Oil

Price Smash!

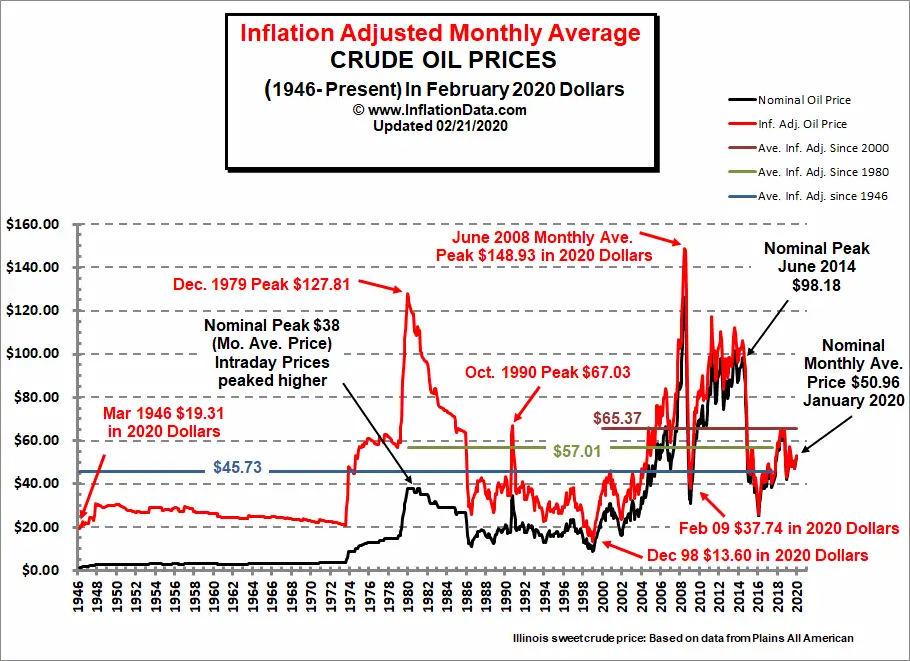

Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy.

DYI: Oil as measured by West Texas

Intermediate as I’m writing this post 9:22 A.M. 4/17/20 is trading at

$17.51! As compared to 5 years ago at

$55.74 prices from that time till now has dropped by a staggering 69%! If oil

prices go single digits [I have no idea if they will or won’t] then oil and gas

shares will be at “the give-away-table.” Prices when corrected for inflation will be far cheaper than the 1998

price smash.

As of 4/17/20

$17.51

For those of you with

401k’s that have an oil/gas energy sector funds this is a great time to dollar

cost average at very low prices. Recovery for oil prices may take months especially if the U.S. experiences a deflationary smash. That is great as that will allow you time to build a position with some size. My favorite of course

is Vanguard’s Energy Fund symbol VGENX current 6.42% yield.

You will know that you

are close to the bottom when see headlines almost daily discussing the demise

of the oil and gas industry. Below is

such an example.

Why oil prices will never recover

Disclaimer

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

DYI

No comments:

Post a Comment