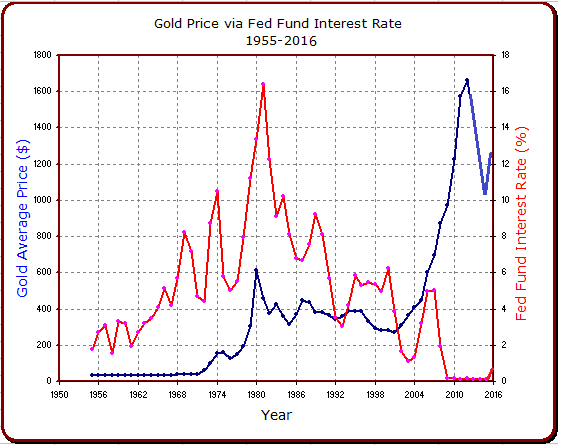

Below is a chart for the Dow/Gold Ratio currently at 15 to 1. This chart places the average around 22 to 1 for DYI's purpose I averaged the three secular highs and two secular lows since 1913 when we started a fiat currency. My average is 16 to 1. Today gold in relation to stocks is trading at its mean from DYI's point of view. Gold is neither undervalued nor overvalued simply at its mean. Even with that said gold and especially the mining companies have a long way to run before they end their secular bull market that started since the year 2000.

DYI's sentiment indicators(below) based on a secular basis shows our four asset categories and their placement. Cash or short term bonds is our "go to" investment, a "waiting room" until it can be put to use (and earn some interest while waiting) in our three other assets. As amazing at it seems the most undervalued among the four is cash, only gold plays a secondary role. Stocks and long bonds are in bubble land.

Market Sentiment

Updated Monthly