The (Declining) Status of the US Dollar as Global Reserve Currency: Central Banks Diversify into other Currencies & Gold

by Wolf Richter •

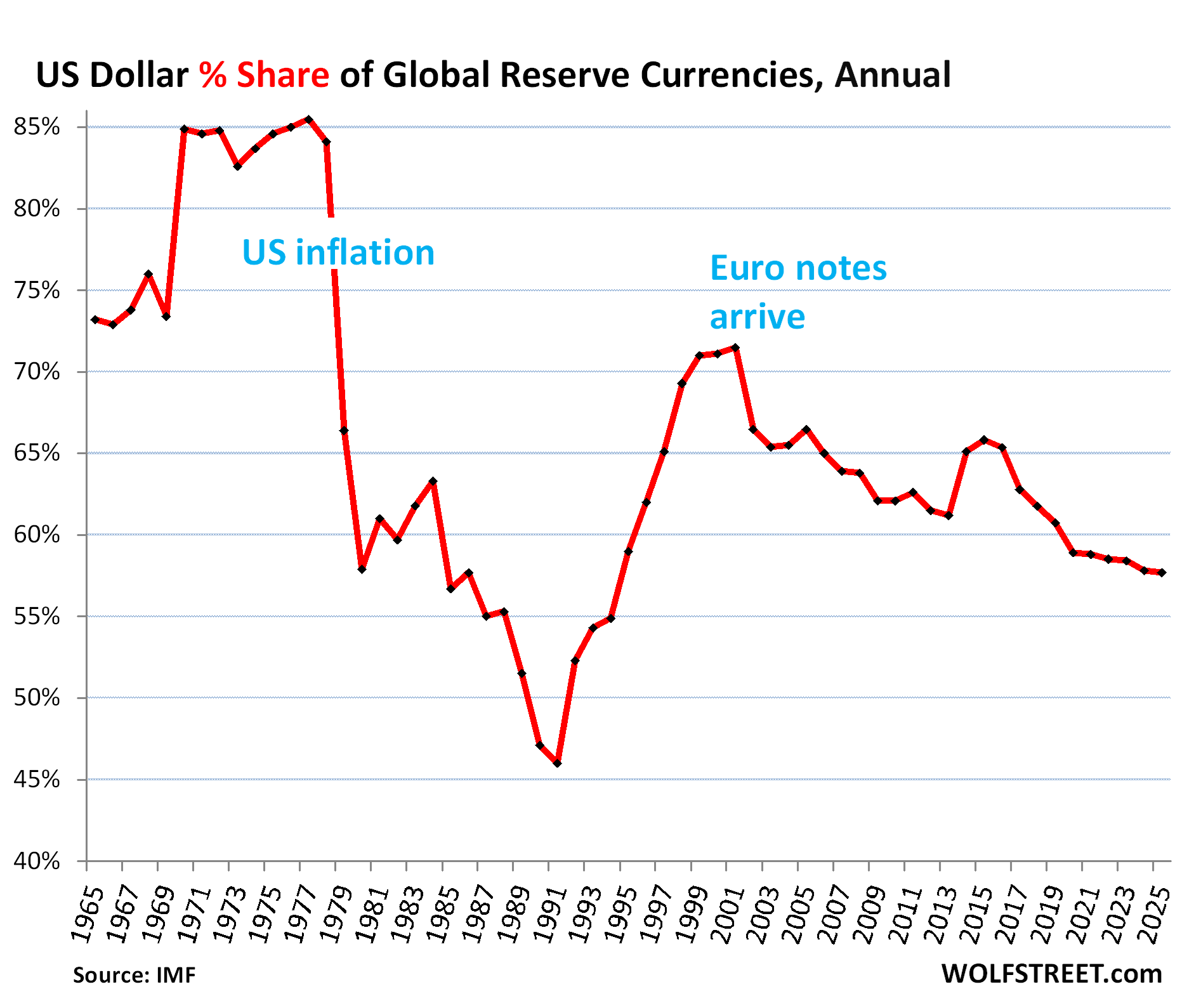

The dollar’s status as dominant foreign exchange-reserve currency has been diminishing for years as central banks have been diversifying to other currencies and over the past three years massively into gold. The decline of the dollar has been slow and halting, a couple of steps forward, one step back, sometimes bigger steps, other times smaller steps, and it remains by far the dominant global reserve currency. But the long-term trend is clear – and this has significant long-term consequences for the US.

