Bubble

An Omen of Global Collapse

In the absence of a gold standard, the modern economy runs largely on credit. The Daily Reckoning’s Richard Duncan argues for example that credit must increase 2% to avoid recession.

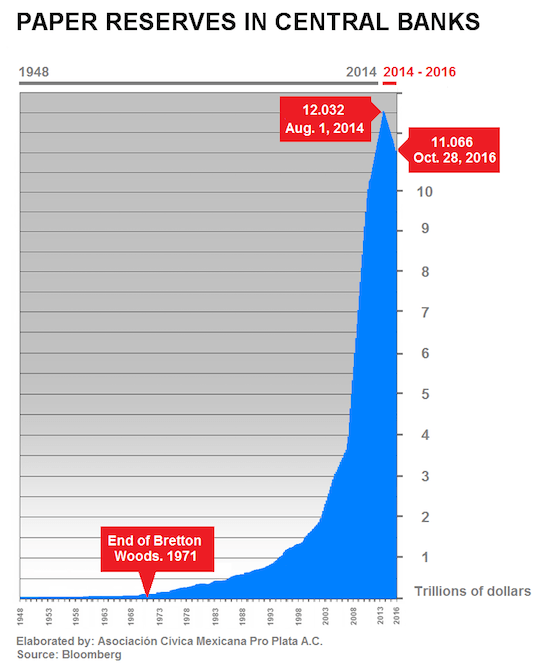

And St. Angelo thinks the contraction represents “the popping of the massive inflationary asset bubble” that began inflating after 1971. That, curiously enough, is the year Nixon closed the gold window and ended Bretton Woods.

Then on Aug. 1, 2014, they reached their peak of $12.03 trillion. But then they started dropping. And by Oct, 28, 2016, they fell to $11.06 trillion.The trend, starting in 1971, has now gone into reverse. Look:

This contraction is still in the early stages. But that can change, quick as a wink: “Deflation can take place at great speed, feeding on itself as fear of losses in investments propels the public to liquidate investments as quickly as possible.”

Ron Paul Warns: "Second Financial Bubble Going To Burst Soon...

Even Trump Can't Stop It"

By all appearances notes SHTFPlan.com's Mac Slavo, President Trump is doing his damnedest to turn around the economy, revitalize jobs and bring back prosperity. But the larger trends are already in place; the cycle is turning, and the bust cannot be put off forever.

Unfortunately, it looks like Trump may be blamed for a financial crisis that he didn’t cause. Analysts, including notably Brandon Smith, may be correct in pinpointing the attempt to use the new and highly controversial president as a scapegoat for the dirty work of the bankers.

Paul noted that he thinks U.S. policy has created a “failed system” in the country.

“All empires end and we’re the empire. It’s going to end and it’s going to be for economic reasons…we’re going to fail because we’re working within a failed system…this is a monetary problem…a spending problem…it’s going to be financial,”

Paul emphatically claimed, once again stating the collapse of America is imminent. “We have something arriving worse than 2008, 2009, much worse…It was the fault of the Federal Reserve,” Paul said, adding, the Keynesian economic model contributed greatly to the first bubble burst. Paul said the left will blame Trump for it like the right did to Obama, but he says it’s bigger than the office of the president, and blames the federal reserve and the previous 17 years of governmental spending.

DYI

Excellent article as to why the Federal Reserve needs to be abolished

Cheap credit--newly issued money that can be borrowed at low rates of interest--is presented as the savior of our economic system, but in reality, it's why our system is broken. The conventional economic pitch goes like this: cheap credit enables consumers to buy more goods and services (and since the system needs growth or it implodes, that's good).

The first thing we observe is those closest to the central bank credit spigot get the lowest rates and nearly unlimited lines of credit. J.Q. Citizen may be thrilled to get a 4% annual-rate mortgage, but the mega-millionaire closer to the credit spigot can borrow 10 times as much as J.Q. can, and at half the rate of interest.

In other words, cash isn't king in this perverse system: cheap credit is king. Those with access to cheap unlimited credit can scoop up all the productive assets, greatly increasing their wealth--and they can buy the political class, too, with campaign contributions and donations to false-front foundations.

This is why our system is broken: cheap credit has enabled the rich to become immensely richer while producing nothing of value--no additional goods or services have been produced by these financier skims.

You want to fix the economic system, reduce political bribery and reduce rising income inequality? Shut off the cheap unlimited credit spigot to banks, financiers and corporations.

If everyone with good credit had to pay 6% to borrow money, regardless of their position in the wealth-power pyramid, perverse incentives for parasitic skimming would take a major hit.

DYI

No comments:

Post a Comment