Negative interest rates fascinate both professional economists and the public. Conventional wisdom is that interest rates earned on investments are never less than zero because investors could alternatively hold currency. Yet currency is not costless to hold: It is subject to theft and physical destruction, is expensive to safeguard in large amounts, is difficult to use for large and remote transactions, and, in large quantities, may be monitored by governments. Currency does not provide even a logical zero floor for market interest rates.

Interest rates come in two flavors. Nominal rates (or yields) refer to a periodic payment received by an investor relative to either the asset's principal (face) amount or its market price. Real rates refer to nominal rates minus the anticipated inflation rate. Each rate, at certain times and for certain securities, can be negative. Consider, for example, nominal Treasury notes and bonds, that is, securities not indexed for inflation. The yield to maturity on the 5-year Treasury note has been below 2 percent since July 2010, and the yield to maturity on the 10-year Treasury note has been below 2 percent since May 2012.

Yet, looking forward, the Federal Open Market Committee in January 2012 announced an inflation target of 2 percent—implying an anticipated negative real yield over the life of the securities.

Investors, facing uncertainty, appear willing to pay the U.S. government—when measured in real, ex postinflation-adjusted dollars—for the privilege of owning Treasury securities.

Federal Reserve Act

Section 2A. Monetary policy objectives

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

DYI Quick Comment: Amazing indeed how the Federal Reserve does almost anything it wants (accept outright fraud) and with the full blessing of past/present congress' and Presidents. The handmaiden for our budget deficits to finance the remainder after whatever level of taxes they can place on the populous. Stable prices is NOT two percent inflationary rate BUT ZERO. Alas if you read through The Federal Reserve Act there are exactly zero punishments from altering this mandate.

INTEREST RATES CONTINUE TO TREAD LOWER

The U.S. economy continues to lose steam with reporting corporate profits and more importantly sales declining. There is only so much remaining in the corporate system to wring out additional wage decreases from their employees. If we are on the Precipice (which I believe we are) of another world wide recession then layoffs will begin in about two quarters from now and maybe sooner. Obviously demand will fall off as will oil prices and interest rates along with corporate profits. A deflationary bust appears to be on its way.

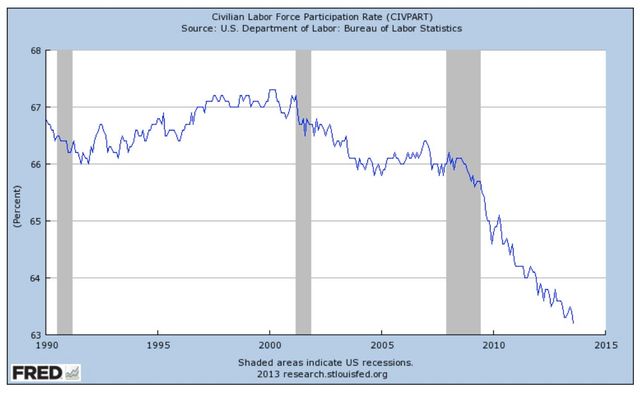

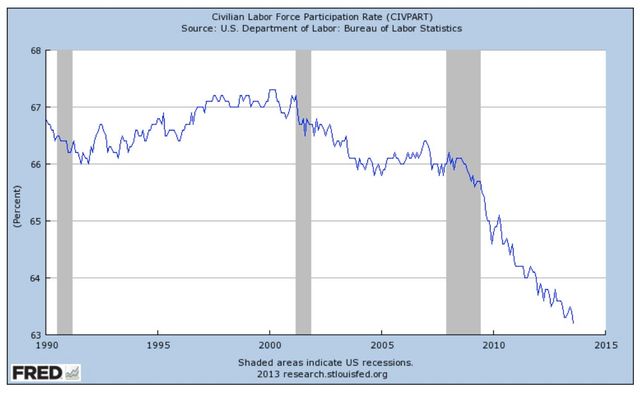

The chart below is exactly where we are in this secular downturn that began in January of 1999 (another chart follows) and it will finish in the early 2020's moving to high taxes, high inflation, and a LABOR SHORTAGE! This labor shortage will occur due to Boomer's leaving the work force in statistically significant numbers for the entire decade of the 2020's.

BACK TO THE PRESENT

The ending of this secular move will be marked by world wide plant closing and massive debt defaults world wide. American citizens will become very debt adverse. This is already occurring as the momentum for student loans is loosing steam. Paying down of credit cards, and Millennials are gun shy of home ownership. The only area where sub prime is back is in auto loans in which that bubble will burst during the next recession.

SUB ATOMIC LOW INTEREST RATES DISTORTS THE ECONOMY

As another sign that the financial services organizations are returning to the abusive practices that led to the financial crisis of 2007-8, BlackRock Inc. has found that insurance companies are increasingly making risky investments.

The most serious investment problem facing insurers is the low interest rate environment, led by the near-zero Federal Reserve funds rate, currently at 0.12%. In normal times, insurers invest money is corporate or government bonds, but in the current environment, the yield (interest rate) on these bonds is also close to zero.

According to BlackRock analyst David Lomas:

"The mix of divergent central bank policy, bond market liquidity risk, and a heightened regulatory regime, presents the industry with a dilemma. Opportunities exist to protect balance sheet health and maintain challenged business lines, but investors need to quickly get familiar with diversifying portfolios into higher-risk, higher-yield assets, and also closely manage the risks inherent in these new areas."

In other words, many insurers are investing in risky derivatives and exchange-traded funds, in the hope of getting higher yields. In addition, many insurers are investing in stocks, despite the high S&P 500 Price/Earnings ratio. Insurers are incurring exactly the same kinds of risks that led to the last financial crisis.

There's a big irony in this situation. As we said, the biggest investment problem is the low interest rate environment, led by the Fed's near-zero funds rate. But insurers say that one of their biggest risks is that interest rates may increase, triggering a correction in stock prices, and possibly a recession.

Generational Dynamics predicts that we're headed for a global financial panic and crisis. According to Friday'sWall Street Journal, the S&P 500 Price/Earnings index (stock valuations index) on Friday morning (October 23) was at an astronomically high 22.07.

This is far above the historical average of 14, indicating that the stock market is in a huge bubble that could burst at any time. Generational Dynamics predicts that the P/E ratio will fall to the 5-6 range or lower, which is where it was as recently as 1982, resulting in a Dow Jones Industrial Average of 3000 or lower.

DYI Continues: Resulting in Dow Jones below 3000 is a bit of a stretch even for this bear. However, Dow 5000 is possible moving the dividend yield to the 6%, 7% and possibly 8% range signifying a secular bottom forming for stocks. Currently today stocks and bonds are priced to the heavens leaving the value player little choice but to "sit this out" until reasonable values return.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 10/1/15

Active Allocation Bands (excluding cash) 0% to 60%

83% - Cash -Short Term Bond Index - VBIRX

17% -Gold- Precious Metals & Mining - VGPMX

0% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

DYI