%

Gold/Silver

Allocation

3-1-2026

Updated Monthly

100 x (Current GS – Avg. GS / 4)

_______________________________________

(Avg.GS x 2 – Avg. GS / 2)

[The formula's answer allocates silver percentage]

[The formula's answer allocates silver percentage]

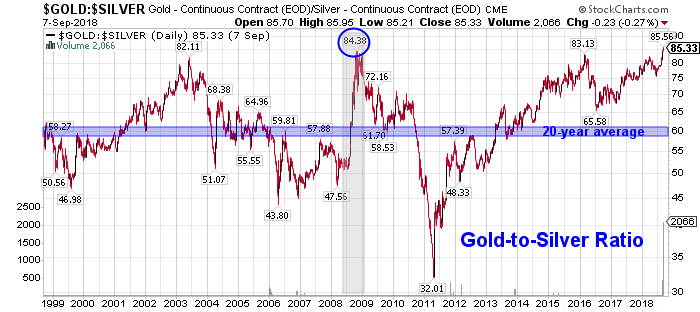

Current Gold/Silver Ratio 59 (rounded)

Average Gold/silver Ratio 50 [Averaged from year 1900]

Allocation:

Gold 38%

Silver 62%

Average Gold/Silver Ratio since 1900

50 to 1

Gold and silver bullion buyers and

traders use the fluctuating Gold Silver Ratio to better determine which

precious metal may be poised to outperform the other.

The essence of trading the gold-silver ratio

is to switch holdings when the ratio swings to historically determined

extremes.

So...

So...

When a trader possesses one ounce of gold and

the ratio rises to an unprecedented 100, the trader would sell their single

gold ounce for 100 ounces of silver.

When the ratio then contracted to an opposite

historical extreme of 50, for example, the trader would then sell his or her

100 ounces for two ounces of gold.

In this manner, the trader would continue to

accumulate quantities of metal seeking extreme ratio numbers to trade and

maximize holdings.

Note that no dollar value is considered when

making the trade;

the relative value of the metal is considered unimportant.

DYI’s averaging formula is best used when

accumulating bullion. Simply buy up to

the stated allocation only selling/buying when necessary [lessen capital gains

taxes]. For those in the distribution stage

[retirees] of life sell off gold or silver to bring back in line with the

current allocation.

DYI

No comments:

Post a Comment