Bubble

News

Our Currency, Your Problem

We’ve been witnessing widespread protest and unrest across countries with distinct political and economic systems, such as Hong Kong, France, Chile, Spain, Ecuador, Lebanon and Venezuela just to name a few. Those with vested interests and an ideological solution to sell insist it’s all because of socialism, capitalism or some other ism, but the truth is this goes far deeper than that.

What’s actually happening is the geopolitical and economic paradigm that’s dominated the planet for decades is failing, and rather than address the failure in any real sense.

Elites globally have decided to loot everything they possibly can until the house of cards comes crashing down.

Here's why the stock market can never crash or the US will slide into a historic depression: financial assets are now 5.6x GDP

Which gets us to the key point surrounding the unsustainable nature of the world’s monetary and financial system. Specifically, we already live in a world where several powers (namely China and Russia) have very publicly and clearly elucidated they will not function as U.S. client states going forward. They appear to be on the winning side of history because it’s much harder to maintain global empire than to frustrate it at this point, but the U.S. maintains an enormous advantage when making moves on the geopolitical chessboard. It’s not the ubiquitous military bases or advanced technology, but a more esoteric and stealth weapon — the U.S. dollar.

Whenever I say stuff like this people insist there’s nothing ready to replace the USD as a global reserve currency. On this front I agree, but my argument isn’t that another nation-state fiat is going to totally usurp the USD on the world stage in the years ahead (nor should anyone want that).

Rather, my view is competing powers will figure out a way to avoid the dollar in an increasing percentage of global transactions simply because they have no other option in a world where the dollar’s been fully weaponized to achieve U.S. geopolitical goals.

Ultimately, I hope humanity learns from the experience of recent decades and never again permits one country to control monetary policy for the entire planet. A reserve currency controlled by a single nation is effectively the most potent geopolitical weapon ever invented. No country or institution should ever have such power, now or in the future.

DYI:

Traditional

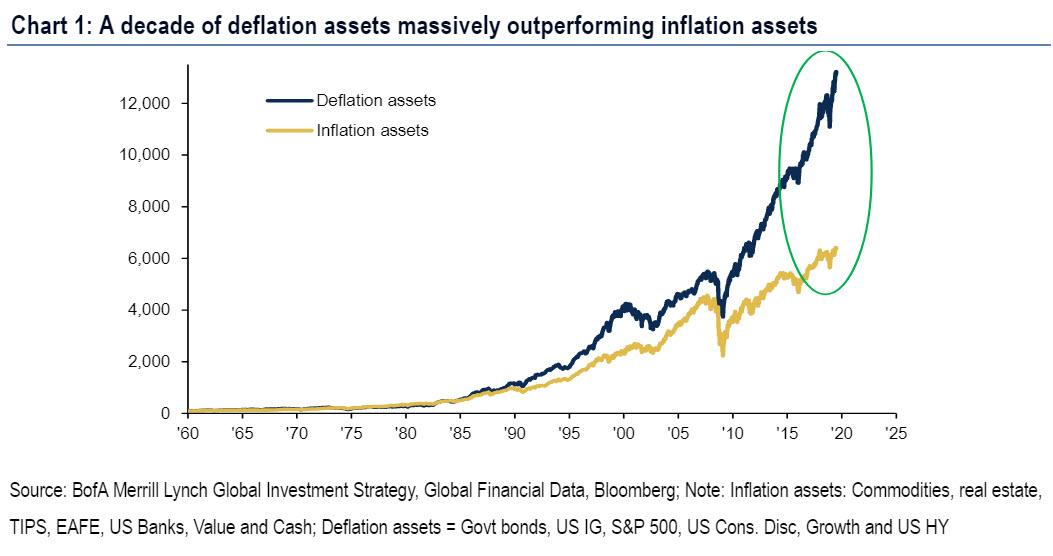

stocks and bonds due to massive overvaluation are set to deliver sub par

returns for the next 20 years. This is

for monies held or purchased today for stocks and bonds go to sleep like Rip

Van Winkle waking 20 years from now.

Expect an average annual return of around 3% for a standard 60% stocks,

30% bonds, and 10% cash (T-bills) retirement portfolio. This return is before all expenses such as

management fees [1%], commission [0.20%], trading impact costs [0.50%] and the

Granddaddy inflation [4% est.] All told

you are looking at a 2.7% negative return!

Eventually

Mr. Market will have his way with stocks and bonds dropping from their lofty perch! Whether or not this causes an economic

depression is to be seen however it will bring a deflationary smash. Stopping after 5 or more years when the money

printing overwhelms deflation. For now

the place to be is with precious metals whether physical bars/coins or shares

of the mining companies with a heavy dose of cash. The Great Wait continues with better values

ahead for the patience investor.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 11/1/19

DYI

No comments:

Post a Comment