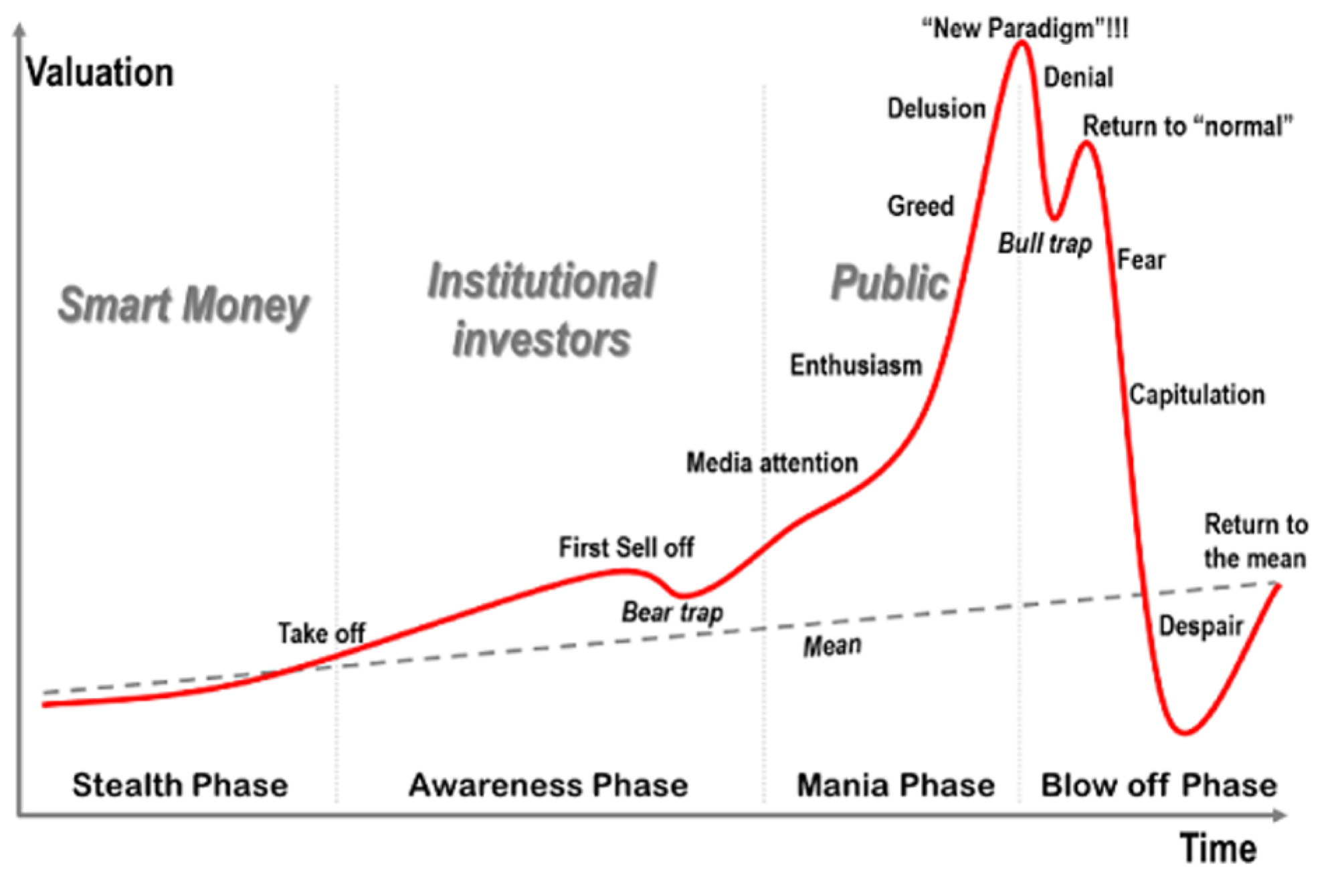

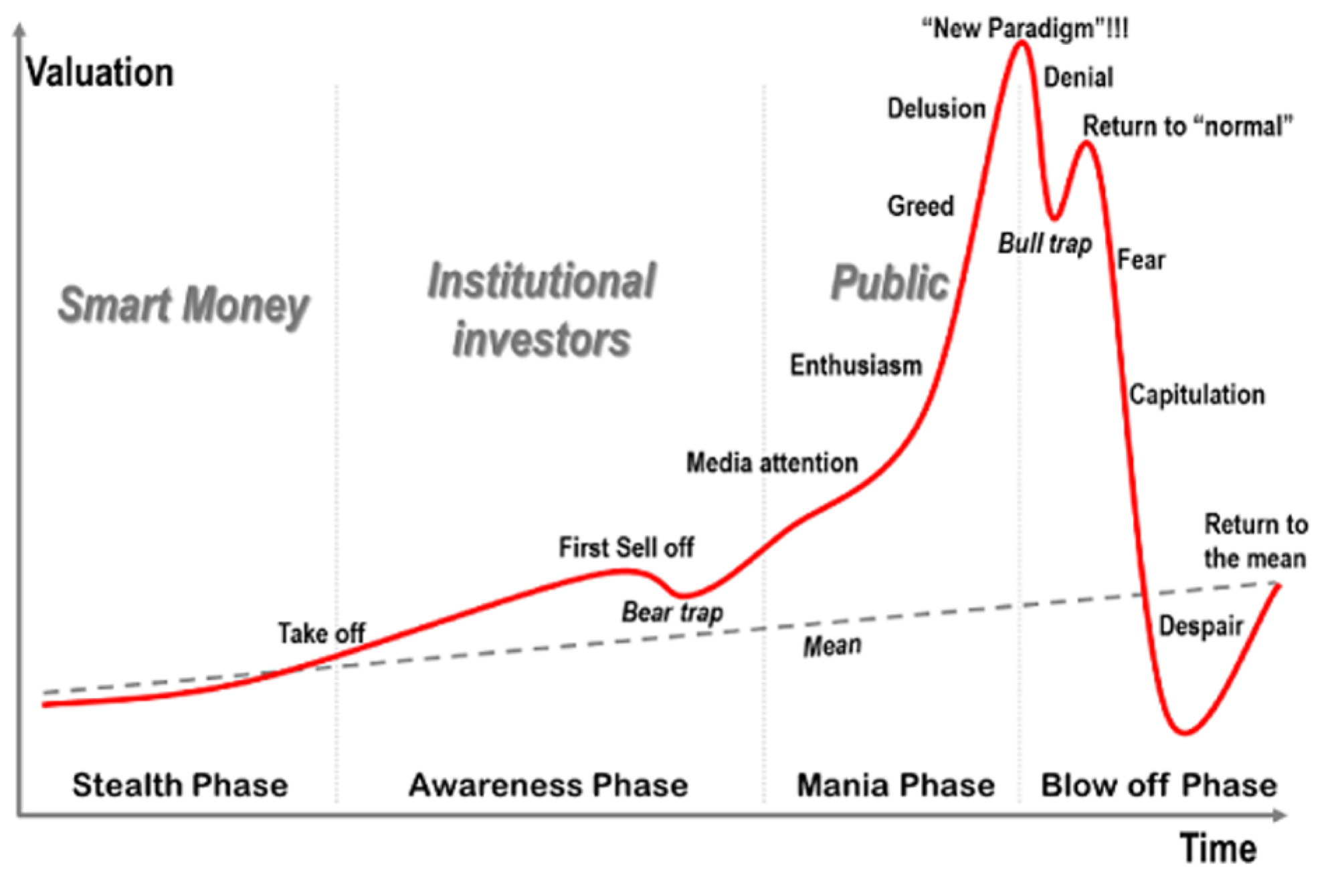

The Bear’s job is to

suck in as many investors to ride stocks all way to the bottom!

Kenneth E. Royer –

Dividend Yield Investor.

Cantor Fitzgerald on

the Stock Market Rally:

We continue to suggest

the rally this week was due to market participants smoking hopium. One of the five silliest rallies we’ve seen in our

careers. That is exactly how a bear trap feels. We continue to believe it is

time to aggressively hedge equity portfolios. To be fair, this has been our

suggestion for the past week. Yesterday’s market action was emblematic

disconnect for equity markets from any kind of reality – not just a fundamental

one. In a world in which central banks distort risk and prevent price

discovery, we understand that the markets and the economy are distinct.

#1 According to economists surveyed by the Wall Street Journal, the April jobs report will show that the unemployment rate in the United States

is now above 16 percent.

#4 Light vehicle sales in the U.S. just fell to the lowest level that we have seen

since the early 1970s.

#5 The government program that was supposed to get small businesses through this crisis has been

a tremendous failure…

According to the CNBC/SurveyMonkey Small Business Survey released Monday, which surveyed 2,200 small business owners across America, while the $660 billion

Paycheck Protection Program was instituted to give them a lifeline through the coronavirus and economic shutdown, only 13% of the 45% who applied for the PPP were approved.

#6 The “coming meat shortages” are already here. According to

the New York Post, Costco is now rationing meat and Kroger is warning customers of very serious supply problems…

Costco on Monday said it will be limiting customers to just three packages of meat per shopper, while Kroger supermarkets posted an alert on the meat section of its website warning that it may have limited inventory “due to high demand.”

Grocers have been bracing for a run on meat in mid-May as major meat processing plants, including Tyson Foods, have been forced to shut down production. But the shortages appear to have come earlier than expected as consumers worried about the meat shortage have been stocking up, experts say.

