Yields Drop

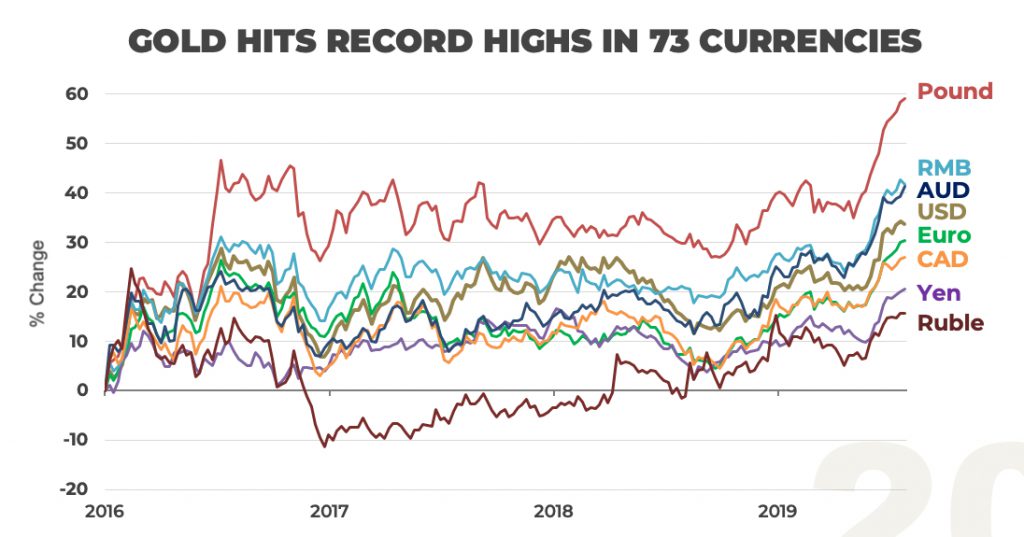

Precious Metal Surge

LONDON, Aug 2 (Reuters) - Yields across the entire German government bond market dipped into negative territory on Friday for the first time ever, as investors scrambled to buy less risky assets after an escalation in the U.S.-China trade conflict.

Germany’s 30-year bond yield briefly dropped more than eight basis points to -0.006%, its first fall below zero, and was last at 0.015%. It had been as high as 0.89% as recently as January.

The yield on the benchmark German 10-year note marked new ground with a fall below -0.50 bps.

Gold hit a six-year high on Friday as investors piled into the safe haven metal amid an escalating US-China trade war, and the prospects of a return to ultra-loose monetary policy by the Fed.

Updated Monthly

No comments:

Post a Comment