Is

America

Going Japanese?

No Fix for Recession: Without a Financial Crisis, There's No Central Bank Policy Fix

Speculative credit bubbles inevitably deflate, and this is universally viewed as a crisis, even though the bubble was inflated by easy money, fraud, embezzlement and socializing risk and thus was entirely predictable.

A slow, steady decline is precisely what we can expect in an era of credit exhaustion, which I've covered recently: ( The Coming Global Financial Crisis: Debt Exhaustion). The central bank "solution" to runaway credit expansion that flowed into malinvestment was to lower interest rates to zero and enable tens of trillions in new debt. As a result, global debt has skyrocketed from $84 trillion to $250 trillion. Debt in China has blasted from $7 trillion 2008 to $40 trillion in 2018.

This erosion is so gradual, it doesn't qualify as a crisis, and therefore central banks can't unleash crisis-era fixes. Not only do they lack the political will to launch extreme policies in a moderate decline, it would be unwise to empty the tool bag of extreme fixes at the first hint of trouble; what's left for the crisis to come?

But what if the current speculative credit bubbles in junk bonds, stocks and other assets don't crash into crisis?

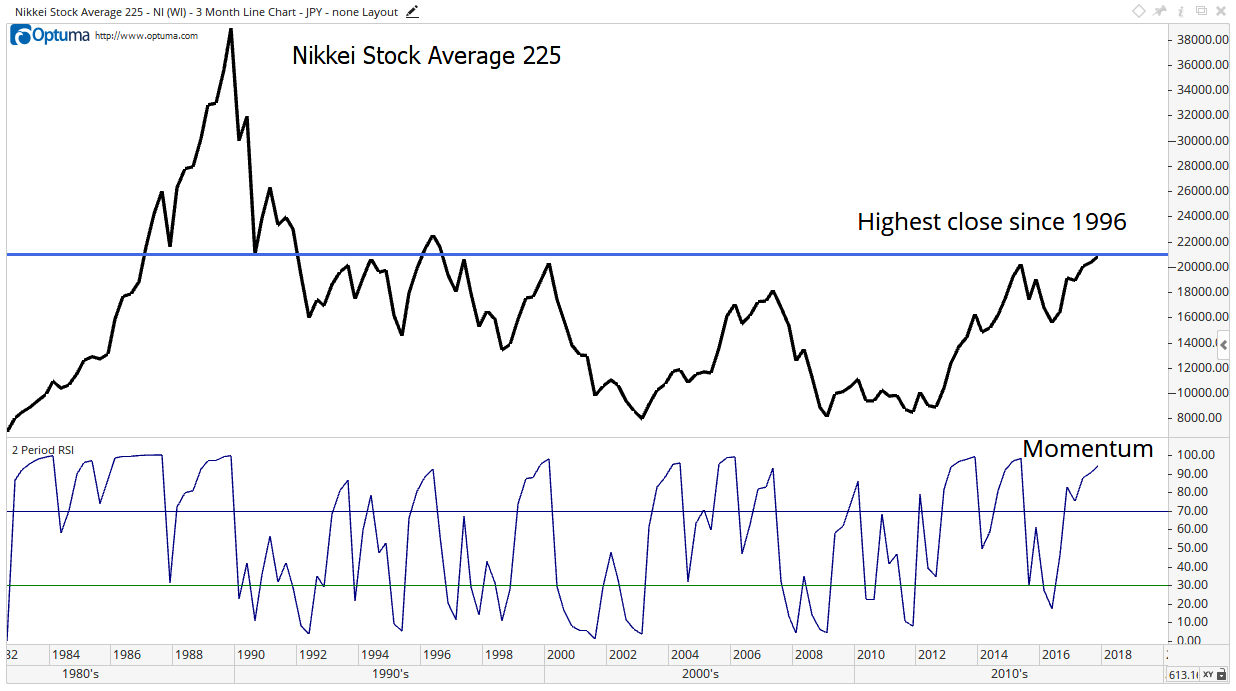

What if they deflate slowly, losing value steadily but with the occasional blip up to signal "the Fed has our back" and all is well?DYI: Instead of a crash we could be in for a long term melting of asset prices similar to the Japanese 22 year bear market.

What will be in store for American

equities? No one knows for sure nor does

this blogger. However, let valuations be

your guide and currently this is an awful time to buy as stocks are priced to the

moon with future returns subpar at best and very easily negative at this point

12 years out.

Hold onto your hats and your cash better

values are ahead it could be a long wait.

DYI

No comments:

Post a Comment