John P. Hussman, Ph.D.

It’s largely forgotten that during the 2000 top formation, the S&P 500 lost 12% from July-October 1999, recovered to fresh highs, retreated by nearly 10% from December 1999 to February 2000, recovered to fresh highs, experienced another 10% correction into May, recovered to a new high in total return (though not in price) on September 1, 2000, retreated 17% by December, and by January 2001 had recovered within 10% from its all-time high, and was unchanged from its level of June 1999.

DYI Quick Comment: No doubt the U.S. stock market has created a massive top in the form of an arch.

I continue to have little doubt that the current market cycle will be completed by a 40-55% market collapse, with near-zero total returns for the S&P 500 on a 10-12 year horizon. Meanwhile, however, we have to accept that central banks have wreaked havoc on the ability of the financial markets to usefully allocate capital toward productive ends. Relevant warning signs that would normally prevent misallocation and malinvestment have been repeatedly disabled in the advancing half-cycle since 2009.

DYI: The only difference I have that the peak to trough decline will be the range of 45% to 60%! That makes Professor Hussman the optimist!

There’s a story of an American golfer playing a Scottish course, and having hit the ball perfectly, a massive gust of wind carries the ball wildly off-course. The golfer complains “Did you see that wind take my ball?” The caddy looks at him, unfazed, “Aye, now you’ve got to play the wind too then, don’t you?” We feel the same about central bank distortions.

DYI: Central banks will distort markets far longer than one believes is possible. However, Mr. Market in the end will have the final word and that word will be bearish. Valuations will regress back to the mean plus over shoot to the downside. To finally end the mean inversion from bubble land beginning in the year 2000 to massive undervaluation [Shiller PE10 under 10] will take a few more years.

To give you an idea for how much time is needed just look at the chart below. From 1907 to 1922 or 1966 to 1982. The exception was 1929 to 1932. First world market are on the long term version in reducing valuation metrics. Here we are 17 years later except for a brief time period where valuations touched the mean in 2009 and then central bank money printing propelled markets back to bubble land.

I have to agree. This wouldn’t be the first time in history, nor even in the past century, that inept economic policy, class divisions, and growing nationalism led humanity to choose leaders that seduced them to abandon the better angels of their nature.

The same trend is apparent in our own political process. Speaking as someone who values human rights and diversity, some elements strike me as more offensive than others, but the current environment is bathed in the language of “enemy,” of division, of coercion, and of simplistic solutions. It also largely ignores the Federal Reserve’s role in creating the bubbles and crashes that still weigh on the economy, and now threaten a third act.

DYI: There is no way to reform the Federal Reserve System. First of all there are no reserves only a fiat currency back up only by the full faith and credit of the U.S. Government. It was designed from day one to guarantee an underlining level of inflation to insure interest payments and continuous roll over of debt. On top of that it is not a system but a banking cartel that favors primarily the New York banks. Due to the Fed's bailout mentality this system encourages reckless lending. Now that the Fed is over 100 years old the Fed itself has institutionalized reckless booms and busts as being normal. Despite the fact that with an induced inflation plus the booms and busts are crucifying the poor and slow motion destruction of the middle class.

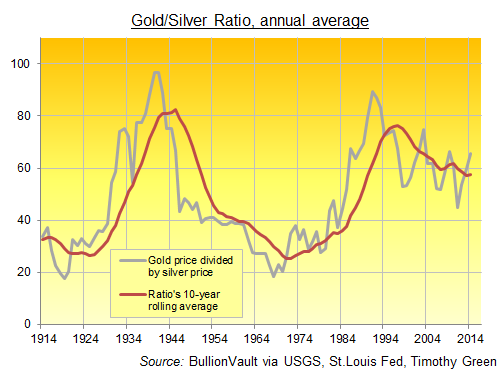

To stop this insanity we must end the Fed and by the power of law end fractional lending by the commercial banks. End legal tender laws. Allowing our citizens to use in the private sector whatever form of currency they choose. Swiss Francs, Euro's, Pounds, Yen, gold and/or silver or digital money allow the market to sort it out. The only thing that is required a bank cannot by law loan out more than their deposits they can no longer be in the debt/money creation business. If caught and no doubt some will it will be deemed fraud and the bad actors would be fined and imprisoned.

So....The Fed's have us set up for another bust just the timing is impossible to determine. My model portfolio remains steadfastly defensive.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 4/1/16

Active Allocation Bands (excluding cash) 0% to 60%

85% - Cash -Short Term Bond Index - VBIRX

15% -Gold- Precious Metals & Mining - VGPMX

0% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

DYI