Bubble

News

Ron Paul

It’s a fallacy to believe the US has a free market economy. The economy is run by a conglomerate of individuals and special interests, in and out of government, including the Deep State, which controls central economic planning.

Rigging the economy is required to prevent market forces from demanding a halt to the mistakes that planners continuously make. This deceptive policy can last only for a limited time. Ultimately, the market proves more powerful than government manipulation of economic events. The longer the process lasts, the greater the bubble that always bursts. The planners in charge have many tools to perpetuate confidence in an unstable system, but common sense should tell us that grave dangers lie ahead.

DYI: Ron Paul as always has hit the nail squarely

on the head! Although no recession as

yet [prior post] the controllers have completely mismanaged the economy

creating one bubble after another.

Currently the U.S. stock market is in its second secular top without inverting

to its secular bottom. In other words

the Fed’s and other controllers have blown another bubble in stocks and junk

bonds. DYI is anticipating a 60% to 75%

decline in stock prices once the bubble pops.

Junk bonds will at the very least be cut in half.

Official government reports inevitably claim inflation is low and we must work harder to increase it, claiming price increases somehow mystically indicate economic growth.

The Consumer Price Index is the statistic manipulated to try to prove this point just as they use misleading GDP numbers to do the same. Many people now recognizing these reports are nothing more than propaganda. Anybody who pays the bills to maintain a household knows the truth about inflation.

DYI: In a debt based system inflation is required as

this makes it possible to pay off debts with inflated dollars. Of course not too much the banker’s will

scream about the declining purchasing power of their interest stream of

money. However things appear to be

getting a bit out of hand as inflation reported by the Chapwood Index of 500

commonly used items shows price inflation running at average of around 10%.

Ever since the Great Depression, controlling the dollar price of gold and deciding who gets to hold gold was official policy. This advanced the Federal Reserve’s original goal of demonetizing precious metals, which was fully achieved in August 1971. Today, even though the official position of all central banks is that gold is not money, central bankers constantly rig the dollar price of gold, pretending the dollar is stronger than it really is.

Just as the market overrode the artificial price of $35 per ounce in the 1970’s, today’s price will soar when the dollar is dethroned as the king of the world’s currencies.

DYI: With a world wide debt based system of money

gold can be a great store house of wealth if it is bought like any other asset

a bargain prices. Currently the Dow/Gold

Ratio [19 to 1] is only slightly below fair value [just a bit of a bargain] only a modest

investment is warranted at this time whether physical gold or the precious

metals mining companies.

As of 6/25/18 Dow/Gold Ratio is 19 to 1 rounded.

DYI: However

silver as compared to gold is in bargain territory with gold to silver

ratio at a lopsided of 78 to 1.

In the rigged financial system, stock and bond prices are kept artificially high for the wealthy on Wall Street. To do this, interest rates have to be kept below market rates—which is a major contributing factor to gross economic distortions and financial bubbles.

The false belief setting the stage for an economic crash is the doctrine of “deficits don’t matter,” endorsed universally in the nation’s capital, has been going on for decades. We are destined to soon find out that deficits do matter, and matter very much. Denying economic truth and common sense for long periods of time always ends badly.

As of 6/25/18 10 yr rate is 2.90%

DYI: The bond buying bull market of a lifetime is

primarily over. If our economy goes into

a massive deflationary bust we will have negative rates as the Fed’s desperately

attempt to reflate the economy. And yes long term bonds will soar. Just looking at the above chart the preponderance

of gains is clearly behind us. Only

until recently has the Fed’s increased interest rates thus allowing our model

portfolio to purchase a small position [5%].

If one were to listen only to the MSM recite government economic reports, concerns for the future would be minimal. Low unemployment rates, negligible inflation, no hot war going on, and the US remains the wealthiest and militarily the most powerful nation in history. Are the worriers justified in their concerns?

DYI: The Main Stream Media [MSM] is a part of our

shadow government that runs the Deep State.

The MSM and press corps is nothing more and nothing less than flat out

PROPAGANDA. Fortunately less and less of

our fellow Americans believe a word that comes out of their talking heads. And thank God for that!

There are a lot of them yet the Fed doesn’t seem to be concerned, but then again it has never warned of trouble ahead, even when a major correction was at our doorstep. This is either because the Fed chairmen don’t know any better, or they don’t want to panic the people into preparing for a crisis by knowing the truth. My guess is that it’s both.

