Coming to

America Soon??

Selling such bonds – a hot topic after Bank of Japan Governor Haruhiko Kuroda commented on the idea this month – would allow the government to lock in cheap long-term funding and give yield-starved investors higher returns.

It could also offer the BOJ a new tool for its “yield-curve control” (YCC) policy by helping prevent excessive declines in super-long bond yields, which hurt returns of pension funds.

Adding 50-year bonds could drain liquidity from markets of other super-long bonds, making yields vulnerable to wild swings, MOF officials say. It is also unclear whether 50-year bonds would be traded much, as investors could suffer huge losses if yields spike.

Long bonds have drawn global attention as countries try to use super-low rates to lock in debt. Some European countries have sold 100-year bonds, a move Treasury Secretary Steven Mnuchin said the United States could also consider.

DYI:

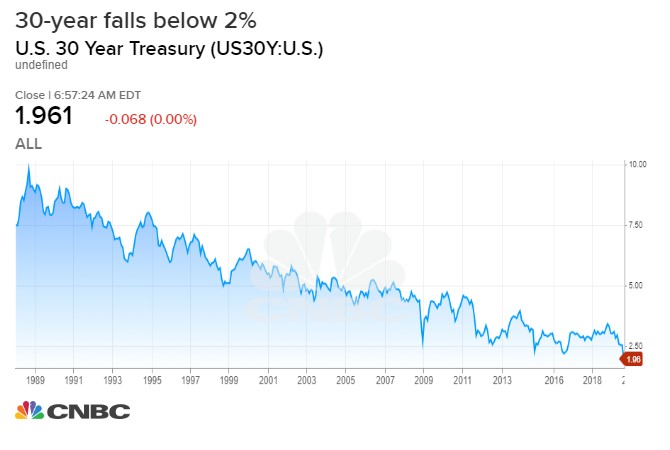

Sub atomic low interest rates with massive

budget deficits as far as one can see it is highly likely the Federal

government will follow Europe using ultra long term financing locking in these

low rates. Of course there will come a

time [if these bonds come to fruition] they will be the flip side of the past

40 years and become the short of a lifetime as interest rates begin their

northern journey. For investors as

oppose to speculators long term bonds [10 years or longer] have played out the

huge bulk of their bull market that began in 1981.

Yield as of 11/22/19

2.22%

DYI’s model portfolio remains heavily in precious

metals and short term bills/notes.

Updated Monthly

No comments:

Post a Comment