Oil

Prices Fall!

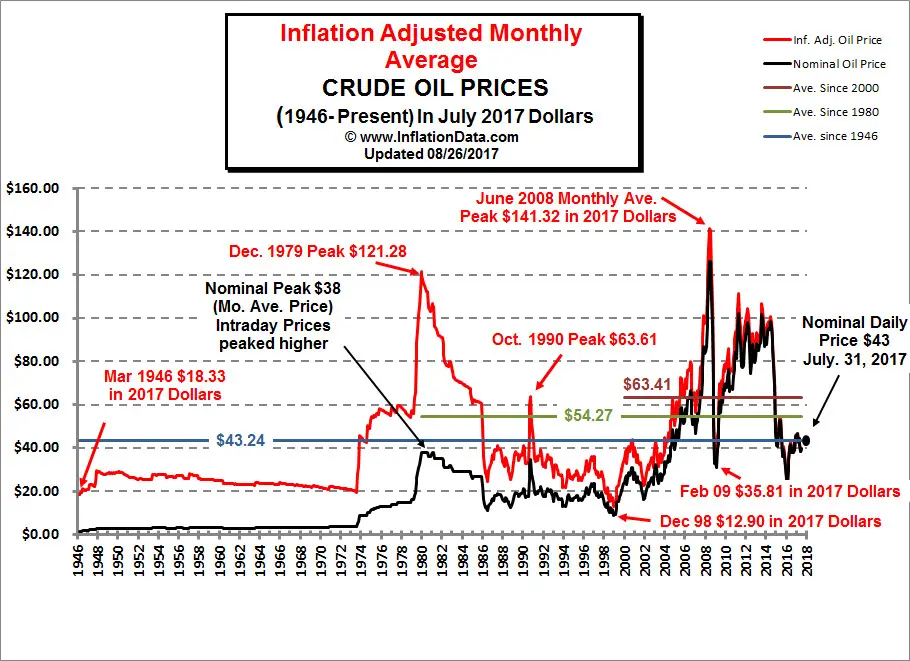

Oil Price as of 11/13/18

$58.57

DYI: Oil prices since October 2018

till today are down 23% (rounded) as Middle Eastern tensions have diminished. It appears that saner heads have – so far –

prevailed by not going to war with Iran that would automatically pull in the

Russians.

A head to head war would be

nothing like beating up on 2nd and 3rd world

countries. The Russians have top notch

fighter aircraft such as their Sukhoi SU-57 along with highly skilled pilots.

Sukhoi SU-57 Jet Fighter

Plus their supply lines are far shorter for

resupply and/or troop movements. They

can bring in on a moments notice their S-300 or S-500 surface to air missiles

very capable of shooting down our attack aircraft.

Our losses would be staggering but actually

be normal going head to head as it were with an adversary as well equipped as

the U.S. Bottom line the U.S. blinked –

and thank god for that – ginning up world war that could possibly go nuclear is

insane.

***********

Saudi

Arabia’s Mr. Falih stated that his country was going to reduce exports around

500,000 barrels per day due to the oil price slide. Don’t bet on it as the Saudis desperately need

revenues to maintain their socialistic/welfare state. Add on Russian drilling and American fracker’s

are producing oil at a blistering pace. Oil prices could very easily drop further. However in the short run prices since October

have dropped almost straight down it would be wise to expect a bounce to the

upside before prices move lower again.

If

this slide in price holds and especially if oil goes lower as prices work their

way to the retail pump for gasoline and diesel will open up consumer spending

plus reduce inflationary expectations.

The Fed’s could very possibly delay raising interest rates due to lower

oil thus lower inflation. This could

very possibly push up stock prices [and junk bonds] despite being massively

overvalued.

Shiller PE as of 11/13/18

30.64

Till

Next Time!

DYI

No comments:

Post a Comment