Tesla

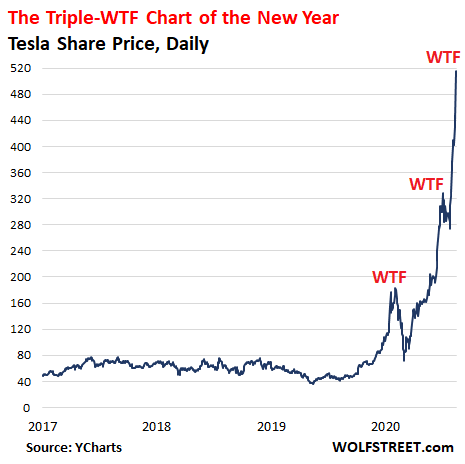

Tiny automaker with less than 1% global market share is a Supernatural Phenomenon and the 7th most valuable US stock.

|

| Wolfstreet.com So here are the seven

US companies with the highest market capitalization:

|

DYI: When this obvious tech bubble

pops these stocks will decline at a minimum of 50% and to around a maximum of

80%. The question of course is

when? This tech and stock plus corporate

bond bubble has lasted far longer than I thought possible but when it does the

crash it will be spectacular! Hang on to

your cash and gold better values are ahead!

DYI: When this obvious tech bubble pops these stocks will decline at a minimum of 50% and to around a maximum of 80%. The question of course is when? This tech and stock plus corporate bond bubble has lasted far longer than I thought possible but when it does the crash it will be spectacular! Hang on to your cash and gold better values are ahead!

Why Americans Are Looking for a Safe Haven from the Dollar

As the Federal Reserve’s quantitative easing practices generate the biggest debt bubble in history, gold futures are trading at record highs, a phenomenon some have called "a bit of a mystery." However, this "mystery" was solved long ago by the laws of economics. The only "mystery" here is why—contrary to centuries of economic wisdom—we allowed centralized paper money to become the dominant form of currency in the first place.On August 1, 1787, George Washington wrote in a letter to Thomas Jefferson that "paper currency will ruin commerce, oppress the honest, and open the door to every species of fraud and injustice." Jefferson also opposed the concept, warning that "banking establishments are more dangerous than standing armies." James Madison called paper money "unjust," recognizing that it allowed the government to confiscate and redistribute property through inflation: "It affects the rights of property as much as taking away equal value in land."

In other words, inflation is a hidden form of taxation. Washington understood this. Jefferson understood this. Madison understood this. And generations of preeminent economists since then—from Ludwig von Mises to F.A. Hayek, to Murray Rothbard—have understood this quite clearly.

Australia's big four banks remove thousands of ATMs and shut down hundreds of branches as the coronavirus crisis pushes nation closer to a cashless society

- At least 2150 ATM terminals removed across Australia in the recent June quarter

- Australia's big four banks shut up a combined 175 branches in the last 12 months

- Sparked by COVID-19 as Australia move closer to becoming a cashless society

- Opinion divided over branch and ATM closures which will inconvenience elderly

DYI: Australia is the test

site for the elites as they rid of cash and move to a digital economy. Being cashless means that the government has

another method to track your moves within the economy only remaining is to

develop a social credit type scoring designed to control the citizens. Full fledged soft style tyranny will have

arrived in Australia. After that it will

be rolled out in one form or another from country to country eventually here to

the good old USA.

No comments:

Post a Comment