%

Gold/Silver

Allocation

08-24-19

Updated Monthly

100 – [100 x (Current GS – Avg. GS / 4)

_______________________________________

(Avg.GS x 2 – Avg. GS / 2)

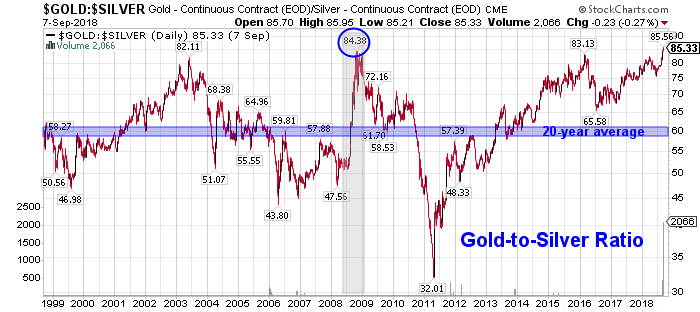

Current Gold/Silver Ratio 84

Average Gold/silver Ratio 50

Allocation:

Gold 1%

Silver 99%

Average Gold/Silver Ratio since 1900

50 to 1

Gold and silver bullion buyers and traders use the fluctuating Gold Silver Ratio to better determine which precious metal may be poised to outperform the other.

The essence of trading the gold-silver ratio is to switch holdings when the ratio swings to historically determined extremes. So:

When a trader possesses one ounce of gold and the ratio rises to an unprecedented 100, the trader would sell their single gold ounce for 100 ounces of silver.

When the ratio then contracted to an opposite historical extreme of 50, for example, the trader would then sell his or her 100 ounces for two ounces of gold.

In this manner, the trader would continue to accumulate quantities of metal seeking extreme ratio numbers to trade and maximize holdings.

Note that no dollar value is considered when making the trade; the relative value of the metal is considered unimportant.

DYI’s averaging formula is best used when accumulating bullion. Simply buy up to the stated allocation only selling/buying when necessary [lessen capital gains taxes]. For those in the distribution stage [retirees] of life sells off gold or silver to bring back in line with the current allocation.

DYI

No comments:

Post a Comment