#7 Global smartphone shipments were down

11.7 percent in the first quarter compared to a year ago. That represents the fastest drop on record.

#9 U.S. consumer spending was down

7.6 percent during the first quarter of 2020.

#12 Fox Business

is reporting that Hertz is preparing to file for bankruptcy due to plunging car rental ridership.

#13 Gold’s Gym field for bankruptcy

on Monday.

#15 In Mexico, manufacturing activity is falling at the fastest pace ever recorded. The following comes from

Zero Hedge…

While few have lofty expectations for economic performance with the global economy still largely shutdown, what is happening in Mexico is simply unprecedented. Here are some striking observations detailing the unprecedented economic collapse of the southern US neighbor, courtesy of Goldman.

Business confidence declined sharply in April (the seventh consecutive monthly decline) with the index now sitting deep within pessimist territory. The Manufacturing and Services PMIs also fell sharply in April, and are now at the lowest levels on record.

#16 More than 30 million Americans

have already lost their jobs, and economists are projecting that millions more will lose their jobs in the weeks ahead.

#18 White House economic adviser Kevin Hassett is warning that U.S. GDP could fall

by up to 30 percent during the second quarter of 2020.

DYI: The U.S. stock market valuations

remain at nose bleeding levels.

Purchasing stocks at this time – on a whole sale basis [i.e. index fund]

is a horrible adventure as the estimated average annual return for the next 10

years is currently at 1.87%! If this bear

rally continues higher the estimated return will move closer and closer to

0%! This of course is before all fees, commissions

and INFLATION over those 10 years.

Investors buying or holding stocks at this level going to sleep like Rip

Van Winkle waking 10 years from now will have a loss nominally [fees and

commission costs] then driven down further as inflation reduces purchasing

power.

Till Next Time

DYI

No comments:

Post a Comment