Here We Go Again——August 2007 Redux

by David Stockman •

Charts added by DYI

Nearly everywhere on the planet the giant financial bubbles created by the central banks during the last two decades are fracturing. The latest examples are the crashing bank stocks in Italy and elsewhere in Europe and the sudden trading suspensions by three UK commercial property funds.

Brexit-Beleaguered Bankers Back to Begging for Bailouts!

More shameless in a bedazzling sort of way than rich banksters standing on the public curb with their hands out. First, we had the admission this past week by a major French bank that Italian banks are so sick (and so too big to fail) they could cause systemic banking failure throughout Europe if not bailed out by over-taxed taxpayers.

Lorenzo Bini Smaghi — who was a member of the European Central Bank’s executive board and who is now Chair of French megabank Societe Generale — said the only way to save European banks, if they start to fall like dominoes due to Italy’s banking problems, is with taxpayer-funded bailouts.

DYI: Has the pin found the bubble??? This bubble is destined to burst. Of course those who put these policies into place causing the bubble will blame anyone or anything except themselves. If Italian banks provide the "kick off" so much the better as they (presidents, congress, Federal Reserve) will have "foreigners to blame!"

If this is beginning to sound like August 2007 that’s because it is. And the denials from the casino operators are coming in just as thick and fast.

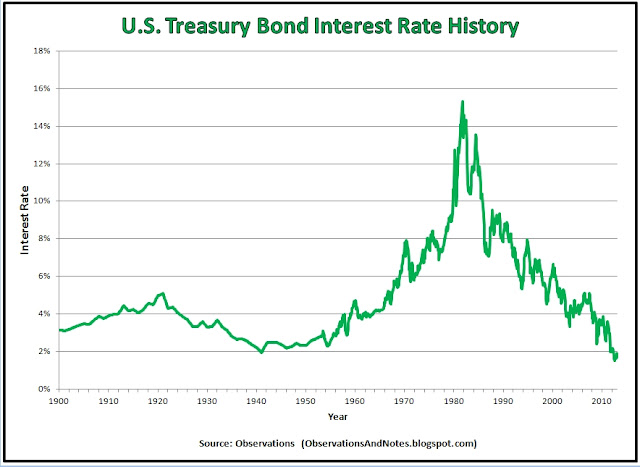

This is complete day traders’ nonsense, of course. During the past year, for example, the core CPI has increased by 2.20% while the 10-year treasury this morning penetrated its all-time low of 1.38%. The real yield is effectively negative 1%, and that’s ignoring taxes on interest payments.

10 year T-Bond yield as of 7-8-16 1.37%!

The claim that you can capitalize the stock market at an unusually high PE multiple owing to ultra-low interest rates,

therefore, implies that deep negative real rates are a permanent condition,

and that governments will be able to

destroy savers until the end of time.

30 year T-Bond yield as of 7-8-16 2.11%

DYI: The Federal Reserve are now out to totally destroy the basic saver and outright impoverish retirees who augment Social Security payments from their savings. This outrageous policy is miss allocating funds for business formation AND has unintended consequences of forcing retirees onto food stamps(SNAP)!

The truth of the matter is that interest rates have nowhere to go in the longer-run except up, meaning that the current cap rates are just plain absurd. Indeed, after last’s week’s “bre-lief” rally the S&P 500 was trading at 24.3X LTM reported earnings.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 7/1/16

DYI: DYI is a secular market player moving our asset allocation as very long term valuations change. Today valuation are insanely priced for both stocks and long term bonds. David Stockman is correct on a secular basis interest rates are forming a bottom. Could rates go lower? Absolutely. I don't rule out the insanity of the Fed's and other central banks. However, we are now to a point that the bond rally of a lifetime, for the most part, is finished.

Stocks are at insane levels as well. To simply bring prices back to the mean a 45% to 60% decline is required. On a secular basis when this market mean inverts stocks on a after inflation basis will drop around 80%! This will take a couple of cyclical round trips to complete with the Shiller PE10 under 10!

Market Sentiment

The trouble is, financial prices cannot be falsified indefinitely. At length, they become the subject of a pure confidence game and the risk of shocks and black swans that even the central banks are unable to off-set. Then the day of reckoning arrives in traumatic and violent aspect.

And that brings us to the father of Bubble Finance, former Fed Chairman Alan Greenspan. In a word, he systematically misused the power of the Fed to short-circuit every single attempt at old-fashion financial market corrections and bubble liquidations during his entire 19-year tenure in the Eccles Building.DYI: DYI reported a few days ago that former Fed Chairman Alan Greenspan at the age of 90 is now advocating going back onto a gold standard. Of course no admission of his misuse of power during his two decades as chairman as stated above curtailing market corrections or stopping bubbles from forming.

Hang onto your hats a stiff market wind has arrived.

DYI

No comments:

Post a Comment