The

Bubble

Make Good Choices!

John P. Hussman, Ph.D.

President, Hussman Investment Trust

President, Hussman Investment Trust

There are two key drivers of investment returns. One is valuations, which provide a great deal of information about long-term investment prospects, and about the income component of total returns.

The other is the uniformity or divergence of prices across thousands of individual securities, which helps to distinguish whether shorter-term investor psychology is inclined toward speculation or risk-aversion.

Our disciplined approach to full-cycle investing is driven primarily by those two considerations, because together, they capture the central elements that define capital gains, income, and total return.

DYI: DYI anticipates long term returns

based upon valuations. Determining short

term aberrations for speculative gains I’ll leave to others – who may or may

not be successful.

The menu of passive investment choices is now the worst in history

When market valuations are reasonable or depressed, investors can expect that their willingness to take risk will be compensated by a satisfactory “risk premium” over the long-term. Conversely, when market valuations are elevated or extreme, investors put themselves in a position where the long-term compensation for taking risk becomes very thin.

DYI: Spot on Professor Hussman! Common sense but never followed; obviously or

we would not have the great rises and falls in markets. These insane valuations are not just thin

they will now produce market losses for the passive investor for stocks held or

purchase today over the next 10 years.

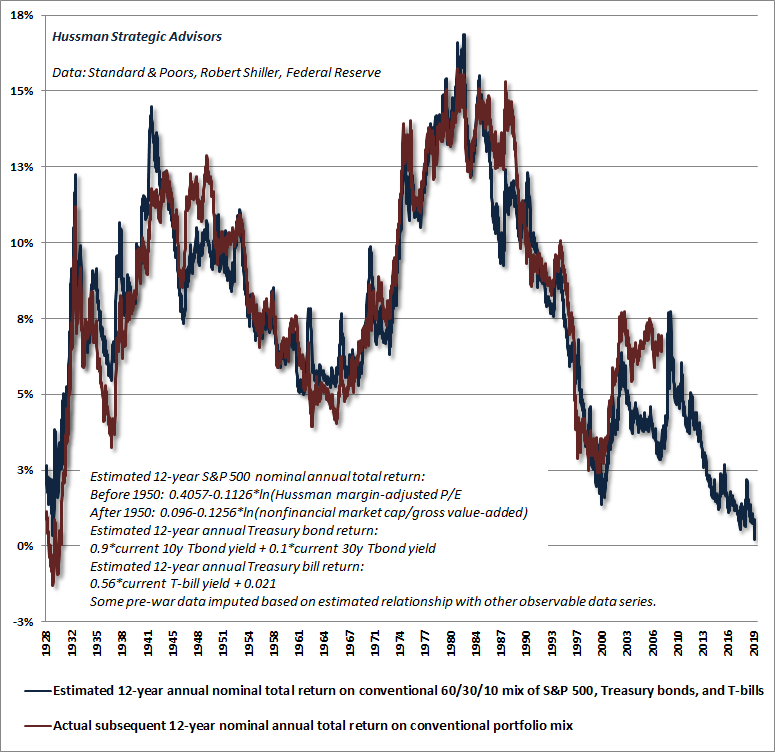

Our estimate of prospective 12-year total returns on a conventional passive investment portfolio (invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills) fell below zero for the first time in history.

The recent low of -0.16% even lower than the level of 0.34% reached at the market extreme of August 1929.

12 year annual nominal total return

is now below zero - [ -0.16%]

DYI: Valuations have relentlessly marched

higher since 2012 surpassing 1907 and 1966 top while continuing this runaway

train blowing past the 1929 high in 2018!

When dshort.com updates their chart in early March it will be

interesting to see if the Great Insanity Year of 2000 will be tied or defeated.

Be as that may be this is a terrible

time to purchase stocks [or long term bonds as well] for the long haul. Unless relatives are purchasing stocks for

you as you’re drinking out of a sippy cup watching Barney thus having a 50 year

plus holding time you will do fine.

However at 45 years of age or more attempting to put it all together for

retirement returns will be lousy. So bad

the returns the difference between eating New York Strip steaks or ground

chuck!

Updated Monthly

No comments:

Post a Comment