American

Ageing Empire

Russia can cover its debt dollar for dollar in cash

Russia’s gross international reserves (GIR), including gold, continue to creep upwards and reached $487.1bn as of March 22 – enough to cover Russia’s external debt dollar for dollar in cash.

At the end of the last quarter of 2018 Russia had an external debt of $453.7bn and the debt has been falling steadily over the twelve months as the government makes use of the windfall from rising oil prices and falling expenditures to pay off more debt early.

Russia already had one of the lowest levels of debt of any major country in the world.

While most western countries have debt to GDP ratios well over the Maastricht rules recommended maximum of 60% (and some like Italy are well over 100%), Russia’s debt to GDP ratio has been hovering around 15% for years. At the start of 2016 Russia’s external debt was $520bn and it rose to a high of $537bn in the third quarter of 2017, but it began to taper off quickly as 2018 got underway.

The falling debt is part of the Kremlin’s strategy to sanction-proof as more financial sanctions are expected to be imposed this year. The Defending American Security Against Kremlin Aggression Act (DASKAA) sanctions that could target Russia’s sovereign bonds are supposed to be read by the US Congress in April.

DYI: Kremlin Aggressive Act. Total hogwash all in

an attempt by the American Empire and our subordinates U.K./Canada/NATO Central

Europe to bring down the Russia Federation where vast portions breaking away forming

new countries all friendly to the empire’s global natural resource

corporation. Russia is a master at

playing a weak hand and has so far beaten back those attempts.

A “financial fortress” had been built that makes it very difficult to pressure the Kremlin, but it comes at a cost. With the emphasis on stability over prosperity investment has been below par and the economy underperforming. Despite Russia’s growing cash pile of reserves real incomes in Russia fell again slightly in 2018, down for the fifth year in a row.

Now the economy has been largely insulated from the dangers of more sanctions the Kremlin is turning to the growing discontent and has launched a massive social and infrastructure investment plan that is supposed to “transform” Russia and improve lives as outlined in the May Decrees and the RUB25.7 trillion ($390bn) investments planned for the 12 national projects. The jury remains out on if this will be enough to see GDP growth accelerate to over 3% in 2021, which is the short-term goal.

The Beginning Of The End Of SWIFT: Russian Banks Join Chinese Alternative Global Payments System

With Russia actively dumping US dollars and buying gold at the fastest paced in decades, the writing is on the wall when it comes to what the Kremlin thinks of any possibility for a detente in the painfully strained US-Russian relations.

And with Russia now clearly seeking to end monetary ties with a dollar-denominated "west", there is just one alternative - China. Which is why it will probably not come as a surprise that several Russian banks joined the China International Payments System (CIPS) also known as China's "SWIFT", to ease operations between the two countries, according to a senior official at the Central Bank of Russia (CBR).

