My

Problem

With Harry

The Perfect Portfolio For Those Who Hate To Lose Money

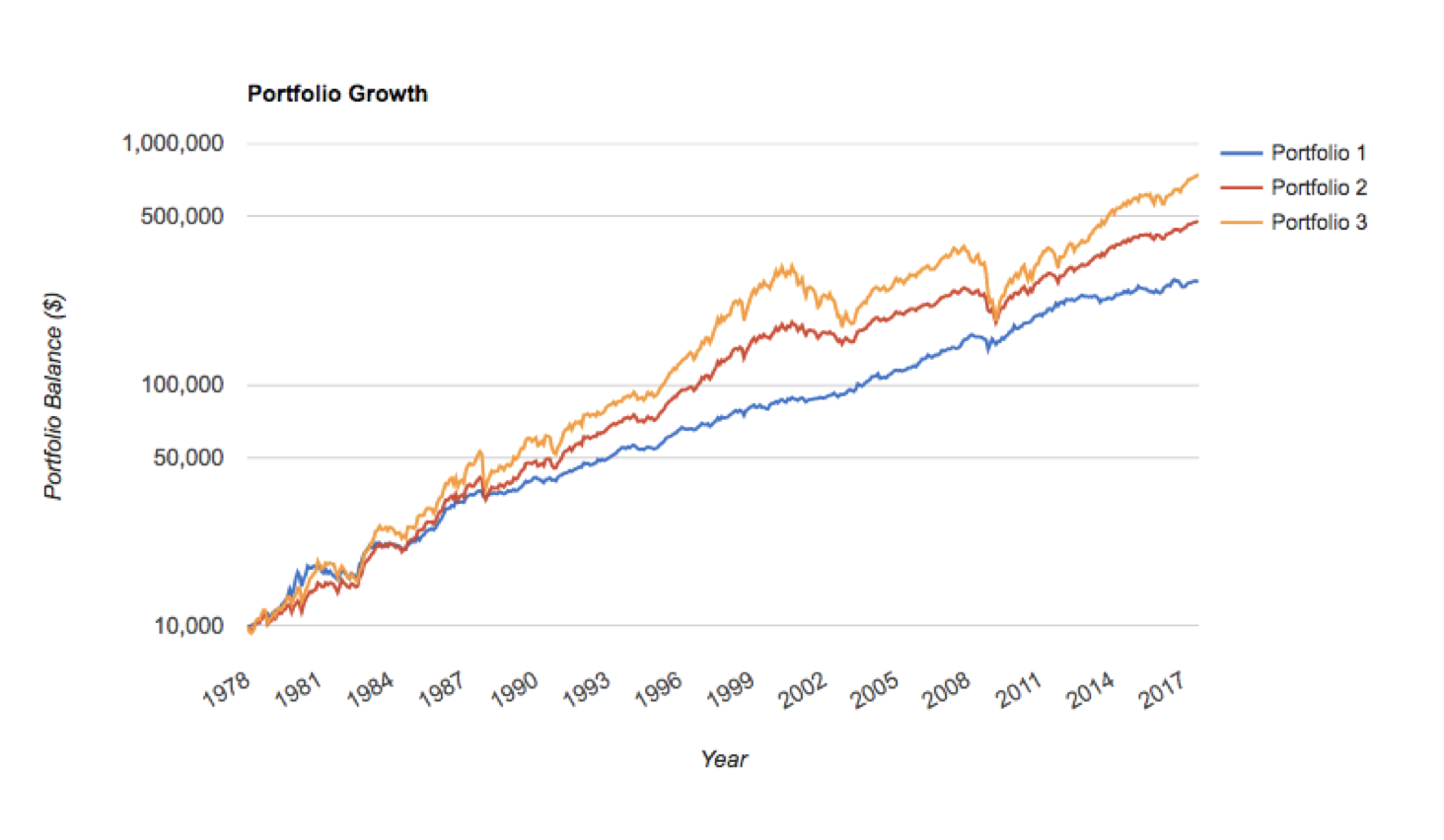

Average

Annual Returns from 1978 to 2017

Portfolio 3.) 100% Stocks 11.50%

Portfolio

2.) 60% Stocks 40% U.S. Gov’t Bonds

10.26%

Portfolio 1.) Permanent Portfolio 8.69%

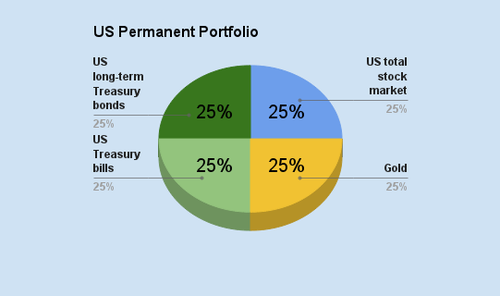

Permanent

Portfolio

25%

Stocks

25%

Lt. Bonds

25%

Gold

25%

Cash [MMF]

The investor’s only responsibility is to buy or sell once a year, as needed, to maintain the target allocation. The Permanent Portfolio doesn’t crash when stocks fall because its asset classes often move in opposite directions. It’s also profitable because, when investors rebalance, they buy the underperforming asset class when everybody else is running the other way. When that asset class eventually recovers, a quarter of the Permanent Portfolio surges.

How I Invest: The Permanent Portfolio

The formula for retirement is much easier than you may think. Spend much less than you make and invest the difference. Once you have accumulated twenty-five times your annual living expenses you should be able to live off of 4% interest for the rest of your life. For example if you want to spend $40,000 per year for the rest of your life you should probably have $1,000,000 or more ($40,000 x 25).

After making his money as an advisor he came to the realization that nobody can accurately and consistently predict the market. This is why he devised the Permanent Portfolio to keep his money safe. It consists of a 25% total stock market index, 25% a long-term bond index, 25% gold ETF or physical gold coins and 25% cash or short term treasuries.

DYI: I

have read every book that Harry Browne had published during his lifetime a definite

pioneer in the use of uncorrelated assets.

Low volatility and a reasonable historical rate of return what was there

not to like!??

My problem with Harry Browne’s Permanent

Portfolio is just that it’s permanent.

Four assets always fixed at 25% despite when very easily measured

valuations will tell you if stocks, Lt. Term bonds, or gold is over or under

valued and to what degree. My hair

wanted to catch on fire in 1980 when stocks and even more so long term bonds

were clearly deeply undervalued and gold being speculated to the moon and yet

doggedly maintain 25% in each category.

Or more recently the year 2000 stocks were hopelessly overvalued and

gold was on the give-away-table with the precious metals mining companies at

huge discount from the price of gold!

Why on earth would I want 25% in stocks at numb minding high prices and

gold with a mere 25%?

The Dividend Yield Investor is a spinoff of

the Permanent Portfolio. If all three

assets, stocks, Lt. Term bonds, gold, [cash is DYI’s default asset] are at

historical fair value then all four categories will be at 25%. A very unlikely event due to their low

correlated nature this pushes up or pulls down by completely different long

term economic forces. However that is a

starting point for measurement as we know the long term average dividend yield

for stocks, yields for bonds, and the average Dow/Gold ratio for gold. Simply put; DYI’s averaging formulas

determines the amount in each category [up to 50% except cash] based upon its

relative position based on long term valuation.

DYI makes zero assessment for short term direction of any of the

categories.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 05/1/19

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

DYI

No comments:

Post a Comment