One thing for sure is that middle class America is not of much concern to the money managers. What occupies their minds is how to protect Wall Street from any financial crisis that might arise. The monetary elite are alert as to who will be blamed, and the Fed in particular, must be protected.

The key individuals, involved in any rescue operation during a financial crisis, are the Fed Chairman, the Treasury Secretary, the Chairman of the SEC, and the CFTC. We can be assured that they were quite active in the financial crisis of 2007 and in the years of quantitative easing failures that followed. Today’s amazing stock market “success” (as of January 2018) is especially interesting since there is a net outflow of funds from the market. This means that the PPT has been successful in delaying the major correction that is required.

DYI: The elites have been systemically selling off

equity securities to the great unwashed attempting to lessen the blow when the collapse

occurs. They own so much it will be

impossible for them to sell everything and of course if they could they would

lose control of those corporations. From

their point of view if they can reduce by 25% that would be a success at 50%

reduction a whirl wind accomplishment!

This would give massive buying power to purchase assets at bargain

prices and unfortunately massive control over our daily lives as well.

Abnormally low interest rates permit buybacks, mergers, and direct intervention in purchasing stocks and bonds by the PPT or by its allies around the world, with funds clandestinely provided by the Fed, to prop up the market and manipulate the gold price.

There’s good reason the financial elite hysterically oppose an audit of the Fed.

