Bubble

News

Why a 60-65% Market Loss

Would Be Run-Of-The-Mill

One might view the very comparison of present stock market conditions to 1929 market peak as exaggerated and preposterous, but then, one would be wrong.

The fact is that on the valuation measures we find most strongly correlated with actual subsequent long-term and full-cycle market returns across history (and even in recent decades), current market valuations match or exceed those observed at the 1929 peak.

DYI:

Extreme

market valuations I’ve been reporting on since 2012 when stock prices reached

their 1966 valuation high then take their long journey to mean invert in 1982

for a 17 year bear market! Now we have

blown past valuation markers for 1929 [see chart below] and could be on our way

[who knows?] for a redo of the year 2000!

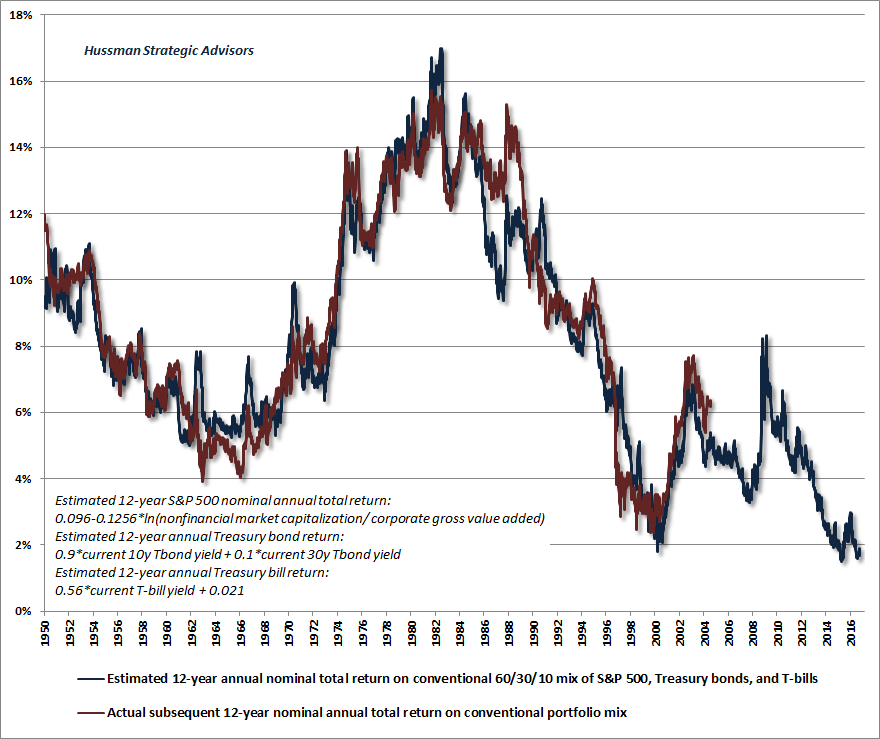

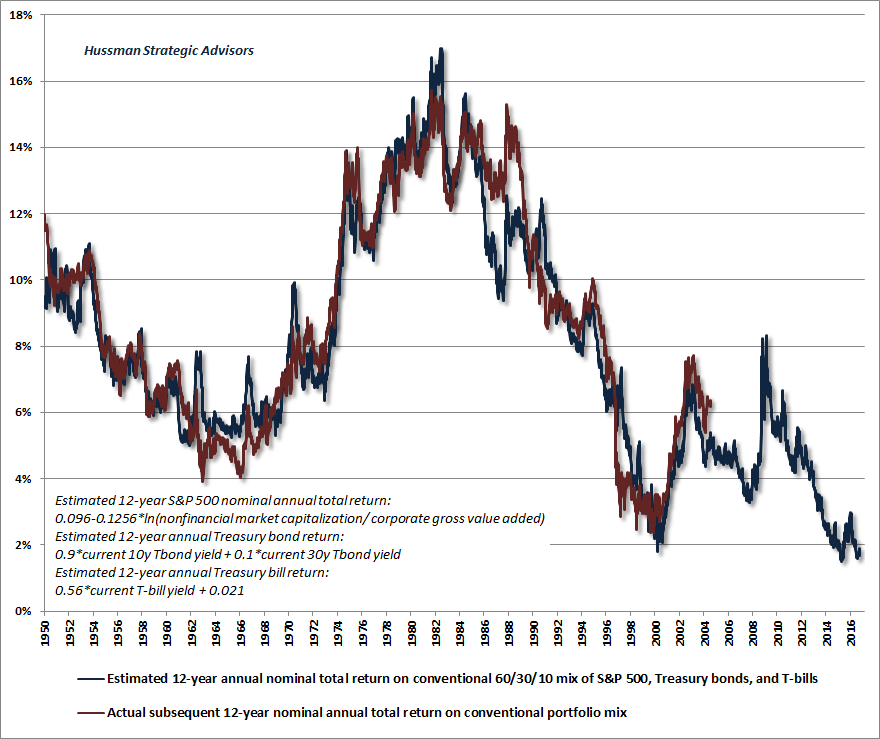

Meanwhile, given the depressed yields on long-term bonds, our estimate for 12-year total returns on a conventional asset mix (60% stocks, 30% Treasury bonds, 10% T-bills) has collapsed to just 0.8% annually [May 2019][see chart below].

