DYI: Valuation remains

grotesquely high despite a 14% drop in the Dow Jones Average our model account

remains almost unchanged only a small reduction in gold from 50% to 45%

boosting cash to 55%.

Updated Monthly

Formula Based Asset Allocation*** STOCKS *** BONDS *** GOLD *** CASH................................ GeoPolitics/Economics...Removing Theory from Conspiracies

--As the stock market becomes more expensive, a conservative investor's stock allocation should go down. The rationale recognizes the reduced expected future returns for stocks, and the increasing risk.

--The formula acknowledges the increased likelihood of the market falling from current levels based on historical valuation levels and regression to the mean, rather than from volatility. Many agree this is the key to value investing.

There are two key drivers of investment returns. One is valuations, which provide a great deal of information about long-term investment prospects, and about the income component of total returns.

The other is the uniformity or divergence of prices across thousands of individual securities, which helps to distinguish whether shorter-term investor psychology is inclined toward speculation or risk-aversion.

Our disciplined approach to full-cycle investing is driven primarily by those two considerations, because together, they capture the central elements that define capital gains, income, and total return.

The menu of passive investment choices is now the worst in history

When market valuations are reasonable or depressed, investors can expect that their willingness to take risk will be compensated by a satisfactory “risk premium” over the long-term. Conversely, when market valuations are elevated or extreme, investors put themselves in a position where the long-term compensation for taking risk becomes very thin.

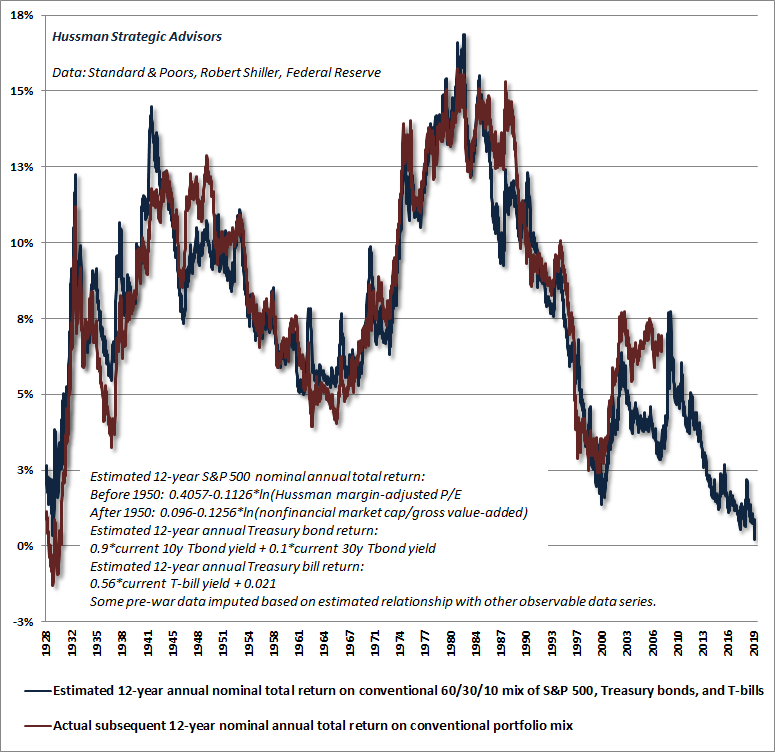

Our estimate of prospective 12-year total returns on a conventional passive investment portfolio (invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills) fell below zero for the first time in history.

The recent low of -0.16% even lower than the level of 0.34% reached at the market extreme of August 1929.

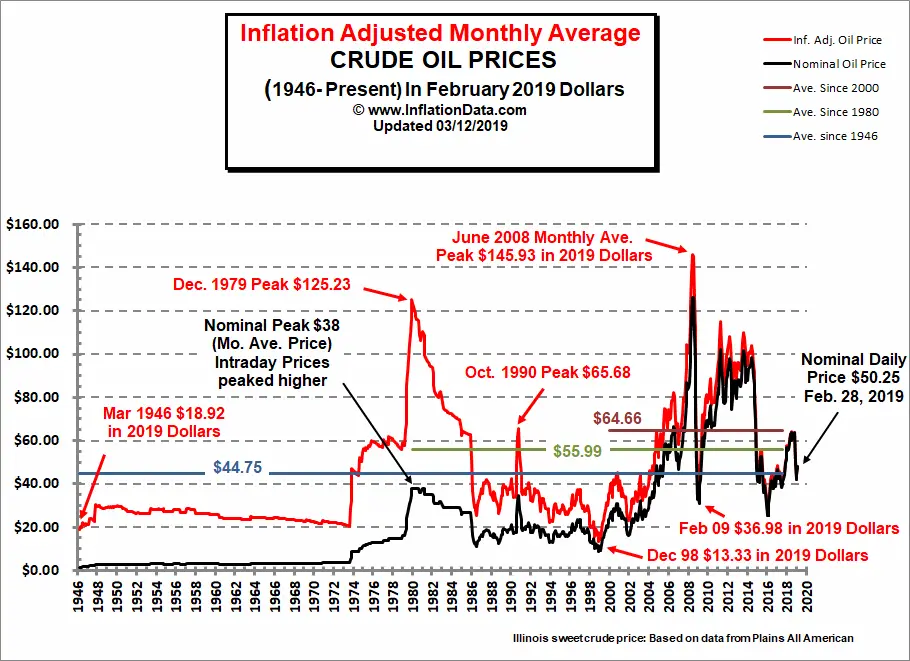

Copper has spoken. Its voice is the loudest of the commodities, and it’s not optimistic for the global economy.

By Monday, copper had seen a 12% drop in price.

What Does Copper Have To Do With Oil?

Because it’s tied so closely to manufacturing, industrial production, construction, engineering, and--most recently--information technology, not to mention a host of other sectors, copper is pretty much the best indicator of global economic strength and global demand.

It’s not a 1:1 correlation, though, and it’s changed quite a bit over the past decade and a half, and particularly since the U.S. shale boom and gains made in the renewable energy sector.

LONDON, Feb 3 (Reuters) - Poland became the first emerging market country to sell a mainstream government bond with a sub-zero interest rate on Monday, marking another major milestone in the post-crisis plunge in global borrowing costs.

Eastern Europe’s biggest economy sold a 1.5 billion euro, five-year bond which once pricing was finalised gave buyers a yield of negative -0.102%.

Many of Poland’s existing bonds trade at negative yields in secondary markets thanks to the neighbouring euro zone’s deeply sub-zero rates, but to date no mainstream emerging market government bond has been sold with one.