Bubble

News

Are 100-Year Mortgages Next? Effects of Negative Real Interest Rates on Nordic Housing Bubble

Historically, central banks throughout Europe had one mandate: price stability. They did not worry about employment or economic growth, only currency integrity. Setting interest rates to contain inflation ensured that a Krone or a Euro would purchase tomorrow what it could today. Nevertheless, since the ebbing of the 2008 financial crisis, The ECB, of which Finland is a member, officially added full employment and economic growth to their mandate. The Norwegian, Swedish, and Danish Central Bank’s followed suit, stating that they would consider “other factors” than inflation when basing an interest rate decision.

Hence, instead of remaining impartial — leaving it to lawmakers, markets, and the public to deal with the prevailing interest rate — the central banks became involved in policy making. Adding employment and economic growth to their mandate equates to the National Institute of Standards changing the definition of the meter to help an engineering firm, working on a major bridge project, meet budgetary and timeline constraints. In addition to creating a dilemma, the additional mandates made central banks appear politically biased.

The Nordic case clearly illustrates that central banks should only maintain price stability which upholds currency integrity. The rates, when correctly managed, act as a regulator, ensuring the economy remains diversified. No one sector can take all the growth. The “negative (real and deposit) interest rate” experiments are failing. They’re distorting the economies which undertook them. Surging housing costs are aggravating inequality and depriving other sectors in the economy. For example, retail sales since 2007 in Norway grew only 8% despite a brisk population increase (up 11% over the same period) and expanding consumer credit (up 13%).

Despite the figures and bubble narrative, the Nordic central banks appear to have little appetite, to raise rates, favoring growth and full employment.

Nevertheless, they will have to rein inflation in at some point, raising rates.

To mitigate a potential crash, we can expect to see the introduction and more widespread availability of longer-term mortgages:

40, 50 and even 100 years. Sweden and Japan already have 100-year intergenerational mortgages.

DYI: The global banking elites have accomplished

at least with mortgages for Sweden and Japan a CORPORATE FEUDAL STATE. A young couple who buys a house with a 100

year mortgage and has plans to start a family, the banking elites have now

captured the unborn child. Wow!

Wall St. is misreading Trump, and a market bloodbath is imminent: Stockman

"Wall Street is totally misreading Washington," Stockman told CNBC's "Futures Now"in a recent interview. "It's pricing in a fantasy about a Trump stimulus that simply isn't going to happen. There will be no tax cut, there will be no 15 or 20 dollar a share reduction in the corporate rate."

According to Stockman, the main catalyst for his pessimism about Trump's policies is the "debt ceiling trap" that he contended will prevent tax reform, infrastructure and defense spending that have excited so many investors.

Given the "factions" among the Republican Party today, the former Reagan aide also believed that the political turmoil could result in a gridlock the markets don't see coming.

DYI: Stock prices are already priced to the

moon. Shiller PE10 is at a

nose bleed level of 29.36 AND a sub atomic low dividend yield of 1.92%. Using Money Chimp.com’s estimated annual rate

of return for the next 10 years is – drum roll please – positive 0.72%! Of course this is BEFORE fees, commissions,

trading impact costs, taxes, and INFLATION.

Add it all up anyone holding or purchasing stocks at this level – go to

sleep like Rip Van Winkle – wake up 10 years later will be severely disappointed

with nominal and more importantly loss of REAL returns (after inflation).

Whether

Trump is successful or not future returns are baked into the cake. So hang onto to hats and cash better values

are ahead!

*************************************

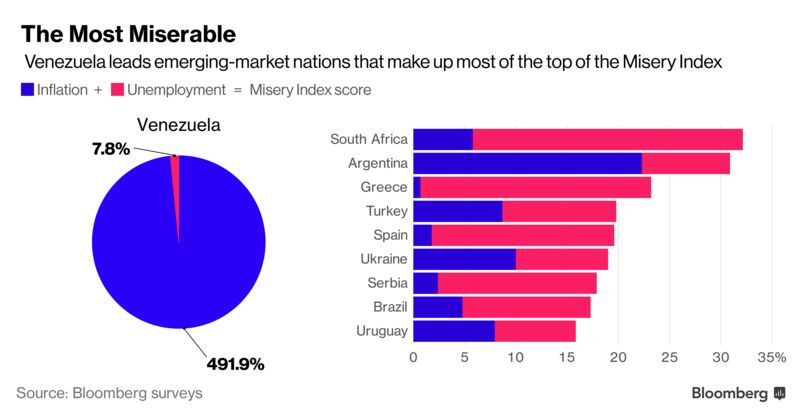

Economic

Misery

These Economies Are Getting More Miserable This Year

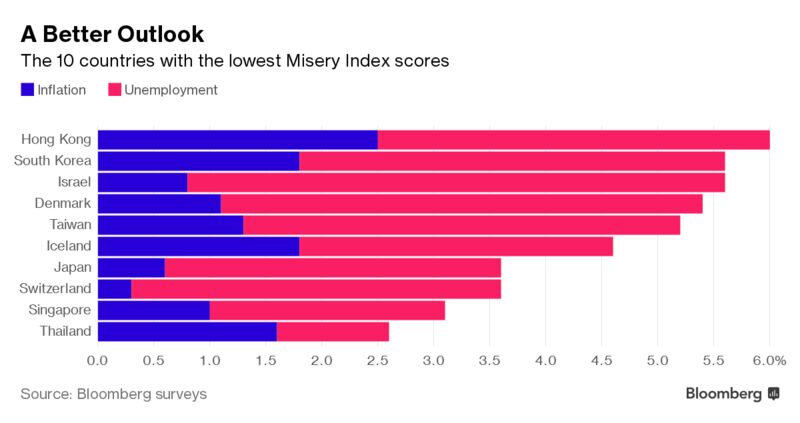

The Flip Side

DYI

No comments:

Post a Comment