This is lower than any point in history except a 6-week period surrounding the 1929 market top, a 3-week period surrounding the January 2018 pre-correction market peak, and a 6-week period surrounding the September 2018 pre-correction market peak.

December 2019

Estimated annual nominal return

0.28%

As a final note on valuations, it’s important to understand that because corporate earnings are more volatile than stock prices themselves, the price/earnings ratio of the S&P 500 is dramatically affected by the position of the economy in the economic cycle. When earnings are depressed, even very high price/earnings ratios can actually be associated with very high expected market returns. On the other hand, investors are regularly misled at bull market peaks by the fact that P/E ratios are often “well below historical extremes” at those points. The error comes in applying an elevated P/E ratio to already elevated (sometimes record) earnings. Historically, this has been a recipe for disaster.No doubt this economy is long in the tooth an expectation of a soon to be expected recession is with warrant. When the downturn will begin remains up in the air as my recession indicators have all receded.

Be careful not to assume that there is some reliable linear relationship between government deficits and subsequent inflation. There isn’t. Inflation has an enormous psychological component. The central point is that there is far greater risk of destabilizing public expectations about the soundness of government liabilities when deficits move well beyond the level that would be appropriate, given the position of the economy in its cycle. That’s a risk that investors seem to be wholly ignoring here.

The OPEC+ Deal Was The First Step To $100 Oil

The price of oil has been trapped in the mid-$50s because of fear:

1) Fear that OPEC+ would break ranks and flood the global market with oil.

2) Fear of weaker oil demand thanks to a global recession, which now looks extremely unlikely.

3) The belief that the United States can ramp up oil production at will to meet global demand.

Fear #1 was eliminated on December 6th: Now that the OPEC Cartel members and Russia have agreed to lower their output by another 500,000 barrels of oil per day through March, oil traders can check that box and we can focus on debunking the “Fear of Recession”.

Fear #2 remains subdued as the U.S Economy is expanding:

“These are blowout numbers and the U.S. economy continues to be all about the jobs,” Tony Bedikian, head of global markets for Citizens Bank said in a note. “The unemployment rate is at a 50-year low and wages are increasing. Business owners may be getting more cautious due to trade and political uncertainty and growth may be slow, but consumers keep spending and the punch bowl still seems full.”

It is impossible to believe that there will be a global recession if the world’s largest economy is this strong. With or without a trade agreement between the U.S. and China, the November jobs report should push WTI over $60/bbl. If a “Phase One” agreement is signed with China, look for WTI to move over $65/bbl within weeks.

Fear #3 U.S. is unable to ramp up production at will:

U.S. production growth is the annual increase in well depletion rates. More and more of our production comes from horizontal shale wells that have steep first year decline rates. After massive frac jobs, horizontal wells (some with more than two-mile laterals) come on strong, payout quickly and then decline by 50% to 70% within twelve months. It is not uncommon for a Permian Basin oil well to produce over 1,000 barrels of oil per day in the first 90 days and then decline to less than 100 barrels per day within two year. Well level economics are great, even at $55/bbl oil, but upstream companies in the shale plays must have an aggressive development drilling program to hold production flat.

Conclusion: This world now consumes over 3 Billion barrels per month of hydrocarbon-based liquids, most of which are refined from crude oil. The oil & gas industry has a massive supply chain that most people cannot comprehend. It only takes a crude oil shortage of 1% to cause a very large price spike. All previous price spikes, including the one to $147/bbl in early 2008, caused a bidding war between refiners for the world’s important commodity – oil.If this comes to past with oil prices at $100 plus per barrel expect a soon to arrive recession causing deflationary pressures. Over the shorter run of two to three years out it appears that the inflationary genie remains in his bottle. An asset smash for stocks, bonds, and to a lesser degree real estate is in the cards. When the smash does arrive the Fed’s will print like mad men in their attempt to turn around prices. Eventually the Fed’s will have their inflation with the unfortunate possibility of letting the genie out of the bottle with a redo of the 1970’s and 80’s.

DYI

No comments:

Post a Comment