John P. Hussman, Ph.D.

President, Hussman Investment Trust

May 2020

Market lows associated with U.S. recessions have generally occurred at valuations that were about 40% of those prevailing today – and sometimes even less.

DYI: Wow! 40% of the current Shiller PE at 27.65 x .4 =

11.06 Shiller PE. Here at DYI I’m one

hell of a bear and have been advocating low valuations after two or more market cycles such as experienced from

1966 to 1982. I’m the first to always

say anything is possible but all at once is a bit hard to swallow even for this

major bear. Let’s move on.

If investors assume that valuations will never again approach historical norms, they must also accept that future investment returns will be dismal compared to historical norms. To say that “low interest rates justify high valuations in stocks” is also to say “low interest rates justify low future returns in stocks.”

If one wishes to protect overvalued prices, one also has to accept meager long-term returns.

DYI: That is correct if you assume

permanent high valuations then investors better factor in permanent low future

returns. You’ll be anticipating real

[after inflation] average annual returns around 1 to 2 percent per year. Try factoring in how much you would need to

retire with those sub atomic low numbers. One hell of a scary thought!

Investors should be careful to avoid the misconception that easy money always supports the market. The fact is that market outcomes are conditional on whether investor psychology is inclined toward speculation or toward risk aversion. This is best inferred directly from the uniformity or divergence of market internals. Despite the fact that the Fed eased the whole way down during the 2000-2002 and 2007-2009 collapses, investors have come to believe that Fed easing always supports stock prices. That’s the wrong lesson, and the re-education of investors is likely to be excruciating.

DYI: Once the crowd decides to sell –

no matter how much the Feds goose the money supply – they will be actively

seeking buyers who will demand lower prices.

With the elites and their small army of technocrats around 10% of the

U.S. adult population now own 84% of all American equities when they attempt to

sell the only way the bottom 90% will be able to afford to buy is at substantially lower prices. Only till that day arrives stocks will become

the hot potato trading lower and lower among the 10%!

In my view, by aggressively intervening in the financial markets, at valuation levels that are still nowhere near run-of-the-mill historical norms, the Federal Reserve has performed an amygdalotomy on the investing public. The Fed has encouraged a maladaptive confidence that risk does not exist. This overconfidence of investors is itself a threat to their survival.

As of 2/19/20

27.36

In recent weeks, despite employment and economic dislocations that now have the Great Depression as their only precedent, the S&P 500 has advanced to valuations that are within 13% of the most extreme levels in history, including 1929, on measures best correlated with actual subsequent 10-12 year market returns. Meanwhile, the total returns of largest junk-debt ETFs have rebounded within 6% of record extremes.

