One Hundred Year

Short Sale?

The 100-Year Bond is Unethical

With central banks globally once again suppressing the borrowing cost of sovereign entities to near zero rates,with yields in some countries even going negative, there is significant talk of issuing a 100-year bond to take advantage of these rates. Part of the argument is to lock in low rates now to hedge against future increase; though if the past decade is any consideration, central banks globally will fight until they collapse to keep sovereign borrowing near zero permanently because they legitimately have no choice in the matter. Even if governments do lock in these rates now, it won’t matter considering interest rate manipulations have placed banks on shaky ground. But if we assume this is a good idea on a purely financial basis (it’s not, I’ll get into that later), the concept of these ultra-long bonds are highly unethical.

Government Admits...No Intention of Paying Off Debt

One of the key reasons behind the relatively short maturity rates of United States debt instruments is to maintain the illusion that the federal government is a responsible debt payer. While debt may be formally paid, it’s done by borrowing additional funds to cover the maturity of the bond. This is demonstrated by examining the federal cash flow statements, which show that $9 trillion was spent paying debt, or over twice the formal federal outlays. Two-thirds of all cash that transitions through the US Treasury today is related to debt maintenance.

However, with the issuance of the 100-year bond or even a perpetual bond, such as this incredible bond that was issued 371 years ago and is still being paid by the Netherlands to this day, is that it’s akin to the government admitting it has no intention to ever pay back the debt. 100 years, for all intents and purposes, is akin to a permanent bond. Government is asking to take the principle and never pay it back, only interest.

The major issue here is that the 100-year bond throws out the entire notion that no prior governing body can bind a future governing body to any activity. The 100-year bond is a solemn promise that people a century from now are obligated to cover the expenses of today’s borrowings.

Obligating hundreds of millions of unborn people to pay for our expenses today is the very meaning of taxation without representation.

The only option handed to the future generation is to either pay for today’s excesses or default on that debt and undermine their own priorities in the process.

DYI:

Currently the U.S. along with the majority of the Western nations will

experience an economic deflationary smash.

Stock markets will easily have there valuations cut in half plus high

yield and junk bonds dropping up to 70%.

Valuations are now so high even a mild recession – DYI is anticipation –

will bring down these markets. The

question remains – and it will not be answered until after the fact – is whether

this will occur in one big crash or a series of rises and falls. As the author of this blog with over 40 years

plus experience in the market is expecting a multiple rises and falls over a

one and even possible two decade period of time before valuations reach their

bottom. For long side only investors [if I’m correct] this will be a two

decade travesty of biblical dimensions!

The Flip Side

Time will come when interest rates will rise

depressing the price of long term bonds and especially if Uncle Sam [or other

countries as well] create 50 to 100 year bonds.

This would set up the short of a lifetime. The time is not right to start shorting ultra

long term bonds but all great investors are great chess players [whether they

play or not] as they are prepared two to three moves ahead! From time to time I

will write about the short of a lifetime and what to look for.

The Silver Play

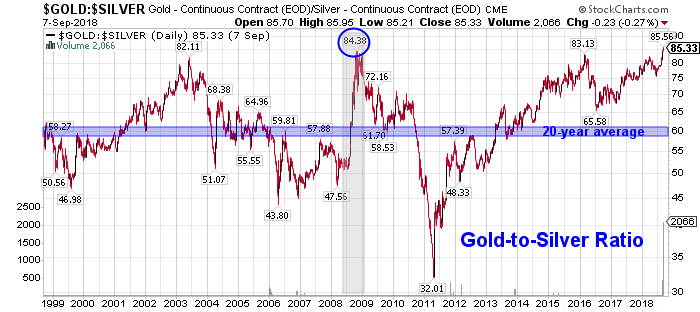

Right now precious metals along with their

respective mining companies are all at fair or a bit below fair value depending

on your measurement tools. Be as that

may be silver as compared to gold is on the give-away-table with a huge

lopsided Gold to Silver Ratio all pointing to silver.

%

Gold/Silver

Allocation

09-1-19

Updated Monthly

100 – [100 x (Current GS – Avg. GS / 4)

_______________________________________

(Avg.GS x 2 – Avg. GS / 2)

Current Gold/Silver Ratio 84

Average Gold/silver Ratio 50

Allocation:

Gold 1%

Silver 99%

Average Gold/Silver Ratio since 1900

50 to 1

Gold and silver bullion buyers and traders use the fluctuating Gold Silver Ratio to better determine which precious metal may be poised to outperform the other.

The essence of trading the gold-silver ratio is to switch holdings when the ratio swings to historically determined extremes. So:

When a trader possesses one ounce of gold and the ratio rises to an unprecedented 100, the trader would sell their single gold ounce for 100 ounces of silver.

When the ratio then contracted to an opposite historical extreme of 50, for example, the trader would then sell his or her 100 ounces for two ounces of gold.

In this manner, the trader would continue to accumulate quantities of metal seeking extreme ratio numbers to trade and maximize holdings.

Note that no dollar value is considered when making the trade; the relative value of the metal is considered unimportant.

DYI’s averaging formula is best used when accumulating bullion. Simply buy up to the stated allocation only selling/buying when necessary [lessen capital gains taxes]. For those in the distribution stage [retirees] of life sells off gold or silver to bring back in line with the current allocation.

How much???

Updated Monthly

No comments:

Post a Comment