Bubble

Trouble

As of 2/7/20

$50.37

Copper has spoken. Its voice is the loudest of the commodities, and it’s not optimistic for the global economy.

By Monday, copper had seen a 12% drop in price.

What Does Copper Have To Do With Oil?

Because it’s tied so closely to manufacturing, industrial production, construction, engineering, and--most recently--information technology, not to mention a host of other sectors, copper is pretty much the best indicator of global economic strength and global demand.

It’s not a 1:1 correlation, though, and it’s changed quite a bit over the past decade and a half, and particularly since the U.S. shale boom and gains made in the renewable energy sector.

Oil

As of 2/7/20

$50.37

Copper

As of 2/7/20

$1.99

But the fact remains, the connection is incredibly strong, and sustaining:

LONDON, Feb 3 (Reuters) - Poland became the first emerging market country to sell a mainstream government bond with a sub-zero interest rate on Monday, marking another major milestone in the post-crisis plunge in global borrowing costs.

Eastern Europe’s biggest economy sold a 1.5 billion euro, five-year bond which once pricing was finalised gave buyers a yield of negative -0.102%.

Many of Poland’s existing bonds trade at negative yields in secondary markets thanks to the neighbouring euro zone’s deeply sub-zero rates, but to date no mainstream emerging market government bond has been sold with one.

DYI:

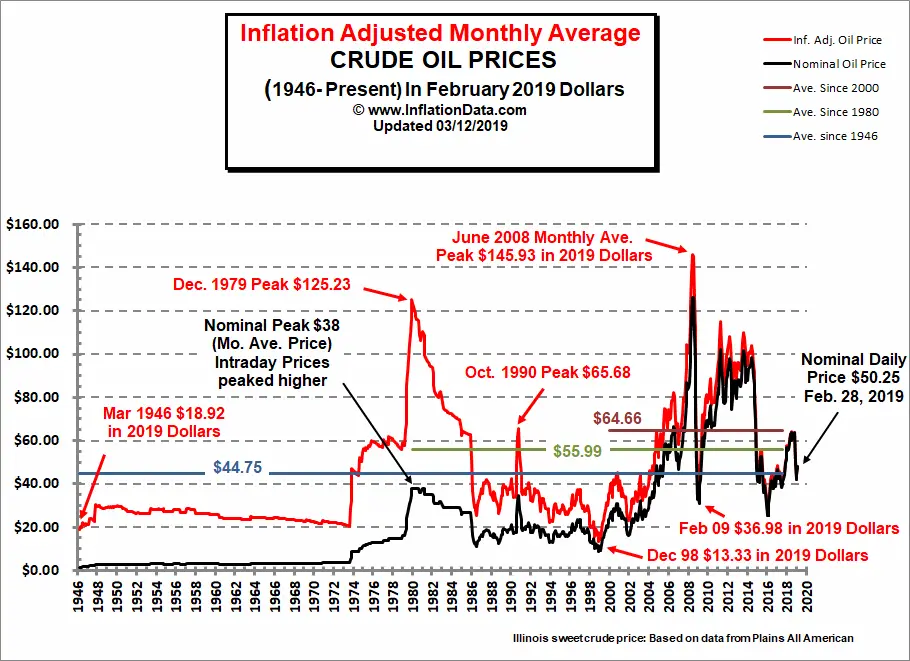

Copper prices are dropping; oil prices declining; Eastern European countries debt gone negative all signs of an ailing world economy. When you are on top of the mountain you will go down no matter which way you go and so it goes for the U.S. economy as well. I only envision a mild downturn economically the U.S. doesn’t have the massive imbalances that occurred during the run up of 2009. Of course the U.S. stock market is terrifyingly overpriced housing commercial or residential and oil/gas prices are far more subdued thus the making of a more tolerable downturn.

Old style pensions [defined benefit] all will slash benefits. Unfortunately politicians have over promised – thus garnering votes from government employees – underfunded and with sub atomic low interest rates for their bond holdings these pensions will have reductions in benefits that will continue for at least another decade. A 50% decline plus [DYI anticipates 65% to 80% multi cycle decline] in stock values for pension equity positions a federal bailout is a high possibility.

DYI

No comments:

Post a Comment