.1567522482534.png)

As of 9/9/19

1.55%

A rout in the hyper-inflated bond market can blow up everything at this point.

DYI:

There

is no doubt in this bloggers mind that the U.S. during the next recession driven

into negative rates. A mild recession

that I’m anticipating will push down [interest rates] T-Bills and T-Notes up to

5 years in length into the negative territory.

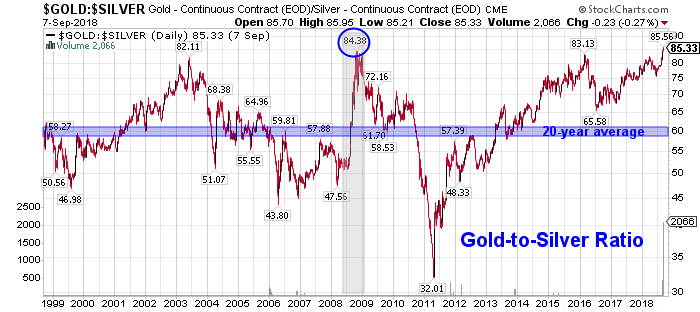

This will push up in price significantly precious metals and especially

with silver undervalued as compared to gold as noted by the Gold /Silver Ratio.

As of 9/9/19

84 to 1

I’m

hoping that silver will take a tip in price so that I can expand my

position. If precious metals are back in

a bull market – as I believe they are – then dips in price will be violent but

just long enough in time to chase out the early bird investors. The value players – those who follow this

blog – will use these moments to expand their positions!

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 09/1/19

Active Allocation Bands (excluding cash) 0% to 50%

73% - Cash -Short Term Bond Index - VBIRX

27% -Gold- Global Capital Cycles Fund - VGPMX **

0% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

[See Disclaimer]

**Tocqueville Gold Fund TGLDX is a pure play 100% junior gold mining gold fund. Vanguard's Global Capital Cycles Fund maintains 25% in precious metal equities the remainder are companies they believe will perform well during times of world wide stress or economic declines.

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

.1567522482534.png)

No comments:

Post a Comment