Hard Money Advocates

Win in Texas

Texas Gold Bullion Depository Getting Closer to Reality; Will Allow Texans to Do Business in Gold

Last week, the Texas House unanimously passed a bill that would facilitate the establishment and operation of the Texas Bullion Depository; helping to undermine the Federal Reserve’s monopoly on money.

The creation of a state gold depository in Texas represents a power shift away from the federal government to the state, and it provides a blueprint that could ultimately end the Fed. The facility will not only provide a secure place for individuals, business, cities, counties, government agencies, and even other countries to to store gold and other precious metals, the law also creates a mechanism to facilitate the everyday use of gold and silver in business transactions. In short, a person will be able to deposit gold or silver – and pay other people through electronic means or checks – in sound money.

As part of the process, Rep. Giovanni Capriglione (R-Keller) introduced House Bill 3169 (HB3169) in March. The legislation includes various provisions for the operation and administration of the Texas Bullion Depository, to define the roles of depository agents, to direct the appropriation of money from depository fees, charges, penalties, and other amounts related to the depository. The bill also includes provisions to exempt precious metals in the depository from property taxes.

On April 20, the Investment and Financial Services Committee passed HB3169 by a 5-0 vote. It was fast-tracked to from there, and the full House passed it by a 143-0 vote on May 5.

Once operational, private individuals and entities will be able to purchase goods and services, using assets in the vault the same way they use cash today. Exemption from taxation of precious metals stored in the vault will further facilitate the use of stored bullion as money.

This would incentivize the use the Texas Bullion Depository. If they then start allowing checks and debit cards to be used in conjunction with the bullion accounts – likely the next step – it would essentially create a specie- and bullion-based bank introducing currency competition with Federal Reserve notes.

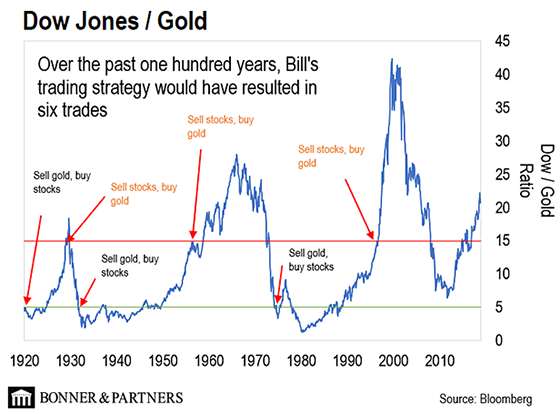

DYI:

All that is needed is for the top 5 states by

population [California, Texas, Florida, New York, and Illinois] to create their

bullion banks. The smallest states by

population would immediately follow suit as they would be forced to compete in

the precious metals banking business.

The remaining middle sized states would fall into line not wanting to be

left out. I don’t see this ending the

Fed but no doubt would put a serious dent into their monopoly. If this becomes popular with Texans I see

Florida falling in line as the remaining three states saddled with leftist

Federal policies.

DYI