Dismal

Returns

DYI:

Amazing

at it may seem precious metals and short term bills and notes are the best

value among DYI’s four asset categories.

Long term bonds and stocks have been priced to the heavens leaving those

with future returns to be dismal at best!

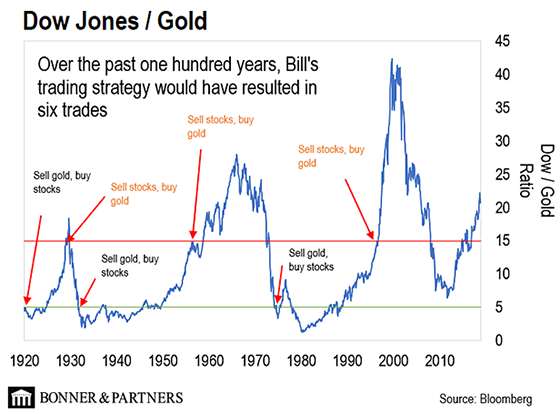

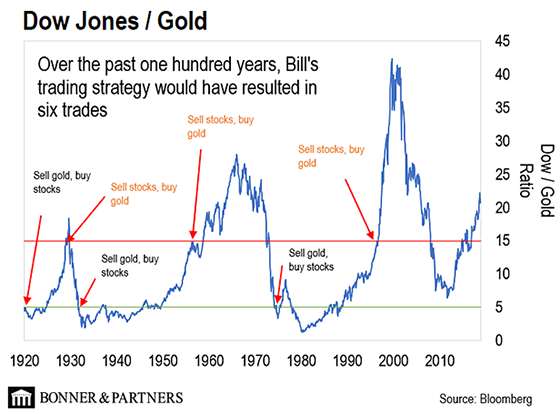

The charts below spell out what is ahead!

Market Sentiment

Smart Money buys aggressively!

Capitulation

Despondency

Max-Pessimism *Market Bottoms* Short Term Bonds

Depression MMF

Hope Gold

Relief *Market returns to Mean*

Smart Money buys the Dips!

Optimism

Media Attention

Enthusiasm

Smart Money - Sells the Rallies!

Thrill

Greed

Delusional

Max-Optimism *Market Tops* U.S. Stocks

Denial of Problem Long Term Bonds

Anxiety

Fear

Desperation

Smart Money Buys Aggressively!

Capitulation

For more than a year, I’ve been strongly encouraging readers to consider buying gold.

Over the last 12 months, the price of gold is up 21.1%, handily outperforming everything from the S&P 500 index in the US to stock markets in China, Europe, and Canada, plus bonds, real estate, and even major commodities like oil.

The real demand that’s worth watching comes from foreign governments and central banks– institutions with such a heavy appetite that they buy gold by the metric ton.

And according to freshly-minted international banking regulations, gold is now considered to be a “zero-risk asset” for central banks and large financial institutions.

This is important– because a number of central banks and foreign governments are really looking for alternatives to diversify away from the US dollars.

And that’s why so many countries are starting to stockpile gold instead. It’s the best alternative to US dollars, and they’re buying up as much as they can.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 12/1/19

Active Allocation Bands (excluding cash) 0% to 50%

50% - Cash -Short Term Bond Index - VBIRX

50% -Gold- Global Capital Cycles Fund - VGPMX **

0% -Lt. Bonds- Long Term Bond Index - VBLTX

0% -Stocks- Total Stock Market Index - VTSAX

[See Disclaimer]

** Vanguard's Global Capital Cycles Fund maintains 25%+ in precious metals equities the remainder are companies they believe will perform well during times of world wide stress or economic declines.

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

DYI

No comments:

Post a Comment