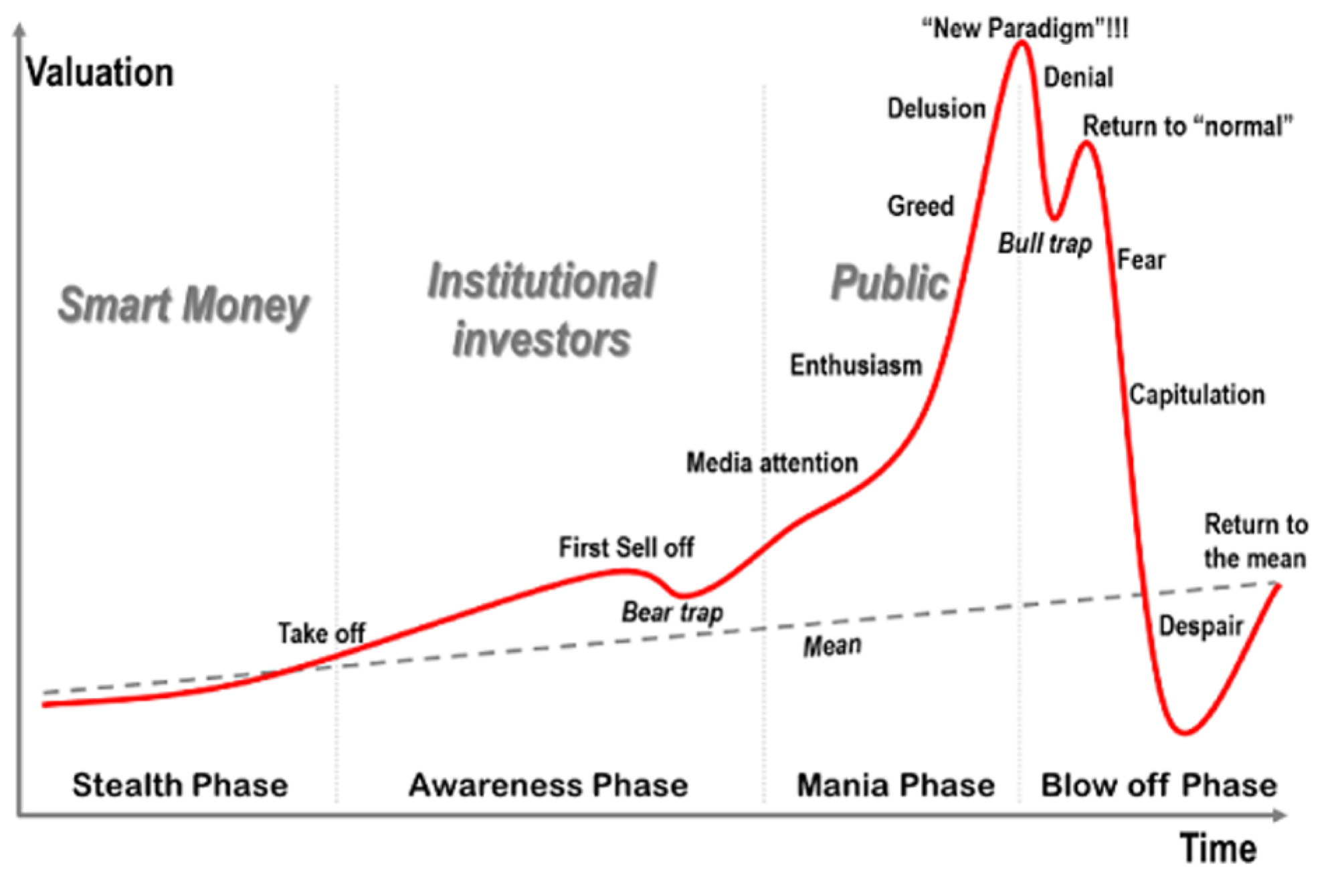

Emboldened by years of “buy the dip” reflex, and despite underlying risk-aversion, investors have found it impossible to resist taking one more bite at the apple. This enthusiasm reflects peak “the Fed has my back” confidence, at valuations that again imply negative S&P 500 10-year total returns, and despite market internals that remain more consistent with an overbought bear-market clearing rally than a sustained shift from risk-aversion.

DYI: In a nut shell this is nothing

more than classic bear market rally.

Once it is completed then you will see the real panic set in!

DYI: The above chart showing the

regression line stocks historically trade below 2/3’s of the time. The remaining one third is the blow off stage

due to massive overvaluation of equities.

Except for a brief period [2009 downturn] stocks have been massively

elevated since the mid 1990’s.

There’s no question investors are looking “over the valley” in expectation of a “V” shaped recovery, and they are already chasing stocks, because recession lows are typically followed by bull markets. In that context, it’s worth remembering that market lows associated with U.S. recessions have generally occurred at valuations that were about 40% of those prevailing today – and sometimes even less.

So yes, once the S&P 500 is down 60% or more, it will probably be reasonable to look “over the valley.”

That’s why the total return of the S&P 500 (nominal, including dividends) since March 2000 has averaged just 5.2% annually,

despite the recent market advance to the most extreme valuations in history. Conversely, it’s also why normal or below-average valuations have historically been associated strong long-term returns.

DYI: If you had invested a lump sum [see

above chart] in March of 2000 notice how long it would be before real after

inflation returns were achieved. Or

dollar cost averaging is nothing more than small lump sums – such as 401k’s

bi-monthly deposits – those made at high valuations will lower the participants

overall return.

With regard to the current downturn, I expect that over the completion of this cycle, the S&P 500 will most likely lose roughly two-thirds of its value as measured from the February 2020 highs.

Even that retreat would only bring the S&P 500 to historically pedestrian, run-of-the-mill valuations.

DYI: If you go to money chimp’s forecasting

calculator putting in Shiller PE at 27.83 with a current dividend yield of

2.00% go to sleep like Rip Van Winkle awake 10 years from now your average annual

estimated rate of return is 1.35%! Of

course most 401k’s charge 1.00% annual management fees plus trading impact

costs around 0.50% AND inflation most likely around 2% or more. Add those all up that’s 3.50% drag on your

return. Or in nut shell buying or holding

stocks on a wholesale basis [generalized equity fund] is a terrible time to

invest.

Hold onto your hats and

cash better values are ahead.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 5/1/20

Active Allocation Bands (excluding cash) 0% to 50%

62% - Cash -Short Term Bond Index - VBIRX

38% -Gold- Global Capital Cycles Fund - VGPMX **

0% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

[See Disclaimer]

** Vanguard's Global Capital Cycles Fund maintains 25%+ in precious metal equities the remainder are domestic or international companies they believe will perform well during times of world wide stress or economic declines.

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.