Why Assets Will Crash

The

increasing concentration of the ownership of wealth/assets in the top 10% has

an

under-appreciated consequence:

When only the top 10% can afford to buy

assets, unleashes an almost karmic payback for the narrowing of ownership,

a.k.a. soaring wealth and income inequality:

Assets Crash!

This means the pool of potential buyers is relatively small, even if we include global wealth owners.

Since price is set on the margins, and assets like houses are illiquid, then we can anticipate all the markets for assets owned solely by the wealthy to go bidless--yachts, collectibles, vacation real estate--because the pool of buyers is small, and if that pool gets cautious due to a drop in net worth/unearned income, there won't be any buyers except at the margins, at incredible discounts.

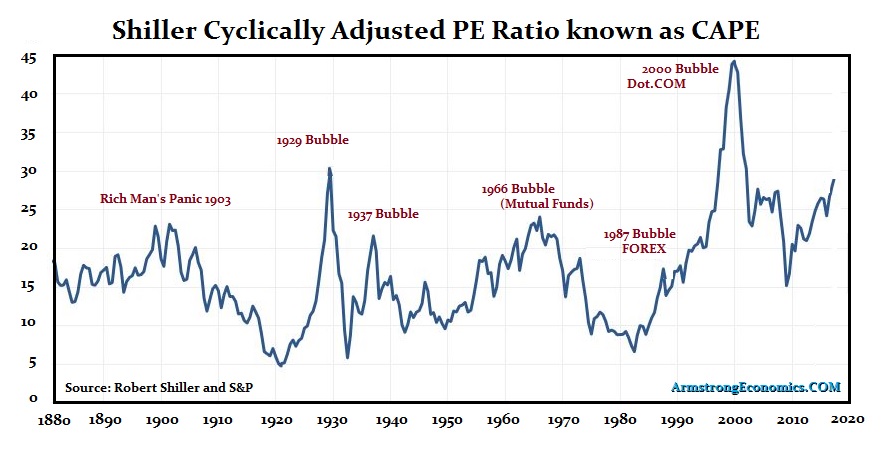

Stocks Remain

at

Bubble

Levels!

As of May 1, 2020

26.50

DYI: With so little potential buyers

available when the crash resumes its downward trajectory available buyers will

only come out of the woodwork at substantially

lower prices. This descend will take

years before a secular bottom – Shiller PE under 10 is achieved. The Federal Reserve will attempt to buy

everything from government and corporate bonds, stocks, to outright junk bonds

all to no avail in its desperate attempt to end asset deflation. Markets just don’t revert to its mean but

decline below thus creating it long term average. What is happening is simply put – revenge of

math!

Despite the overall

stock market being overvalued oil stocks and those in the energy field in

general is a bright spot for purchase.

Energy companies have dropped between 50% to 60% thus spotting current

high dividend yields. Obviously if oil

and gas prices stay this low for more than a year dividend cuts will occur,

however, at this low price you are being compensated for the risk. This is for those who have a time horizon for

3 to 5 years and possibly 7 years for this industry to be back on top of game

with overvalued stock prices.

Updated Monthly

No comments:

Post a Comment