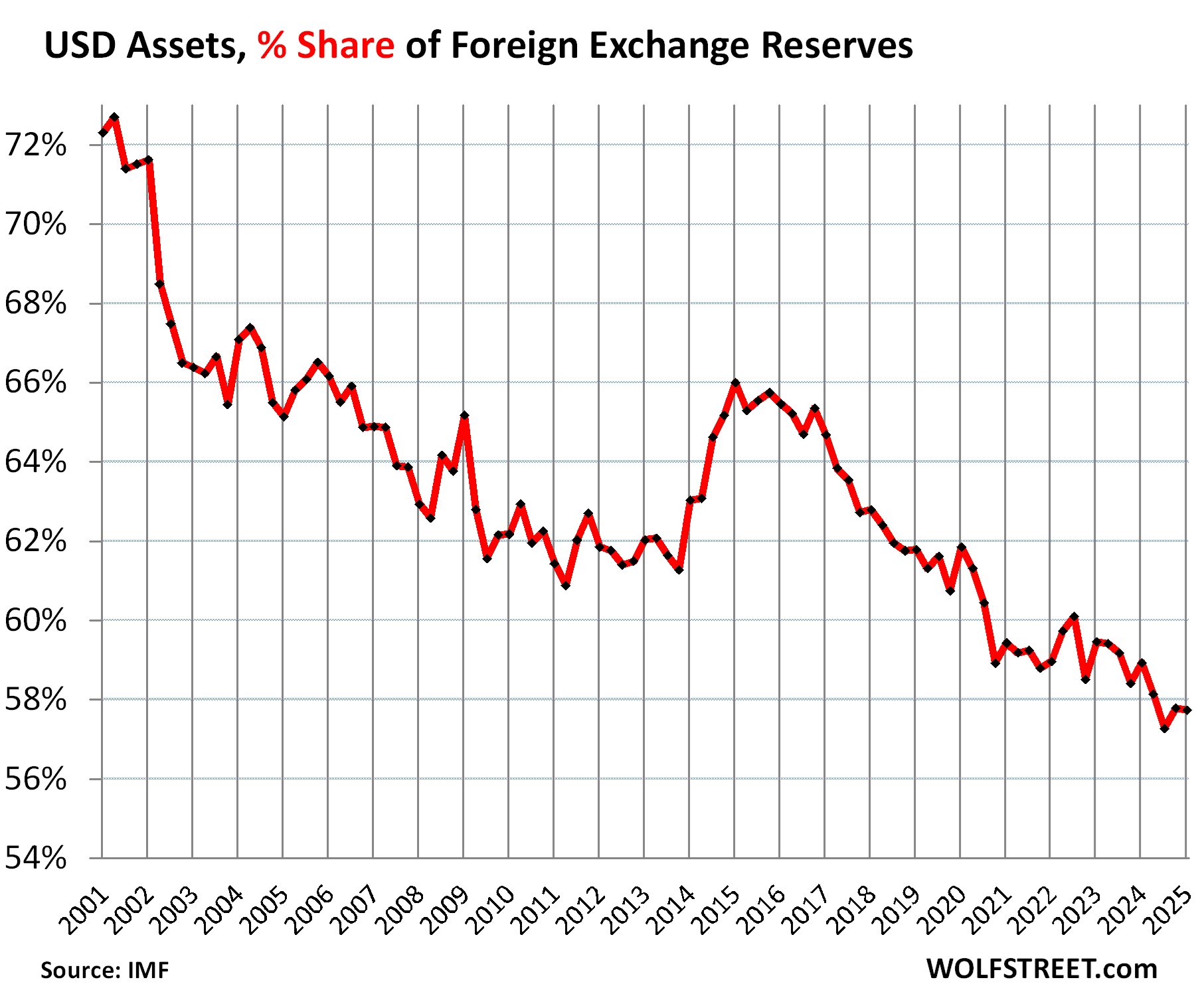

The share of USD-denominated foreign exchange reserves declined to 57.7% of total foreign exchange reserves in Q1, according to IMF’s data today. In Q3 2024, the dollar’s share had dropped to a 30-year low.

Why is the dollar’s status as global reserve currency important?

Central banks other than the Fed have purchased $6.7 trillion in dollar-denominated financial assets, largely US Treasury securities. This money flow into the US has helped the US fund its twin deficits – the huge trade deficit and the even huger budget deficit – and thereby has enabled the US to incur those two deficits.

The dollar status as the dominant reserve currency has been crucial for the US, it has enabled the US to live beyond its means. As that dominance declines slowly — two steps forward, one step back — all kinds of risks pile up ever so slowly, including the sustainability of the government deficits and the debt.

Charles Smith SubStack click HERE

DYI: Our debt pile up. 1st gear 1980; 2nd gear 2000; 3rd gear 2009; 4th gear 2020.

When the next recession hits will the Fed's push the panic button and push inflation into overdrive? So far history says yes they will driving the U.S. economy back into the 20 year inflationary cycle of 1965 to 1985. The current ploy for individual investors is not the return on your principal but the return of your principal after inflation!

I've added to my sentiment indicators Swiss Treasury Securities as another possible safe haven from the long term effects of U.S. inflation.

Smart Money - Buys Aggressively!

No comments:

Post a Comment