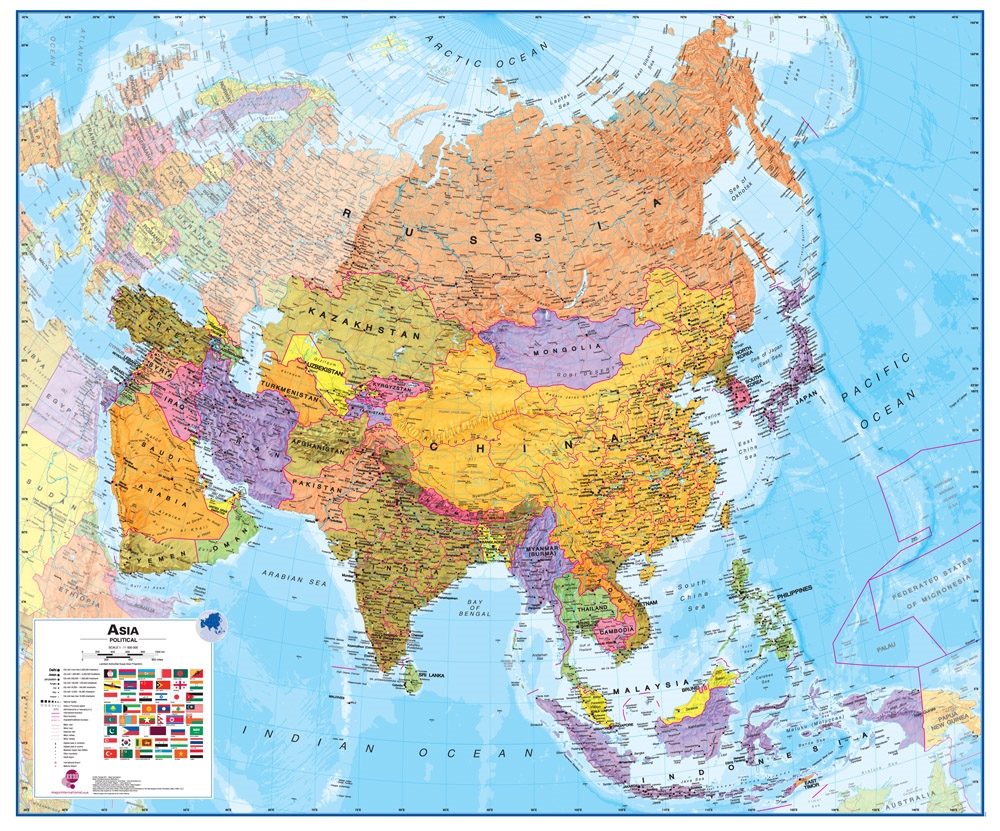

DYI: Once CIPS gets up and running with the

majority of the bugs worked out other countries will slowly but consistently

join in as America’s global military might wanes. This will be years in the making along with

an occasional spurts as more and more countries have the nerve to defy the American ageing

superpower. Obviously this will occur

all within Asian sphere.

DYI: Singapore, Australia and New Zealand will lag

behind due to their historical and cultural connection to England and the U.S.

but in the end geography will trump all of that; simply due to trading partner’s

proximity.

Main findings:

- US debt-to-GDP to reach 140% by 2024

- Net increase in debt could be as enormous as $10 to 15 trillion in just five years 2019 to 2024

- Federal budget interest expenditure could reach $1.5 trillion by 2028, 25% of the total

- There has been no real GDP growth since at least 2007

- Growth of government debt has exceeded even nominal GDP growth multiple times each year since 2007

- US reporting on national debt and inflation full of tricks

- War budgets ripping open huge deficits

- Skyrocketing social spending leaves no room for deficit cuts

- Unfunded liabilities now a reality as Social Security and Medicare funds dry up

In view of this, it is clear that the present US economic system will not survive over the coming 5 to 10 years.

Massive changes in the economic model would have to be undertaken either in an organized fashion (hardly imaginable) or through a mega financial crisis. Ultimately this would lead to a permanent downgrading of US standards of living as the economy would have to adjust back to its pre-financial bubble level of $14.5 trillion (a 30% drop from present debt-fueled level).

Following these cataclysmic adjustments, the US would lose its economic hegemony and hegemonic military power.

This would give a per capita GDP of just above $30 thousand, almost on par with Russia’s present $28 thousand per capita.

DYI: Russia and China know that the

American debt machine is closer and closer to blowing up once again. Russia is definitely in the cat bird seat

with their extremely low debt burden [15% of GDP] providing a far easier

transition when the U.S. loses its world empire status as compared to China

with their debt pyramid.

Be

as that may be here at home we have growing corruption by leap and bounds with

government agencies unable to account for billions and billions of dollars. Between HUD and DOD 21 Trillion is unaccounted

for over a 20 year plus time frame.

Medical

Industrial Complex that colludes to price fix and has moved from local monopolies

to regional swallowing up 21% of our GDP!

All in civil/criminal violation of the Clayton, Robinson/Patman, and the

Sherman Anti-Trust Acts and yet these 100 old year laws are never enforced. Is it any wonder that medical bankruptcy is

the most used form of bankruptcy among our citizens?

To

add on insult to injury our young people are saddled with huge levels of student

loans that cannot be discharged in bankruptcy. Student loans are what pushed up the cost of

higher education as the money never stayed with the student but went to Universities

and Colleges. Almost all of these

schools today have gone on massive building booms many to the likes of four and

five star hotels along with bloated staffs and salaries to match. And just when you thought that it could not

get any worse there is pending legislation to automatically garnish wages for repayment of loans. Classic debt slaves.

Till

Next Time…

DYI

No comments:

Post a Comment