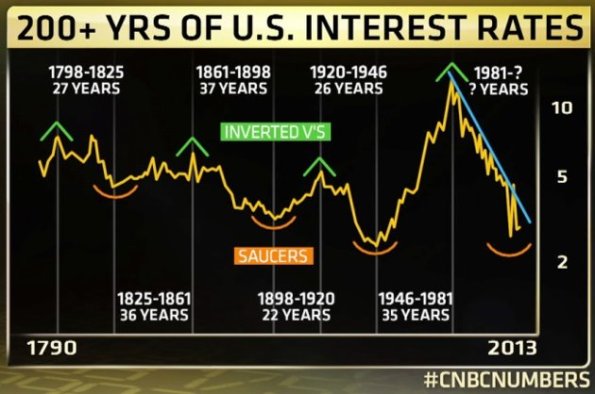

Employment appears to be perking up a bit with early Boomers (ages 69-70) begin to retire is some measure of numbers. They are postponing until late sixties or even seventy (max S.S. payment) as a group Boomer's are in bad shape financially with 1/3 flat broke. Low/Inflation/ Deflation will continue until half of this generation is in retirement moving the country into a labor shortage in the years 2020 -2024. A saving glut will continue with desperate Boomers who have the extra income to save forcing rates down along with world wide central banks battling the on going tepid economy.

For now long term bonds are not toxic. Historically the bond rally of a lifetime that began in 1981 is very long in the tooth. If you are in the accumulation stage it would be advised to slowly move into short term bonds/notes over the next 5 to 7 years. For those who are retired it is a more difficult task as more money moves into short end (or CD's at the bank) when you do need money you may pull down your principal and once its gone its gone. The only solution is to postpone taking S,S. at age 70 if possible and continue working possibly part time. Unfortunately there is no easy solution.

The Semi-Retirement Myth

It’s no secret the baby boomers, not to mention the Gen Xers coming up fast behind them, are not in particularly great financial shape for retirement. Conferences on the topic abound—the National Institute on Retirement Security is hosting “Shaking Up Retirement: Rethinking Financial Security for Americans” this Tuesday in Washington, D.C.

Pensions for people employed outside the public sector are vanishing. The defined-contribution plans that have replaced them aren’t cutting it. According to Fidelity Investments, the average 401(k) account belonging to someone at least 55 years old is worth $165,000. (And those people are lucky. They actually have workplace retirement accounts.) The Federal Reserve says the median amount held in all retirement accounts—individual or workplace—where the head of the household is at least 35 but hasn’t yet reached the official retirement age of 65 is $59,000.

No comments:

Post a Comment