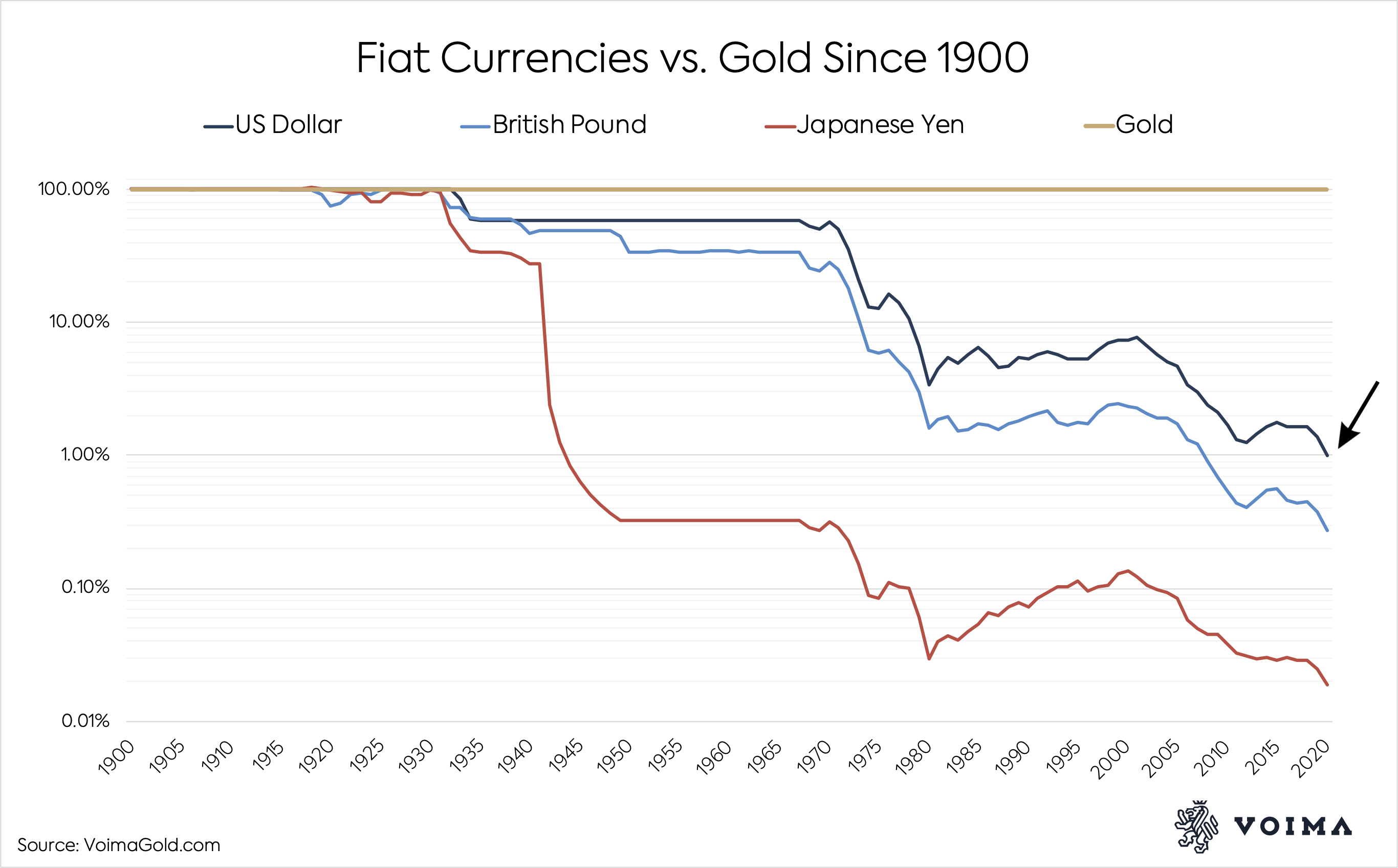

US Dollar Devalues by 99% vs Gold in 100 Years—Gold Price Crosses $2,067

Gold doesn’t yield, if you don’t lend it, but it's the only globally accepted financial asset without counterparty risk. Because of its immutable properties gold sustained its role as the sun in our monetary cosmos after the gold standard was abandoned in 1971. Central banks around the world kept holding on to their gold, despite its price reaching all-time highs such as now. This is due to Gresham’s law, which states “bad money drives out good.” If the price of gold rises central banks are more inclined to hoard gold (good money) and spend currency that declines in value (bad money).

