Popping

Bubbles!

Dow sinks more than 2,000 points amid coronavirus uncertainty and plunging oil prices

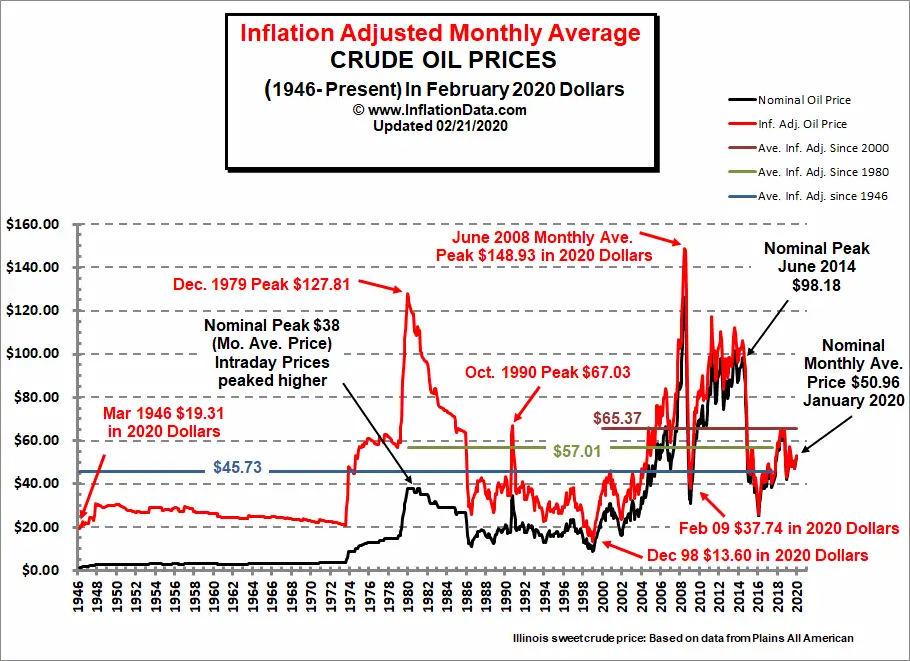

Monday's market plunge came after OPEC talks fizzled over the weekend and Saudi Arabia slashed oil prices, triggering a price war and sending U.S. crude oil prices plunging by more than 25% -- fanning even more uncertainty among investors.

The yield on the 10-year Treasury note dropped to an unprecedented low of 0.408%, a possible signal that investors are expecting a recession.

European Bank Stocks Collapse to March 2009 & 1988 Levels

But it’s even worse:

The Stoxx 600 bank index has collapsed by 82% since its peak in May 2007, after

having quadrupled over the preceding 12 years. It was the frenzied height of

the euro bubble and the sky was supposedly the limit for Europe’s biggest banks.

Things got so crazy that for a brief moment in 2008, before it all come

tumbling down, the Royal Bank of Scotland, now bailed-out and majority

state-owned, was the world’s biggest bank by assets.

“A Toothpick in a Tsunami”: US Big Oil Faces Bankruptcy as Prices Plunge 30% on Saudi Expansion

As of 3/11/20

$33.07

America's housing crisis

What's gone wrong?

From cities to suburbs to rural America, the cost of housing has far outpaced increases in salaries. Home prices are growing at twice the rate of wages, and there are fewer houses on the market than in any year since 1982. The single-family house, with a garage and a front lawn, remains a bedrock of the American dream, even as it recedes from many people's reach. Young adults are one-third less likely to be homeowners than the previous generation was at the same age, and nearly two-thirds of renters say they can't afford a house. The median single-family house costs about $280,000, with demand driving prices at the lower end of the market to rise twice as fast as those of high-end homes. Once the backbone of U.S. wealth, housing has become a civic, economic, and environmental catastrophe.

From cities to suburbs to rural America, the cost of housing has far outpaced increases in salaries. Home prices are growing at twice the rate of wages, and there are fewer houses on the market than in any year since 1982. The single-family house, with a garage and a front lawn, remains a bedrock of the American dream, even as it recedes from many people's reach. Young adults are one-third less likely to be homeowners than the previous generation was at the same age, and nearly two-thirds of renters say they can't afford a house. The median single-family house costs about $280,000, with demand driving prices at the lower end of the market to rise twice as fast as those of high-end homes. Once the backbone of U.S. wealth, housing has become a civic, economic, and environmental catastrophe.

Is renting any better?

It's even worse. Nearly half of renters are cost-burdened — meaning they spend at least 30 percent of their income on rent. Since 1960, renters' average earnings have increased 5 percent as rents have jumped 61 percent. Eleven million Americans spend more than half of their paycheck on rent. They have little choice: After 2011, more than 4 million units renting for $800 or less per month disappeared nationwide. In trendy cities like Seattle and Austin, older, multifamily buildings are being demolished or converted into condominiums and co-ops. A minuscule percentage of new apartments are low-rent. Today, a full-time minimum-wage worker can afford a two-bedroom rental in precisely zero U.S. counties; on average, it would take clocking 127 hours a week at the federal minimum wage to make paying for one possible.

It's even worse. Nearly half of renters are cost-burdened — meaning they spend at least 30 percent of their income on rent. Since 1960, renters' average earnings have increased 5 percent as rents have jumped 61 percent. Eleven million Americans spend more than half of their paycheck on rent. They have little choice: After 2011, more than 4 million units renting for $800 or less per month disappeared nationwide. In trendy cities like Seattle and Austin, older, multifamily buildings are being demolished or converted into condominiums and co-ops. A minuscule percentage of new apartments are low-rent. Today, a full-time minimum-wage worker can afford a two-bedroom rental in precisely zero U.S. counties; on average, it would take clocking 127 hours a week at the federal minimum wage to make paying for one possible.

What the Fed Can Do: Print and Buy, Buy, Buy

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon.

If the stock market drops 50%, that wipes out pension funds, 401Ks, and mountains of leverage.

In other words, the Fed has to save all the asset bubbles to save the real-world economy which is now dependent on the excesses of financialization that have enriched the few at the expense of the many.

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon, as once stocks crater 50% or more, there's no way to recover the $16 trillion that evaporated, or stop the dominoes from falling.

DYI

No comments:

Post a Comment