Oil

Smash!

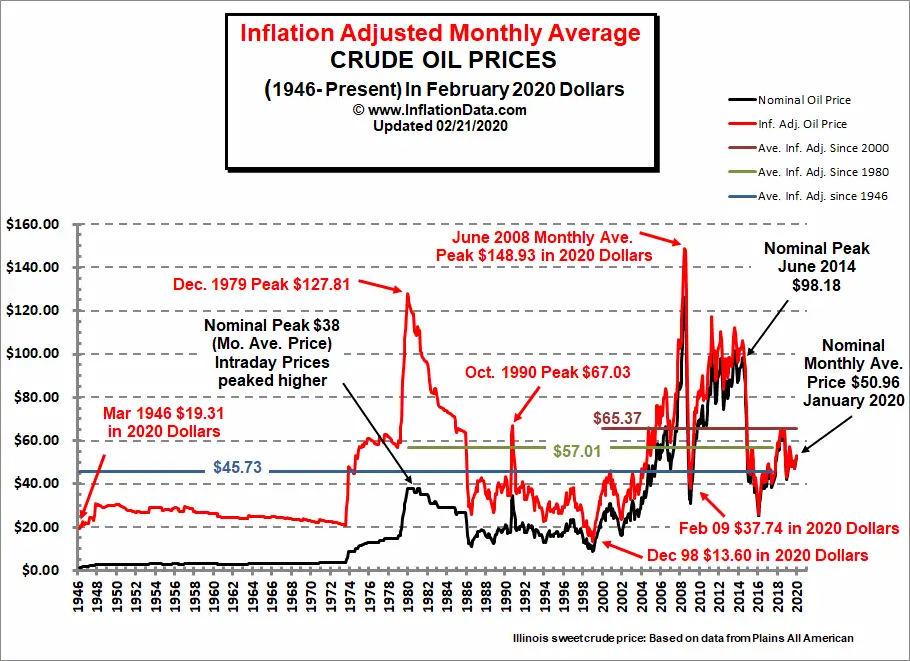

DYI: I want to bring to your attention the huge drop in oil prices. Since 1/6/20 West Texas Intermediate [WTI]

has dropped from $63.27 and as of this morning to $22.74 for a 64%

decline! This has caused a huge bear

market for oil and their related service sector companies share prices. Using a closed end mutual fund Adams

Natural Resources Fund, Inc. (PEO) as a proxy for all oil related share

prices has declined from $15.48 [2/20/20] till yesterday close at $6.11 a

market 61% SMASH!

As of 3/19/20

$22.74

How low is low? No one knows for

sure and yes WTI could very well trade in the teens. Be as that may be the oil and gas industry is

not going away anytime soon no matter what folks say about electric cars or

trucks. If the battery packs are

successful it will take decades to convert all of the world wide fleets of cars

or trucks to electric. A time frame for

us mortals this drop has created a buying opportunity for the long term

investor. If you are relatively young

this is a great time to dollar cost average into your favorite oil/gas mutual

fund. While you wait for the recovery in prices, most funds have a 4.5% or

greater yield. If you are retired, a

great yield play at the onset, with a good possibility of capital gains in the

future. Please note this could very well

take months in the making. Simply put

this is for the long term investors buying in during panics setting your selves

up for future gains!

TILL NEXT TIME

Disclaimer

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

DYI

No comments:

Post a Comment