Outperforming

Harry

A Trend Worth Considering – The Price of Gold Since 1971

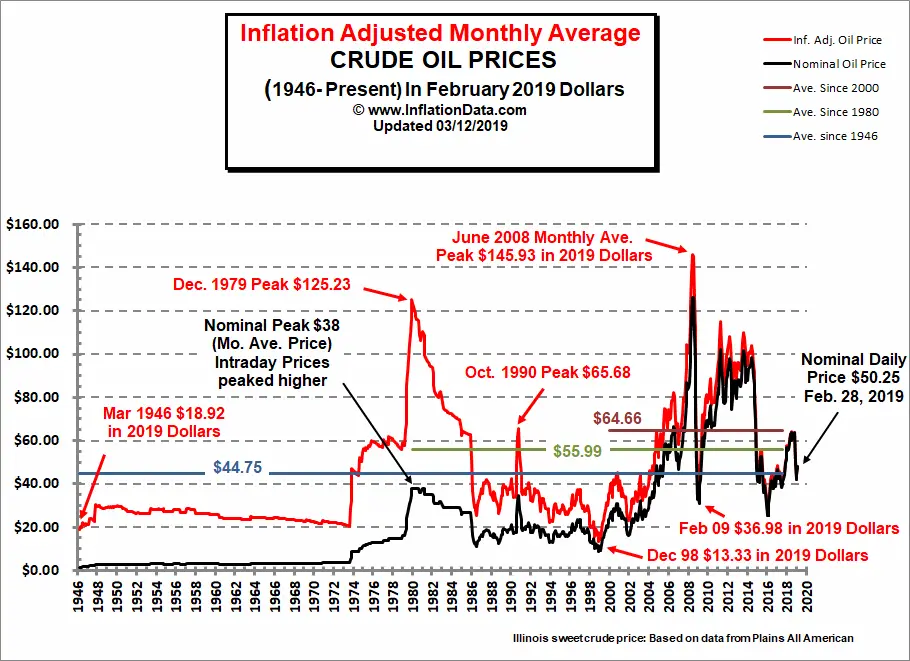

I occasionally get comments on articles posted on the Schiff Gold Facebook page by people complaining that they’ve lost a lot of money in gold because they bought when the market was at its absolute peak in 2011 and the yellow metal nearly hit $1,900. I can certainly understand their frustration, but I don’t buy their argument that their experience proves gold is a bad investment. While eight years seems like a long time, it’s not in the big scheme of things.

When it comes to gold, that key moment is August 15, 1971. That’s the day that Richard Nixon slammed shut the gold window and eliminated the last vestige of the gold standard. From that date, the US — and the world — has been on a pure fiat money system. Governments have taken advantage of it by inflating the money supply relentlessly. As a result, the price of gold has skyrocketed from that moment.

Looking at it another way, the purchasing power of gold has increased dramatically since Nixon closed the gold window. When Nixon made his announcement, gold was official $35 an ounce, but the actual market price was around $45 per ounce. If you take the recent price which has been hovering between $1,450 and $1,500 per ounce, the price has increased by 3122%.

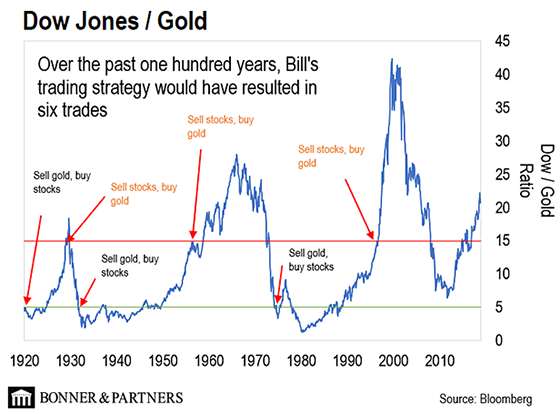

DYI:

Let’s

put that to the test and see if the numbers stack up as the author claims. First step is to go to Average Return Calculator for gold at $45 dollars an ounce in 1971 till today at $1500. Average annual return…drum roll please…7.42%

Ok so far so good. Next stop is Political Calculations that has historical returns for the S&P 500. January 1971 till today…drum roll please…10.56%

[dividends reinvested]. Stocks currently

over this time frame are the clear winner over gold. However as I’ve stated so many times before

us mere mortals only have 20 to 30 years to put it all together for

retirement. We don’t have the luxury of

almost halve a century [49 years] AND with one massive investment at day one!

