Bubbles,

Scams, and Energy,

America’s Permanent Direction?

DYI: Today’s world elite’s – financial

planner controller’s owners for all phases of the financial sphere to the likes

of investment banks, commercial banks, and institutional investors, handing

down macroeconomic policy handled by world wide central banks and their

respective Treasury departments. Today’s

CEO’s of major corporations 1st priority is financial strategy relegating

the backseat to industrial policy, labor relations or sales. Today’s CEO no matter his or hers industry

number task above all else is everything financial. Pumping up their stock price by using

earnings or borrowings, aggressive mergers and acquisitions, rearranging debts with

bond holders, AND moving corporate domiciles with their profits to tax haven

countries all of this expended energy and money has all come at the expense of

R&D rather than expanding production all leading to downsizing of

operations thus a creation of structural

long term unemployment.

This

primarily began in the 1970’s moving briskly in the 80’s and then in the 90’s

at light speed culminating by the year 2000.

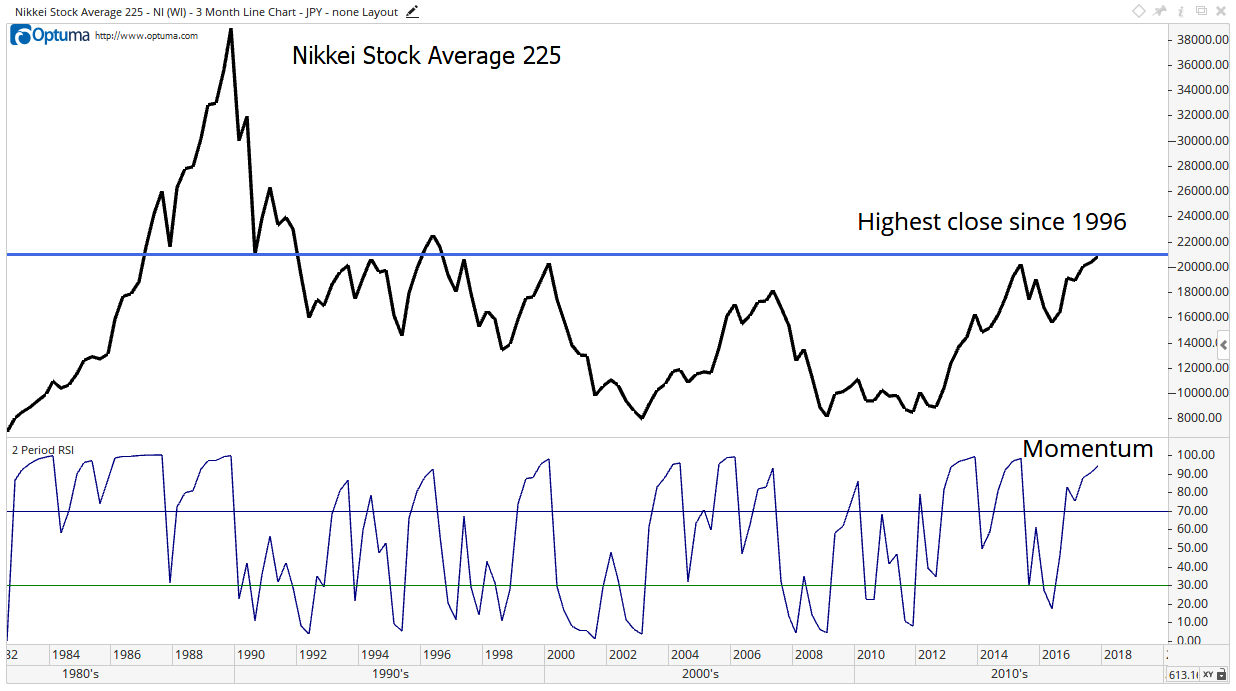

Since then despite a roller coaster ride prices have soared for stocks,

bonds, and real estate as real wages have eroded along with never ending

structural unemployment as corporations have ruthlessly downsized their

operations [moving to Mexico, China, and other foreign lands]. During normal business cycles of the past

after an economic downturn employment, wages and later consumer prices

rose. Not today as price gains are

within the sphere of stocks, bonds, and real estate that has caused a class war

between asset holders and the common man to a level greater than the notorious

Gilded Age.

Monopolies,

trade collusion [medical industrial complex] and the FIRE [Finance, Insurance,

Real estate] economy that has now chewed up the common man’s budget as exampled

here in the United States. They are no

longer able to compete in economy with a sky high monthly break-even as shown

below.

- Rent

or home ownership costs: 40%

- FICA

wage withholding: 15%

- Debt

Service (Credit Cards, Student loans, health care, etc.)

15% plus

- Taxes

– Income and sales taxes: 15%

- TOTAL: 85%

Is

it any wonder why large numbers of Millennials remain living with their parents

despite many who are now in their 30’s, postponing marriage out of necessity

that has dropped our birth rate below replacement pushing even further future

pressure on intergenerational social Security and Medicare social programs.

This

has international effects from the massive debt burden countries of Europe all

causing debt deflation [austerity] along with rent extraction to the likes of

selling off government projects [utilities, roads, railways etc.] to fund their

indebtedness creating long term rent extraction that was once paid at cost or subsidized

thus lowing costs for the common man.

This debt deflation is shrinking the general economy [along with the

U.S.] forcing emigration as portions of their populous tries their luck

elsewhere. Currently today emigration to

foreign lands is a trickle for Americans however as the pressure builds the

upcoming Z generation will begin the exodus to the likes of Europe.

Politically

here in the States and Europe power has shifted from democratically elected

governments to the elite owned/controlled mega sized international banks and

their financial cousin’s institutions either directly through the EU or here in

the States through the use of bribes [campaign monies] AND by controlling our

Intelligence Services all for their benefit.

Their strategy is akin to the Kings who owned everything by privatizing

public enterprises scale back their versions of Social Security, pension plans,

health insurance, and other social programs.

Scams

In

the basket of tricks the elites use is outright scams. These so called mass shootings such as Sandy

Hook, Las Vegas, Marjory Stoneman Douglas High School and so many more are all

fake. DHS FEMA drills promoted as real;

nobody shot; nobody killed or wounded promoted as real by the CIA controlled

main stream media all to promote fear.

This

is the classic psychological operation designed to create a PROBLEM thus a

REACTION from the populous demanding that something be done, providing the

SOLUTION that was already in place.

PROBLEM – REACTION – SOLUTION is the hallmark of a psychological operation

for the basis of a scam. Today’s school

districts are now being besieged by salespersons all selling security programs. These include bullet resistant windows, CCTV

networks, metal detectors, scanners, and an assorted security services. There are 94,500 plus public schools and

5,430 universities/colleges/community colleges many with multiple buildings.

This

is big business who get the THRILL of increased revenues/profits and we the

taxpayer get the BILL! Totally

unnecessary, the fear from the Mom’s and Dad’s that something must be done

pushes the scam forward. For those who

see through the scam they are belittled and scorned by remarks to the likes of “Why

are you against child safety?”

Add

on the burden of net energy decline that I wrote about in the prior post. As American’s unless we as a nation reign in

elites/bankers/monopolies and forthrightly with energy over the coming decades

will end up as serfs working for the King in a third world hell hole. Sorry to be so negative but this is the

direction we’ve been on since the 1970’s.

Till

Next Time…

DYI