U.S.

Stock Market

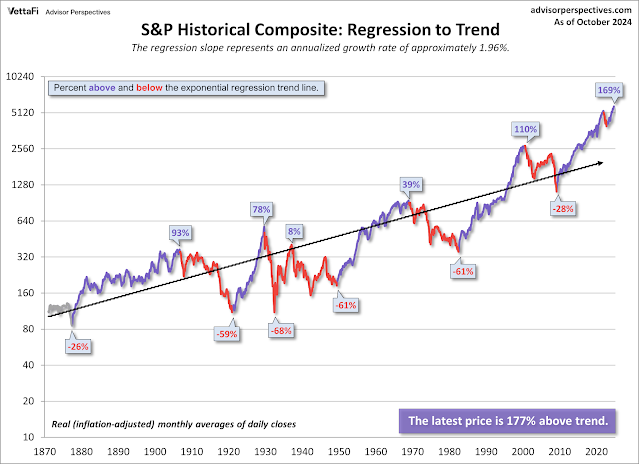

177%

Above Trend Line

Massive

Overvaluation

Returns From

Here Will Be Subdued

OR

Outright Losses Before Fee’s and Inflation

DYI: Today’s U.S. stock market by whatever method for determining valuations

is screaming that equities are poised for sub returns at best and worst

outright losses before fee’s and inflation.

Monies invested today or stocks held today in a S&P 500 index fund

or a generalized all stock growth fund that is found so prevalent in 401k’s –

go to sleep like Rip Van Winkle waking 10 years in the future will have very

subdued (less than 2%) or outright losses.

Dollar cost averaging

is nothing more than very small monthly lump sum purchases. Those dollars invested will reduce your

overall return since valuations being at nose bleed levels.

Currently today IMO

this is a terrible time to be buying stocks for the long term investors even if

they are youngsters in their 20’s with many decades ahead. Best to earn as much as possible in cash or

short term bonds waiting for the next opportunity to purchase stocks at far

more reasonable valuation levels.

DYI

No comments:

Post a Comment