This is the one thing I’m buying right now: Ron Paul

According to Paul, with many assets around the world in bubble territory, silver could be one of the safer places for investors to hide.

"I wouldn't buy bonds. I think that's in a huge bubble," he said. In addition to bonds, Paul noted that the air is beginning to get let out of the U.S. dollar as well as equities.

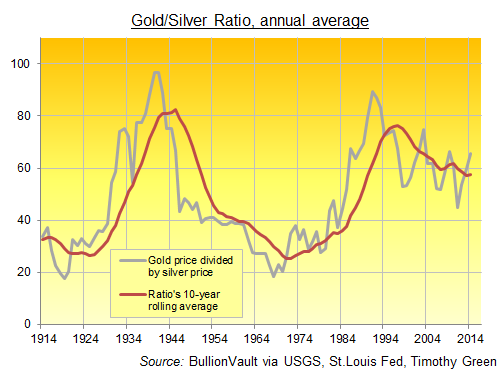

"We are defying gravity. These things can't go up forever," he said. "I think we are facing a downturn that's probably a lot worse than 2008-2009."DYI Comments: For those of you who hold physical gold and silver currently today the ratio of gold to silver is 73 to 1. Silver is the better bargain as compared to gold. Either silver is in a bull market or gold is going to retrace maybe some of both. Which ever way it goes this sets up the trade to increase your grams/ounces precious metals holdings. Gold is on the high end of its trading range as compared to silver.

DYI

No comments:

Post a Comment