Oil

Price

Direction?

Oil price as of 10/21/18

$69.25

Gary Shilling thinks oil prices may have peaked.

Crude oil prices, both Brent and West Texas Intermediate, are at four-year highs. Traders are talking about a return to $100 per barrel, and even higher.

But if you’re a long-term investor, look for oil demand to peak and more subdued prices in the years ahead.

Not the supply shortages and soaring petroleum costs as some observers fear. Royal Dutch Shell Plc and Norway’s Statoil ASA expect the peak in demand as soon as the mid-2020s, while BP Plc sees it happening between 2035 and 2040 and the International Energy Agency is forecasting 2040.

What a switch from the days of M. King Hubbert, the geophysicist at Shell Oil in the late 1940s who believed that oil field production followed the classical bell curve or normal distribution. He predicted that production in the lower 48 U.S. states would top out in the early 1970s with dire economic consequences. Few agreed at the time, but Hubbert proved largely correct, and his adherents subsequently extended his concepts globally and believed that worldwide production would top out in 2010 or 2012 at the latest.

Nevertheless, oil supplies have proved plentiful in recent years as output surged from Russia, Canadian oil sands and, especially, U.S. frackers. This troubles OPEC, which, like any cartel, exists only to keep prices above equilibrium. That encourages producers in and outside the cartel to strive for more market share. So OPEC, led by Saudi Arabia, has tended to curb its own production to accommodate these “cheaters.”

DYI: No

doubt the efficiency of extracting oil has improved dramatically over multiple

decades. However the days of sticking a

straw in the ground and out come’s the bubbling crude has long since vanished. Also major game changing discoveries has

ceased since North Sea and Alaskan oil.

Today what is called a major find is large but nothing to the degree of finds

decades past.

In 2014, OPEC was frustrated that all the growth in global output in the previous decade was going to non-OPEC producers. To teach the “cheaters” a lesson, it hyped its output from 30 million barrels per day to 33.8 million barrels daily. Prices fell to $27 per barrel, but that didn’t chase out American’s increasingly efficient fracker's that now dominate U.S. production. As of August, American shale output was 7.7 million barrels per day, versus 3.3 million barrels from conventional oil.

America is now the largest producer of crude oil, topping Russia and Saudi Arabia,

and production may only rise as temporary pipeline shortages are overcome, allowing U.S. exports to increase.