Harry Browne to the rescue

Harry

Browne’s Permanent Portfolio concept was ground breaking with his four

uncorrelated assets – stocks, long term bonds, cash and gold – permanently maintain

at 25% of the portfolio total. The idea

is winning asset(s) would outshine the losing asset(s) thus propelling the portfolio

ahead all with very low downside volatility.

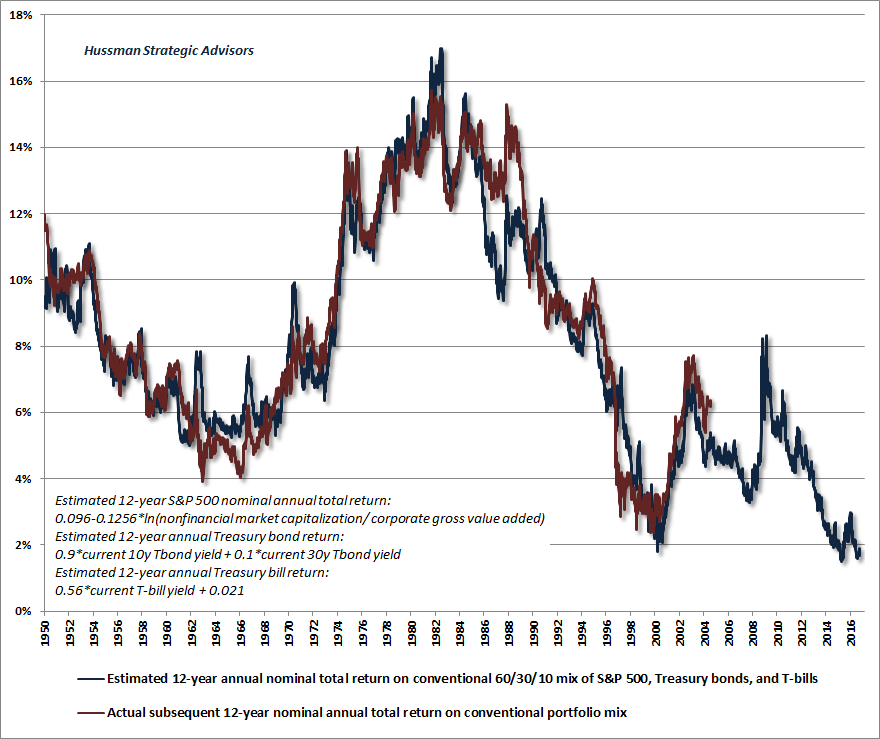

And by George it does work. The

Permanent Portfolio since its inception in 1983 with an average annual return

of 5.96% as compared to the S&P 500 at 11.39% [capturing 48% of the S&P 500]. Despite this big difference downside volatility

is at a minimum. This makes it possible

to place a large lump sum to work without fear that your timing is poor

producing huge losses thus requiring years not just to break even but to move

the account forward with some reasonable return.

3 fund portfolio is U.S. and international stocks plus U.S. bonds

My

problem with Harry

Despite

Harry’s ground breaking advancement a forerunner of modern portfolio theory I always

had a problem maintaining 25% in each asset at all times. There are times such

as today with long term bonds and U.S. stocks being massively overvalued. Why would anyone want to have 25% in bonds

and another 25% in stocks? Over a 5 to

10 period you will be generating losses.

Very easy to see over speculated markets for those who are valuation

players.

Outperforming

Harry

DYI’s

goal is to outperform Harry’s permanent portfolio with low downside volatility and

a secondary ambition of capturing ¾ [over long time periods] of the S&P 500.

DYI’s

averaging formula has our model portfolio either increasing or deceasing

[sometimes to zero] depending upon the historical valuation of each asset. In my opinion DYI is well positioned to out

perform the Permanent Portfolio over the next 5 years.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 12/1/19

[See Disclaimer]

** Vanguard's Global Capital Cycles Fund maintains 25%+ in precious metal equities the remainder are companies they believe will perform well during times of world wide stress or economic declines.

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

DYI

lllll