Opinion: Watch out, America: China and Russia are stockpiling gold

The yellow metal generates no cash, grows no crops, provides no shelter and supplies no useful service. It hasn’t been official money for decades. It isn’t any kind of “safe haven” because it always seems to be crashing or booming or crashing again. It hasn’t been an efficient way of verifying payment since Samuel Morse invented the telegraph.

But here’s the funny thing: It’s been going up. Big time. And for none of the usual reasons.

There’s no inflation. Prices are currently rising by about 1.6% a year.DYI: Bullshit statement #1.) No inflation simply go to the Chapwood Index and you will see that prices have been going up at a scorching 7 to 10 percent. All you have to do is ask either the elderly or young persons if pharmaceutical drugs are up in price or if college tuition has risen way beyond the general rate of inflation!

There’s no obvious economic distress. The U.S. economy is growing by about 2.1% a year.

Bullshit

statement #2.) If everything is so great

why has the empire State Manufacturing Index fallen into recession territory

along with the Chicago Business Barometer??

Plus the Feds are now lowing rates once again! Ask any Millennial as to the job market. Sure they can get a job but go and leave Mom

and Dad? Out of the question the job

doesn’t pay enough unless they have multiple roommates. So much for a great job market; that

statement is total BS.

And there’s no financial panic. Stock markets are rising. Wall Street has been hitting new highs. Junk bond spreads — the extra interest that risky companies have to pay to borrow money — are low.

Bullshit

statement #3.) This time I think I’m

just going to go and throw up. The stock

market is way up in price for sure but that is the problem valuations have gone

to the moon. Future returns from here

are going to be total crap just like your first two statements.

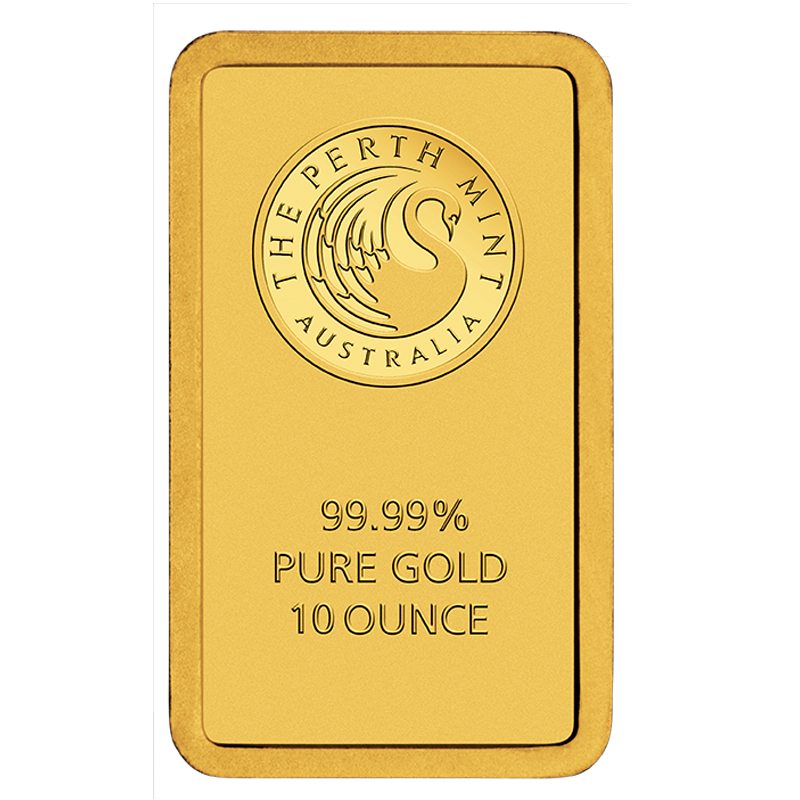

The explanation? Some of America’s biggest geopolitical rivals were stockpiling gold. Especially China and Russia.

And they still are. The People’s Bank of China recently revealed hiking its gold reserves by 74 tons in the six months through May. The Russian central bank has bought about 96 tons in the first half of the year.

U.S. dollar hegemony

And there’s an obvious reason for China to buy gold. It wants to break up the global hegemony of the U.S. dollar — the hegemony that former French President Charles de Gaulle called America’s “exorbitant privilege.” It wants to make its own currency, the renminbi, a world player. And Odey argues that buying gold bullion is a natural move. Gold reserves should add to world confidence in the Chinese currency.OK now you’re talking…You bet the fastest way for Russia and China to throw off the paper monster (U.S. Treasury securities) IS massive gold reserves that can have their currencies converted into gold. Once this platform has all of the bugs worked out countries within Russia and China sphere of influence will soon join ending the American dollar as the reserve currency of the world. As I’ve stated before America will continue to be a powerful country but our days of bending any country in the world to our will we be finished [and thank God].

DYI

No comments:

Post a Comment