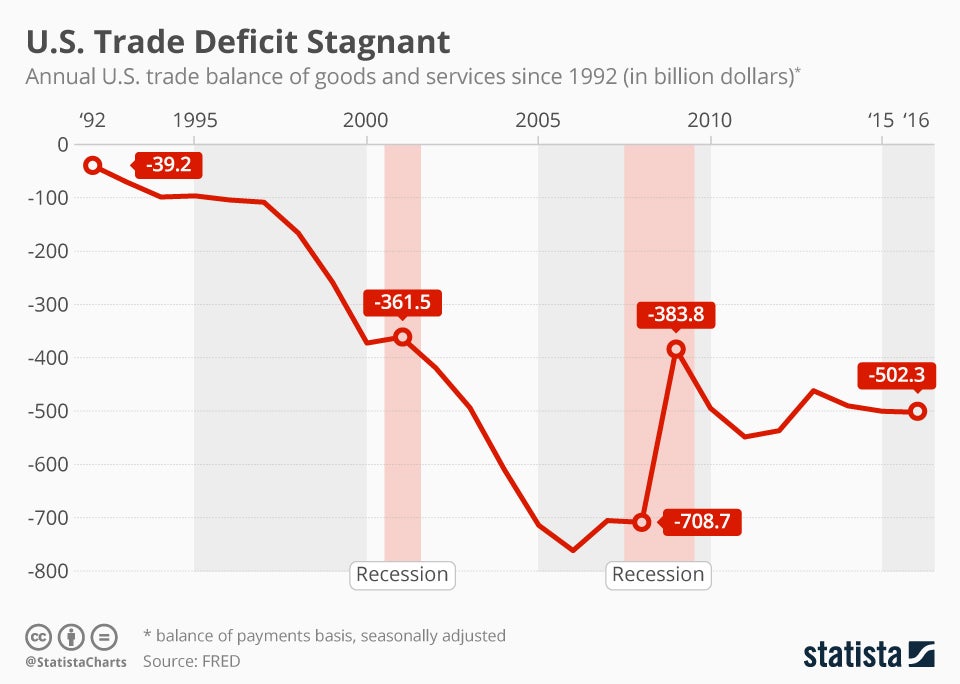

DYI: This

provides a clue as to why the American Dollar has been on the rise despite the

fact that our overall trade imbalance has remained stagnant. Energy is what powers the world’s economies. The U.S. is now pumping out more crude than

Saudi Arabia or Russia individually; along with the world’s strongest military

[for better or worse] translates into a stronger dollar.

Elsewhere, Mexico privatized its deep-water oil reserves in 2015, and output should climb. Brazil has liberalized its oil market, opening its colossal deep-water potential to foreign oil companies. North Sea output is reviving. Fracking for oil is being developed in the Persian Gulf, Argentina, Canada, Russia and China.

Oil will be in surplus in future years not only due to increasing output potential, but also because of rising supplies of natural gas, which has also been made abundant by fracking. American gas, after being cooled and converted to liquefied natural gas, has huge export potential along with LNG from Oman, Australia and elsewhere. Then there’s renewable sources such as wind, solar and biofuel to consider. These accounted for only 12 percent of electricity generation last year but the IEA believes they will make up 56 percent of net generating added capacity through 2025.

The cost of renewables is declining. A U.S. residential solar energy installation now costs $2.93 per watt on average, down from $6.61 in 2010.

DYI: Once

the cost for residential solar installation breaks the buck – under $1.00 per

watt – the U.S. will have a renaissance in home electrical production. The implication is more than just residential

as this will leave excess energy capacity at reasonable costs for

manufacturing. Add on additional energy

efficiencies and automation America’s manufacturing rebirth will expand at a

faster clip.

For a large utility-scale system, the cost has dropped from $3.58 to $1.11 — a plunge of almost 70 percent. Costs are falling for batteries and other methods of storing solar energy at night and wind energy on calm days. Nevertheless, necessary government subsidies for renewables are still substantial.

Continuing energy conservation will also reduce crude oil demand. Since 1970, energy consumption per U.S. dollar of economic activity has dropped 61 percent in the U.S., 48 percent in Japan, 70 percent in the U.K. and 43 percent in Canada. California just enacted a mandate for carbon-free — fossil fuel-free — electricity by 2045.

While the Trump administration is capping fuel-efficiency standards for autos at 37 miles per gallon, down from the Obama administration’s 54.5 miles per gallon by 2025, electric vehicle sales are surging and will further curb gasoline demand. Transportation fuel accounts for half of crude oil use and autos consume half of that, or 25 percent of total oil demand.

Then there are the millennials who eschew driver’s licenses in favor of bikes. And aging postwar babies are being forced to give up driving. In addition, emerging-market economies that binged on borrowing in dollars after the financial crisis to finance growth and oil demand now find themselves strained as the robust dollar makes it much more expensive to service those debts in local currency terms. Since most commodities trade in dollars, their local currency costs of commodity imports, especially oil, are rising as well, and curbing oil demand.

As economies grow, be they developed like the U.S. or developing such as China, services gain a bigger share of spending while spending on goods fall. That’s another long-term deterrent to oil demand and the energy needed to produce goods.

DYI: If

Gary Shilling is correct that we are to expect lower oil and gas prices NOT due

to recession we can expect the U.S. stock market despite being MASSIVELY

overvalued to continue its upward trajectory.

Beware at such market levels higher we go this house of cards could very

easily tumble without a recession to push it over!

DYI

No comments:

Post a Comment