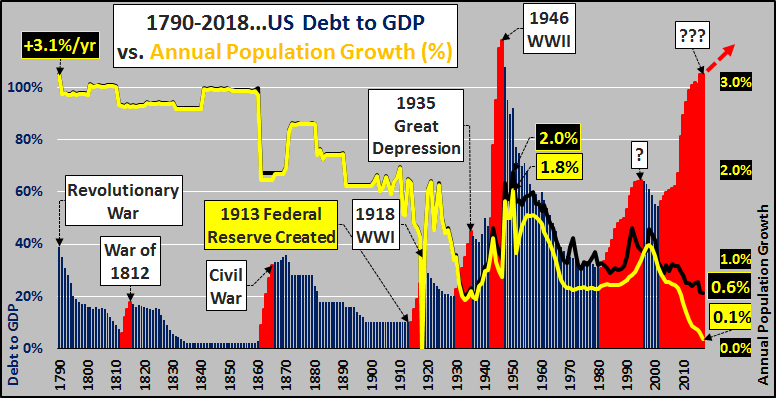

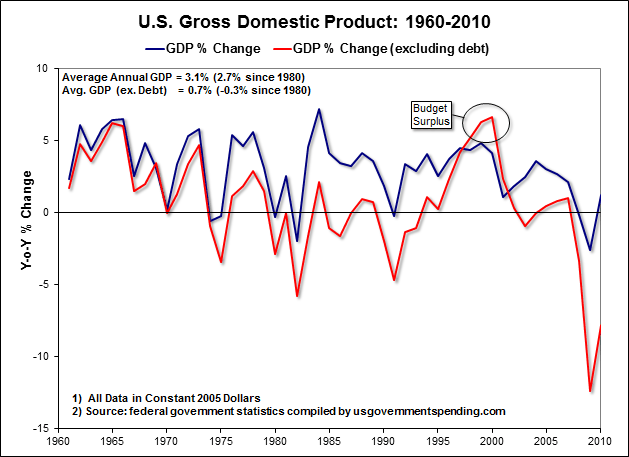

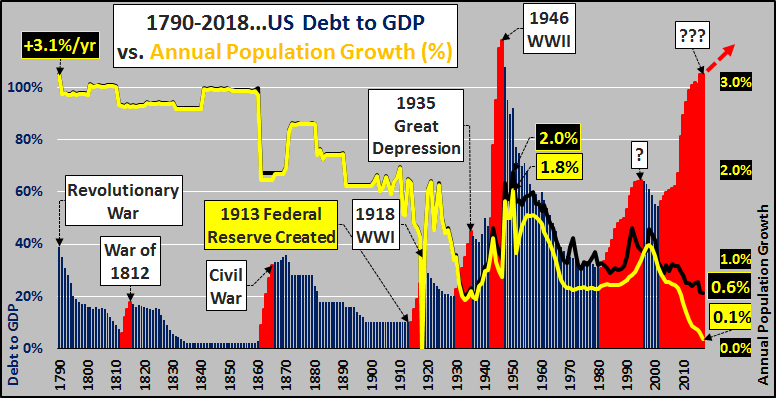

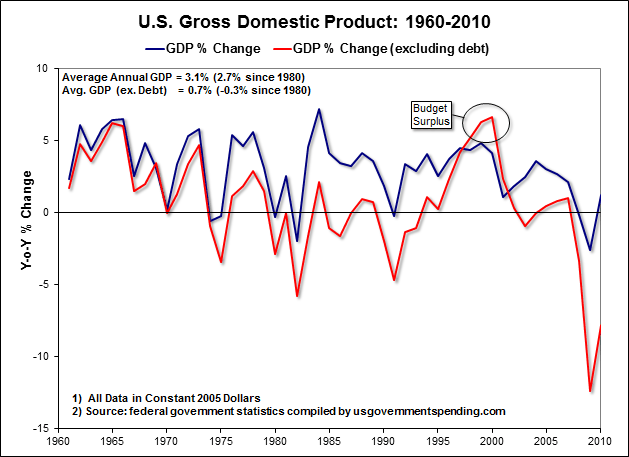

Even the mediocre GDP reports overstate economic growth. Since 2008, government debt has grown much faster than GDP, which some claim supports the notion that the more debt the Congress runs up, the better off the economy will be, rather than admitting there’s been no overall growth.

DYI: Bingo Ron Paul hits this one out of the

park. GDP growth has been pushed by ever

increasing debt. Take away the debt on

average since 1980 there has been negative -0.3% declining standard of

living. Debt is everywhere you turn with

student loans now over the trillion mark, credit cards, mortgages, car loans

and with corporate America leverage up plus Uncle Sam and our 50 States. Hell Puerto Rico’s debt monster of 70 billion

with a population of 3.3 million people which is $21,000 (rounded) per every man,

women and child. And the population is

declining as many have left for the mainland due to the hurricane and overall

poor economic conditions.

There are many reasons why Americans should be deeply concerned. Evidence readily exists that our prosperity and our liberties are threatened. Our bipartisan foreign policy of interventionism is needlessly driving us toward a major military conflict. In the last several decades, the US has engaged in constant military conflict remaking the Middle East and elsewhere. Whether it’s a Republican or Democrat administration, the policy remains the same— an obsession to constantly aggravate Russia, China, Iran, North Korea, Syria, Iraq, and Afghanistan.

One of these days we can expect the victims of our interventions in their internal affairs, to declare “enough is enough” and gang up against us.

The American people will likewise get tired of financing our senseless warmongering policies and demand that they stop.

Corruption in government is epidemic.

Few people believe the lies our officials tell us and most Americans know that the truth-tellers, i.e. the whistle-blowers, are punished, while the criminals in government are rewarded. Commissions, special investigations, and prosecutors are set up to investigate government malfeasance, but instead are used to cover up mistakes and political crimes and never to seek the truth.

Average middle-class citizens, already suffering from the corrupt monetary system, are scrambling to find the best way to protect their wealth and safety in these challenging times. Understanding how we got ourselves into this mess is key to preparing for the tough times that lie ahead.

All fiat currencies are self-limiting since they are based on fraud and are equivalent to counterfeit. Unfortunately, they can last for prolonged periods of time, only making the economic distortions much greater.

DYI: Ron Paul’s article goes on at length. I’ve highlighted the paragraphs that expose

the majority of the problems we face as a nation. Plus where we are in relation to value for

stocks, long term bonds, and gold.

CHEERS!

Market Sentiment

Smart Money buys aggressively!

Capitulation

Despondency

Max-Pessimism *Market Bottoms* Short Term Bonds

Depression MMF

Hope Gold

Relief *Market returns to Mean*

Smart Money buys the Dips!

Optimism

Media Attention

Enthusiasm

Smart Money - Sells the Rallies!

Thrill

Greed

Delusional

Max-Optimism *Market Tops* U.S. Stocks

Denial of Problem Long Term Bonds

Anxiety

Fear

Desperation

Smart Money Buys Aggressively!

Capitulation

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 6/1/18

Active Allocation Bands (excluding cash) 0% to 50%

66% - Cash -Short Term Bond Index - VBIRX

29% -Gold- Precious Metals & Mining - VGPMX

5% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.