“The

fictitious valuation of the stock market will eventually re-connect with

reality in a violent decline.”

Buy The Tumor, Sell the News

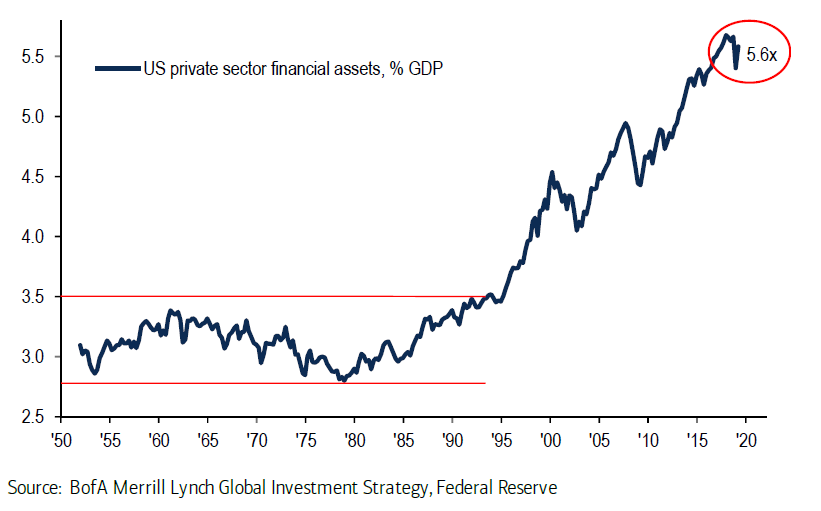

The system's total dependence on asset bubbles in stocks and housing to generate the "wealth effect" that drives consumption defines Fed policy, along with the need to keep stock-dependent pension funds and liquidity-dependent zombie corporations solvent.

That the Fed's pimping of asset bubbles and liquidity has created the greatest wealth inequality in a century is ignored by the self-serving, tone-deaf political/financial "leadership" because the wealth asymmetry has greatly enriched the "leaders," their cronies and the army of technocrat flunkies who do all the real work to keep the rackets functioning.

All this wealth wasn't earned via the creation of value; it was skimmed / embezzled from the bottom 95% via high costs, junk fees, penalties, interest rates and taxes, all set by monopolies and cartels unburdened by competition, accountability or transparency.

SOCIETE GENERALE: Stocks are riding a fleeting rally before fundamentals collapse and 'the real bear market begins'

- Major US indexes recently rebounded into bull-market territory. But precedent suggests stocks will fall further as the US slides into a lengthy recession, Societe Generale said in a Thursday note.

- The stock market is in the middle of a brief bear-market bounce mirroring gains made in October 2008 before the financial crisis pulled equities down another 25%, the strategist and longtime bear Albert Edwards said.

- Downward pressure from low inflation and a near-term recession stand to make the virus-induced profit slump deeper than past declines, he added.

- Many investors are poised to reenter the market "only to be crushed as history suggests is normal," Edwards wrote.

Yield as of 4/13/20

0.74%

No comments:

Post a Comment