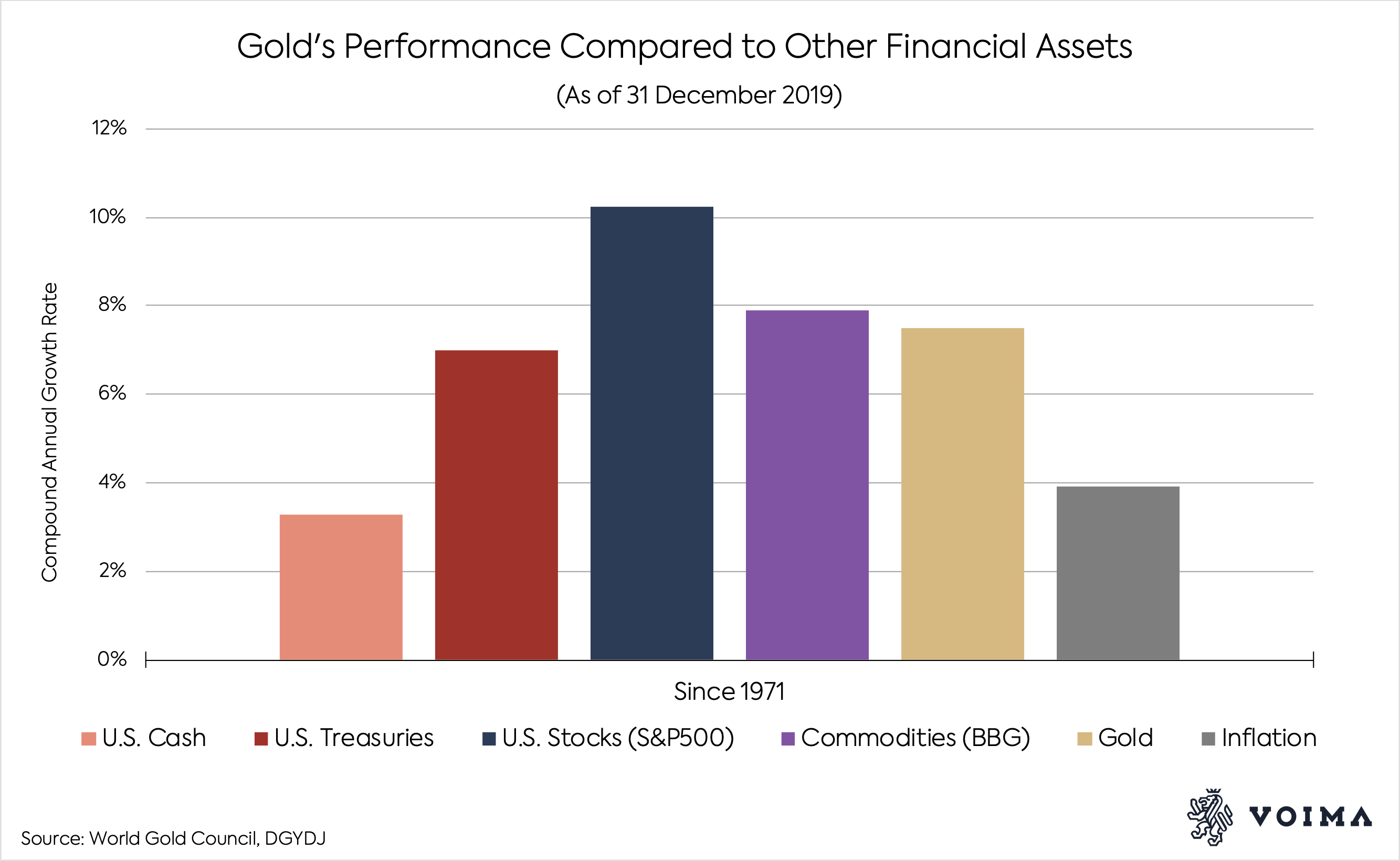

You might think that dollars with interest, for example U.S. government bonds (Treasuries), would have outperformed gold since the gold standard was abandoned in 1971. But this isn't true. Gold has performed better than Treasuries.

+ 129.9% Dow

+ 122.6% S&P 500

+ 81.6% 30yr Treasury Bonds

DYI: These long term charts are very illustrative and instructive whether it

is gold or any other assets. The biggest

drawback we are mere mortals with limited financial time periods “to put it all

together!” All asset categories over

shorter time periods will run either hot or cold knowing their respective

valuation will tip you off when the next change in season will occur. Always remember madness of crowds can and do

very often last far longer – [whether hot or cold] – than we think possible! We are living through such a time period

today with stocks and bond prices elevated to the heavens. Stocks and bonds are massively overvalued

thus making a shift back to the cold reaches of our beloved bear; but when is

the question?

This brings to mind the most revered and yet forgotten financial proverb(s)

of all time. Proverb #1: Don’t lose money. Proverb #2:

Don’t forget proverb #1!

This is not the time to through caution to the wind by loading up on

stocks and bonds. As historical driven valuation(s)

investors – [as opposed to speculators] – will look to other asset categories

for the next bull market. DYI works

through three primary assets. These

assets are: Stocks, long term bonds,

gold/silver along with their respective mining company shares. Cash – [short term bills/notes] – is our bull

pen waiting while earning a few bucks for valuations to justify purchase of one

of the three assets just mentioned.

No comments:

Post a Comment